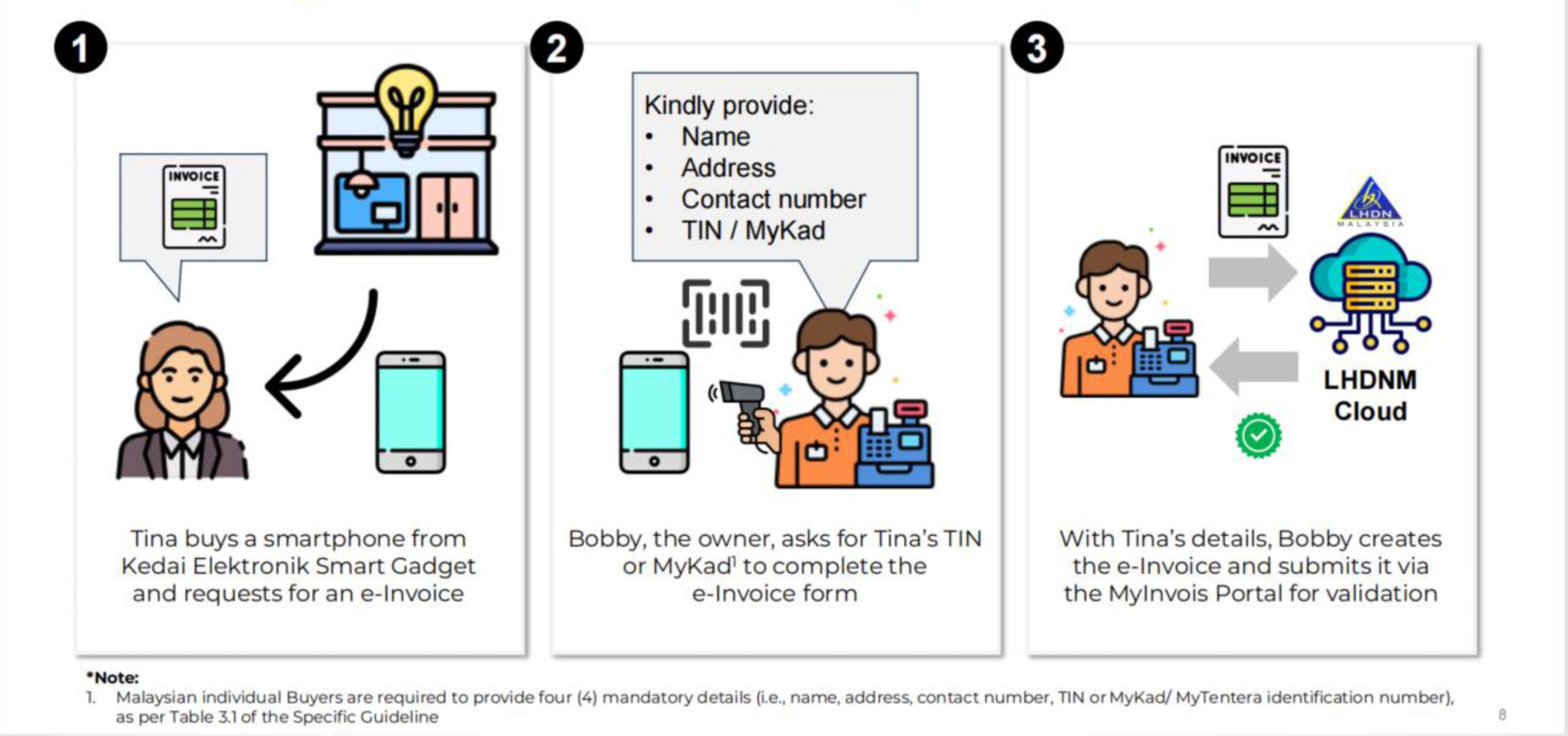

- Illustration 5: Malaysian individual Buyers have the option to provide TIN or Malaysian Identification Number upon creation of e-Invoice

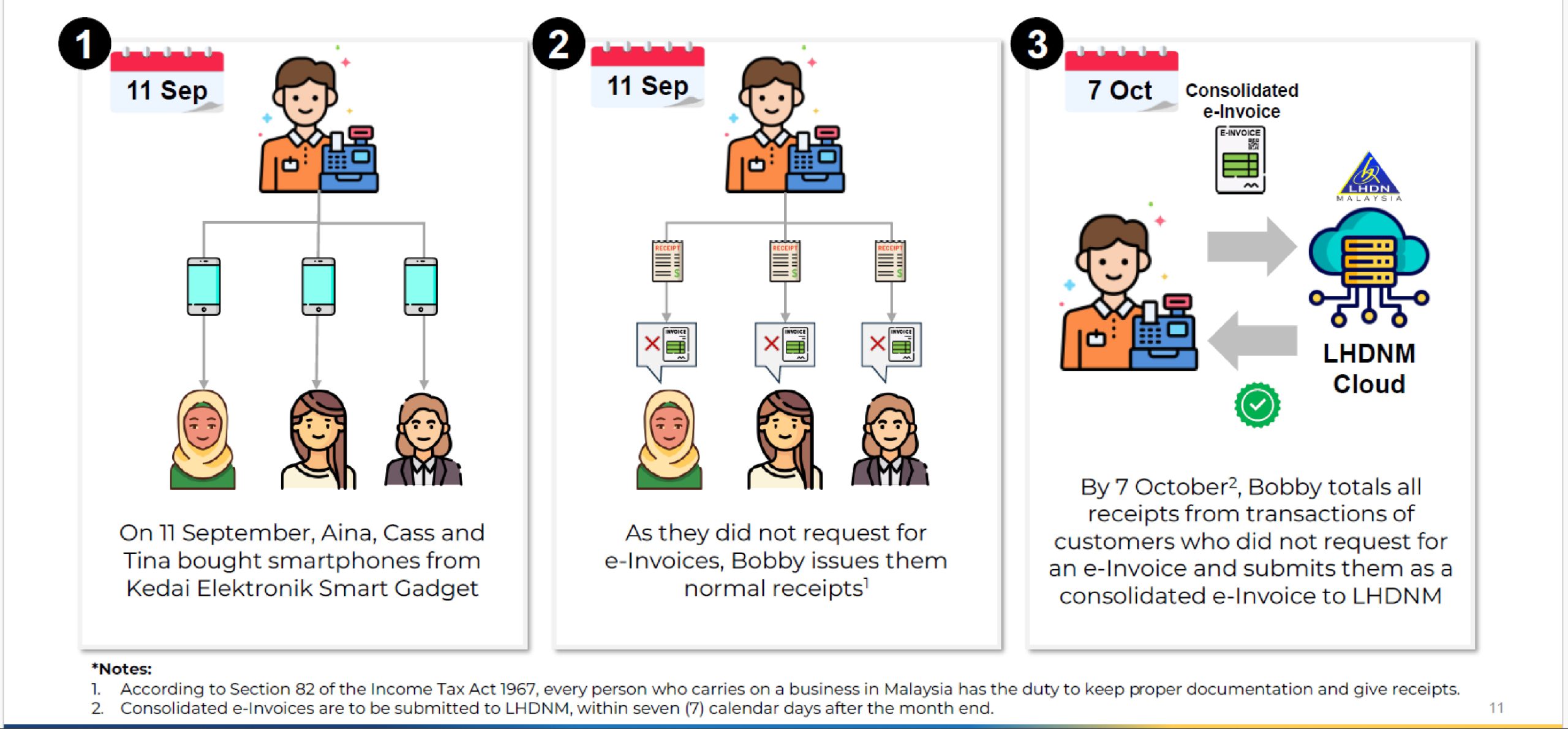

- Illustration 8: Where Buyers do not require an e-invoice, Seller is required to submit consolidated e-Invoice

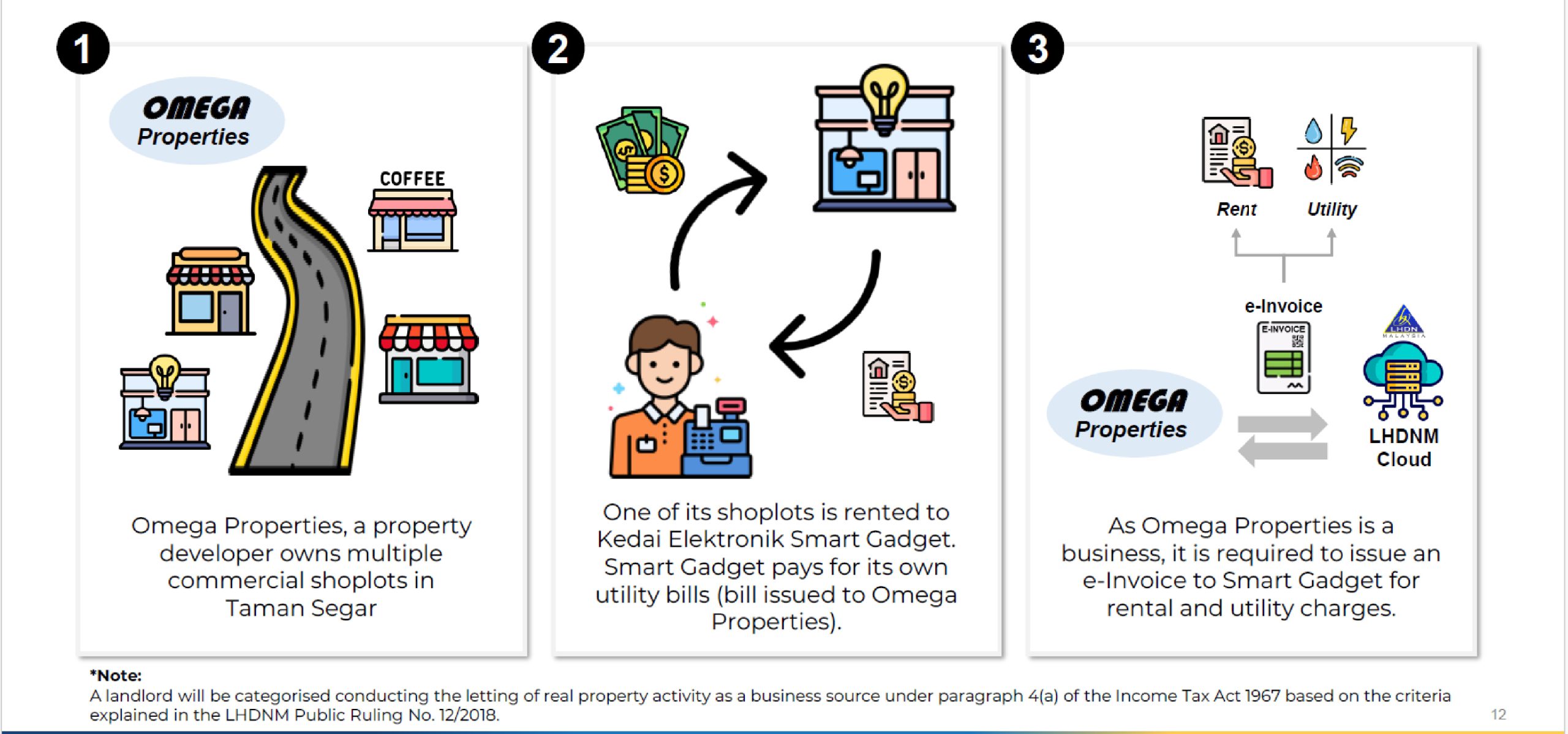

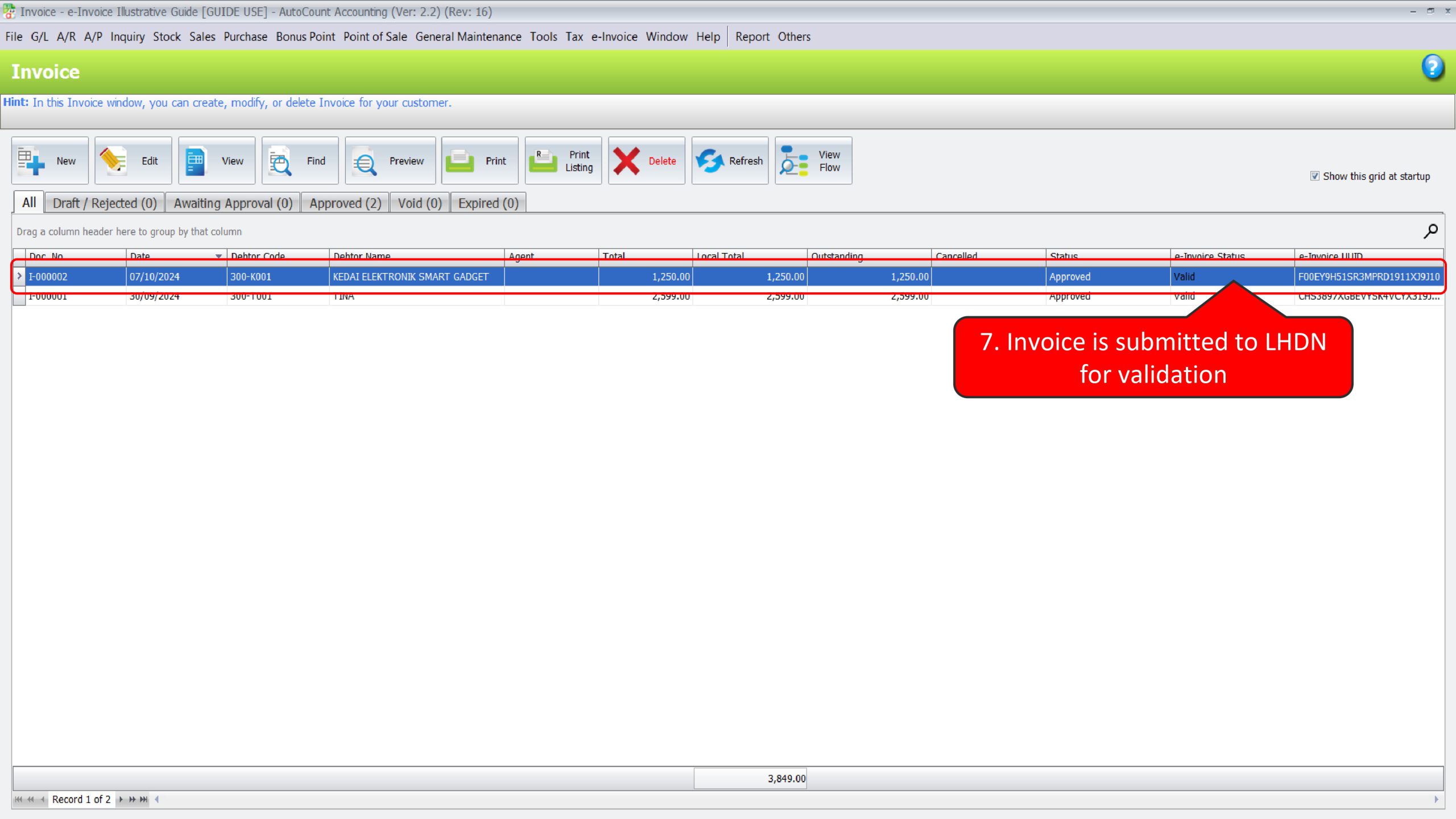

- Illustration 9: Where a landlord conducts business, landlord is required to issue e-Invoice to tenant, including utility charges issued to landlord

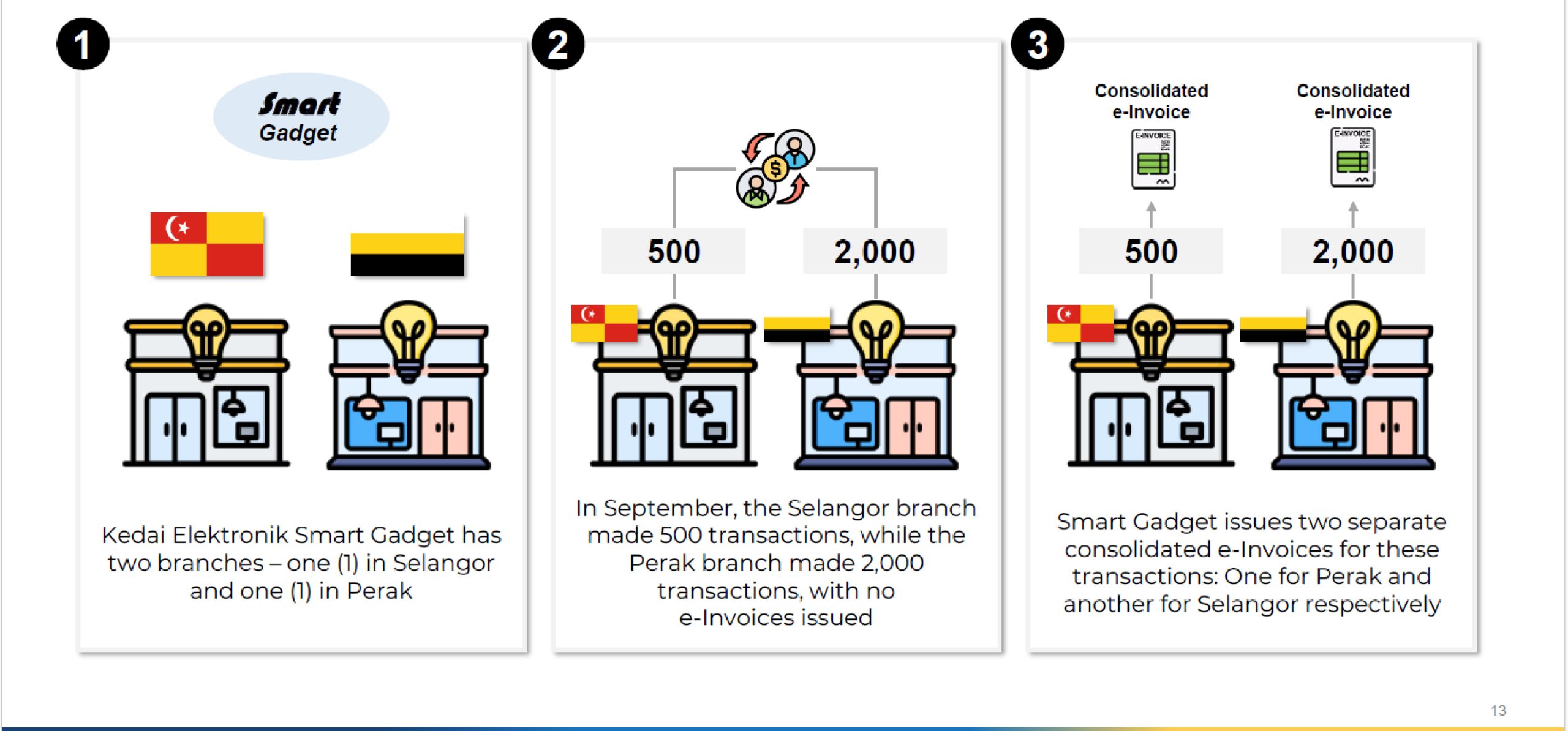

- Illustration 10: Sellers with multiple branches can choose how they would like to consolidate their e-Invoices

- Illustration 11: Sellers that issue statements / bills on a periodic basis are required to issue e-Invoices

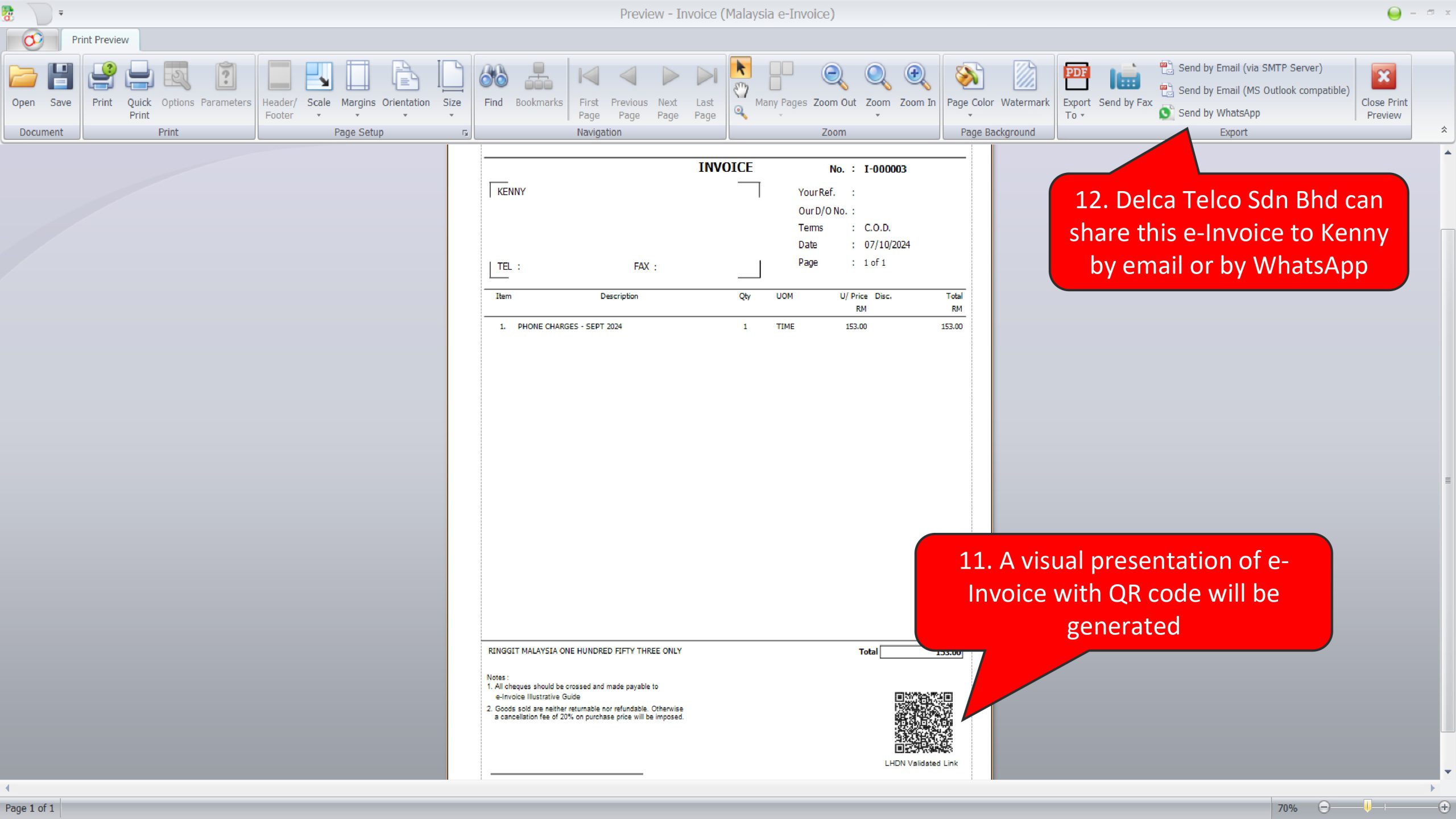

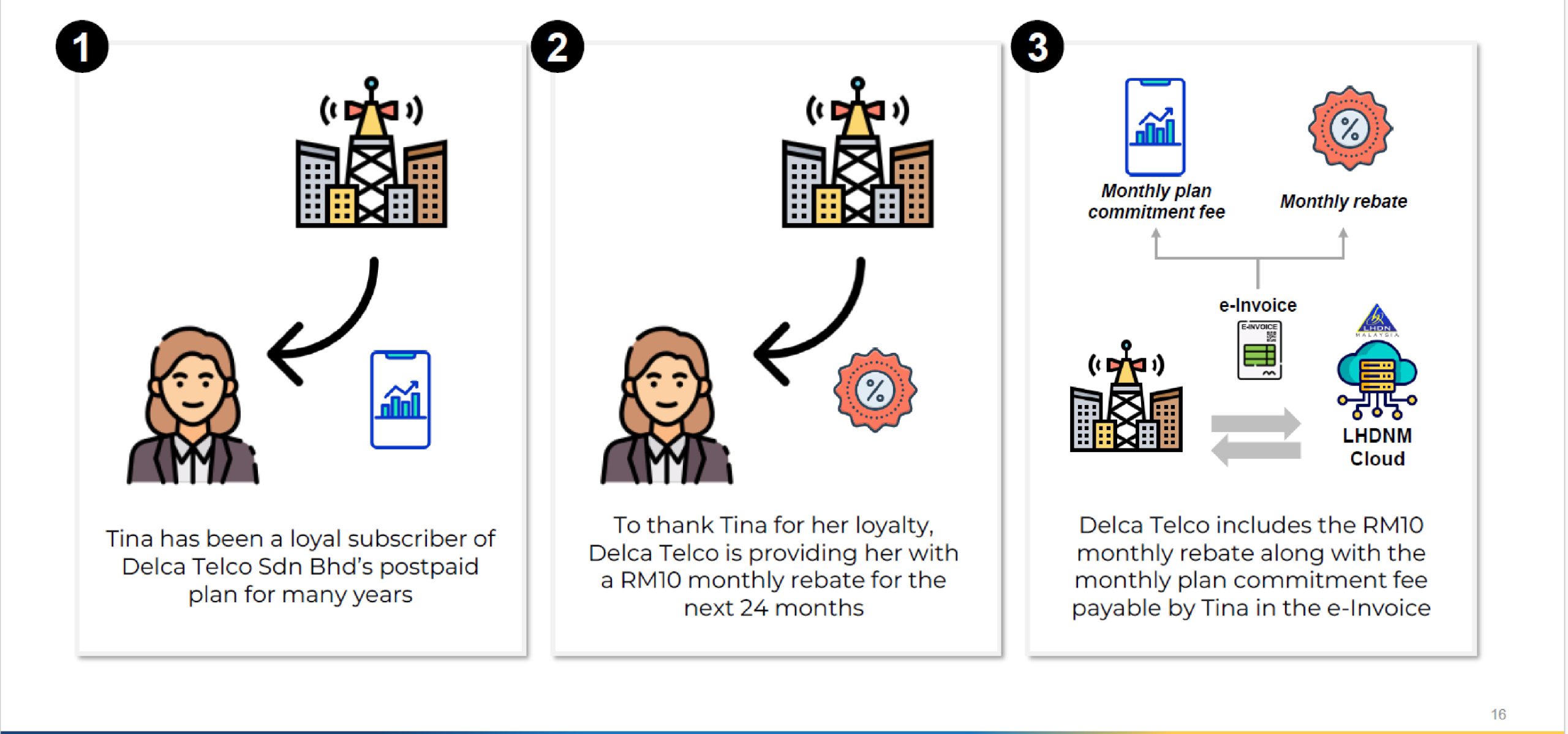

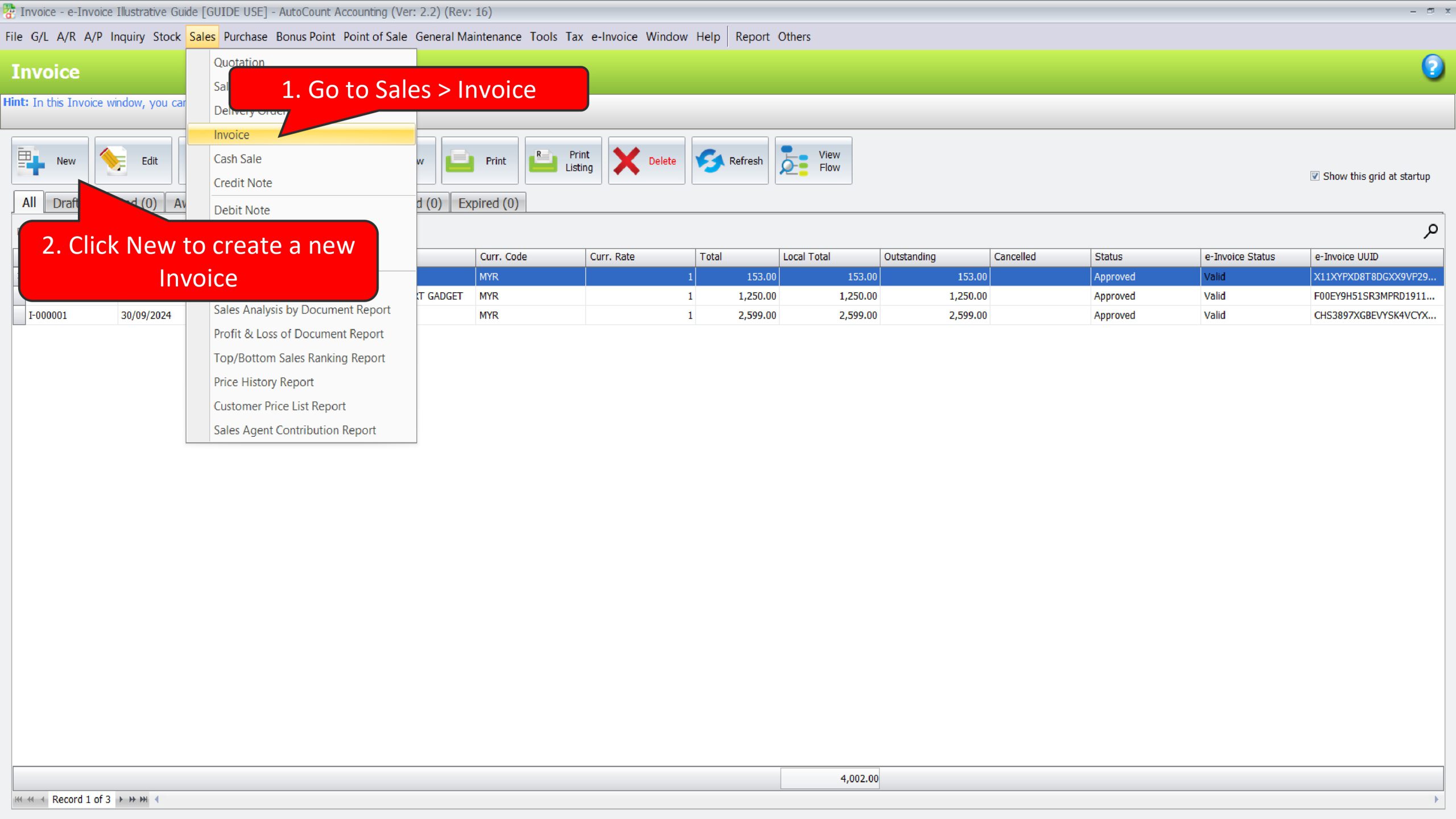

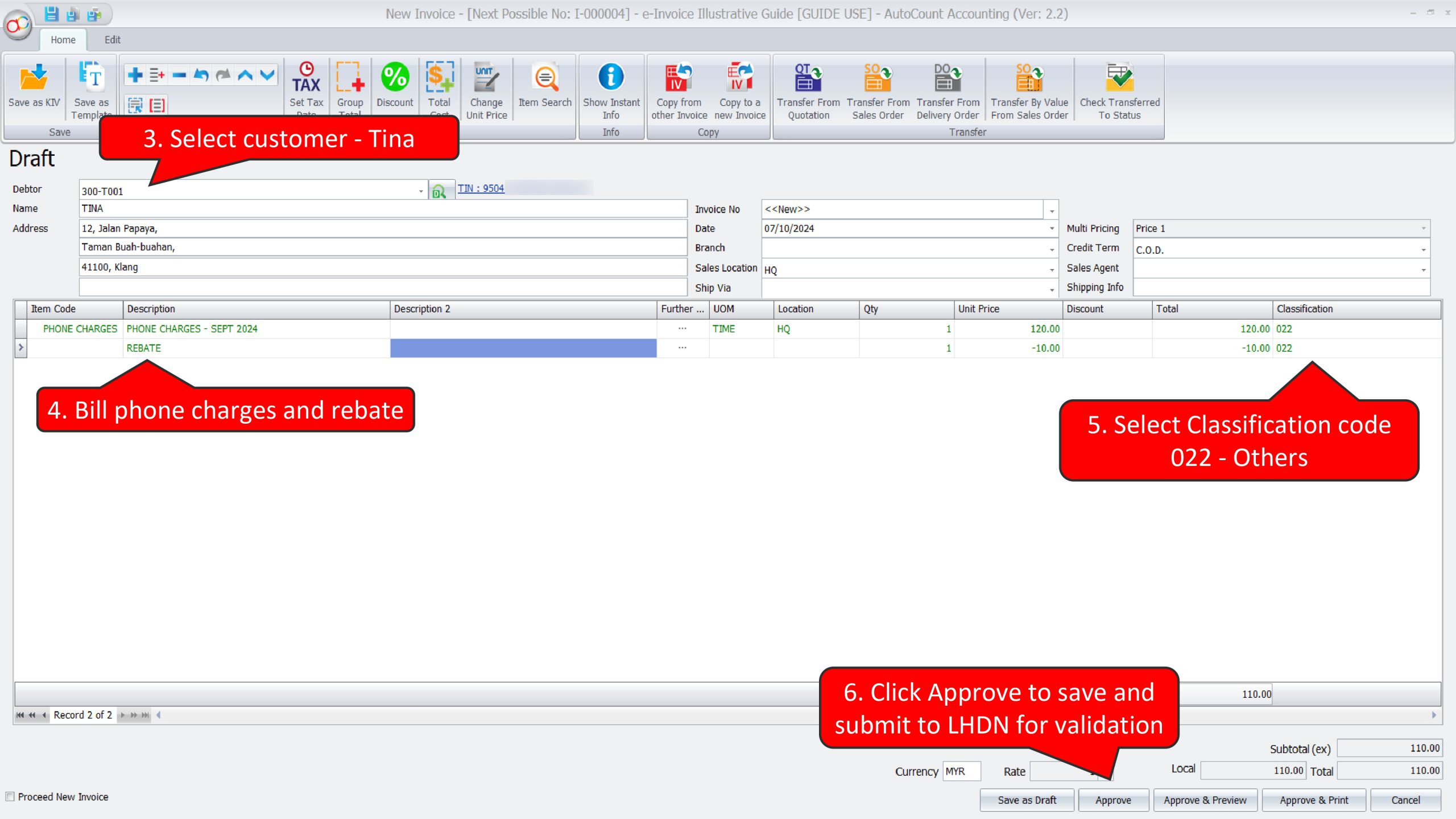

- Illustration 12: e-Invoices issued for bills on periodic basis may include adjustments to statements / bills from a prior period, such as rebates

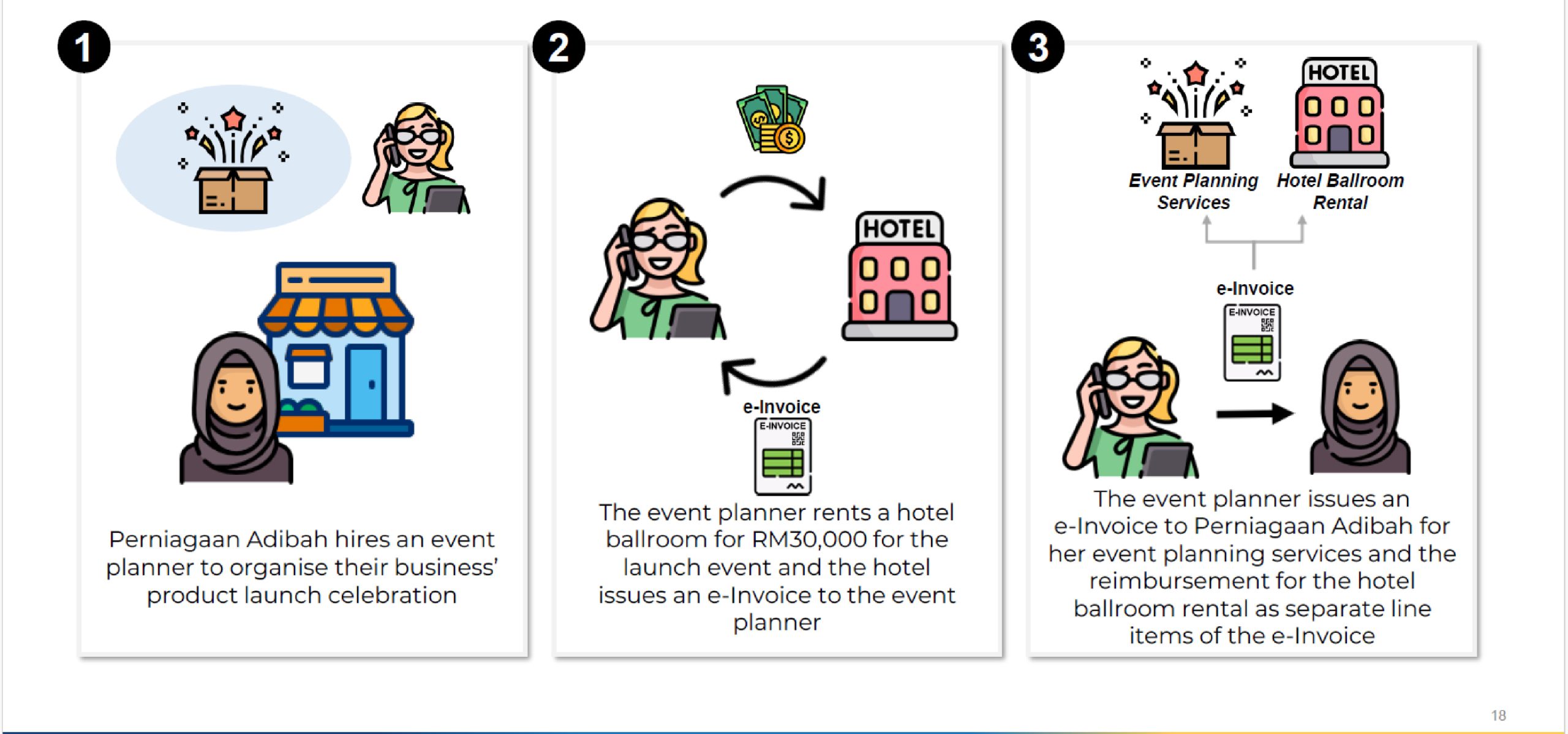

- Illustration 13: A single e-Invoice that includes the service fee and costs is issued to the Buyer (where e-Invoices are issued to the seller)

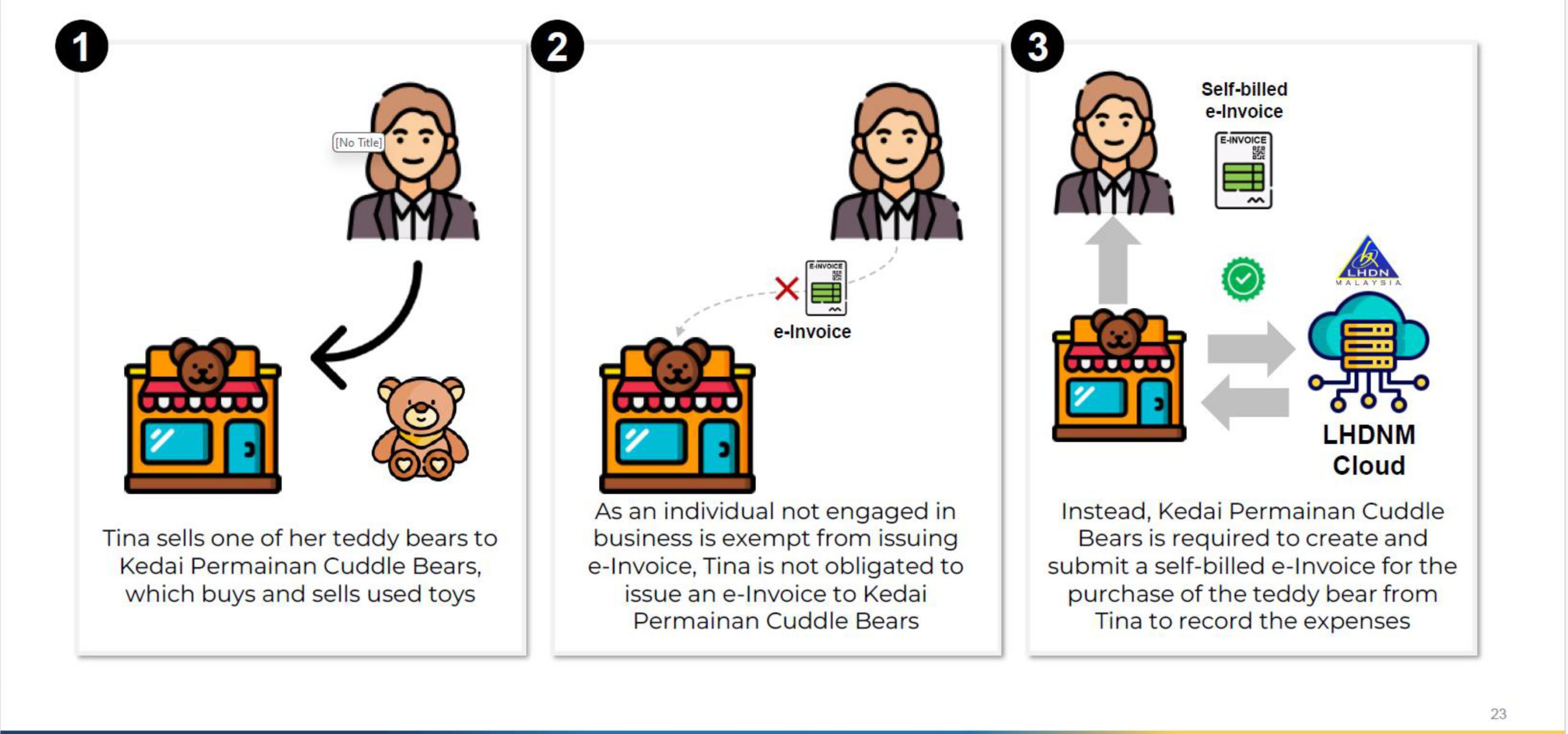

- Illustration 16: Buyer need to issue a self-billed e-Invoice when purchasing products from an individual who is not conducting a business

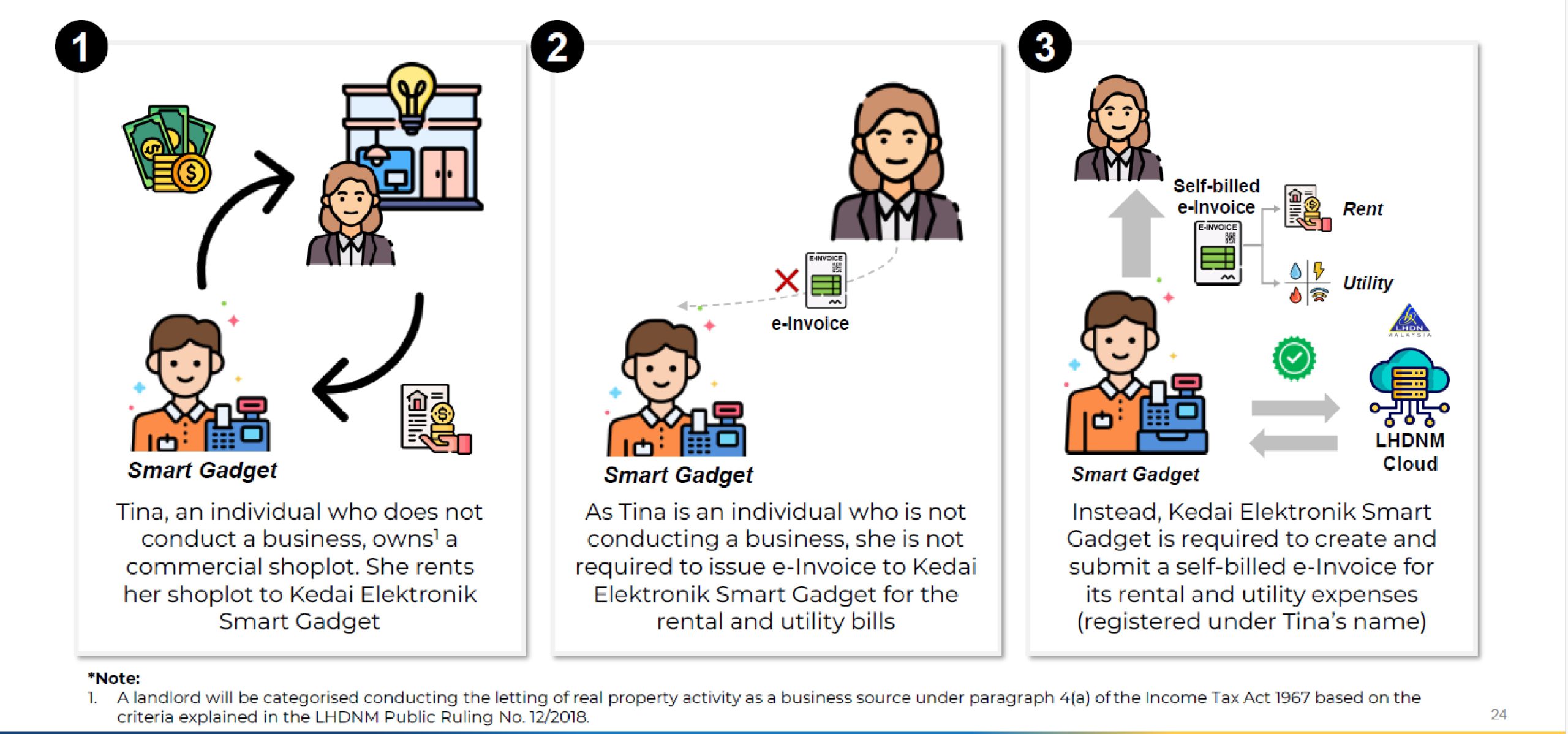

- Illustration 17: Business tenants have to issue self-billed e-Invoice on rental and utility bills if landlord does not conduct business

- Illustration 18: Tenants need to issue self-billed e-Invoices for rental with multiple landlords who are not conducting a business

- Illustration 20: Buyers are required to issue a self-billed e-Invoice on interest payments made to related companies (non-financial institution)

- Illustration 21: Buyer (Payor) shall issue self-billed e-Invoice to applicable transactions for payments to agents, dealers and distributors (i.e., Commission)

- Illustration 22: Malaysian Buyers are required to issue self-billed e-Invoices for services acquired from Foreign Sellers

- Illustration 23: Businesses are required to issue a self-billed e-Invoice when purchasing imported goods from a Foreign Sellers

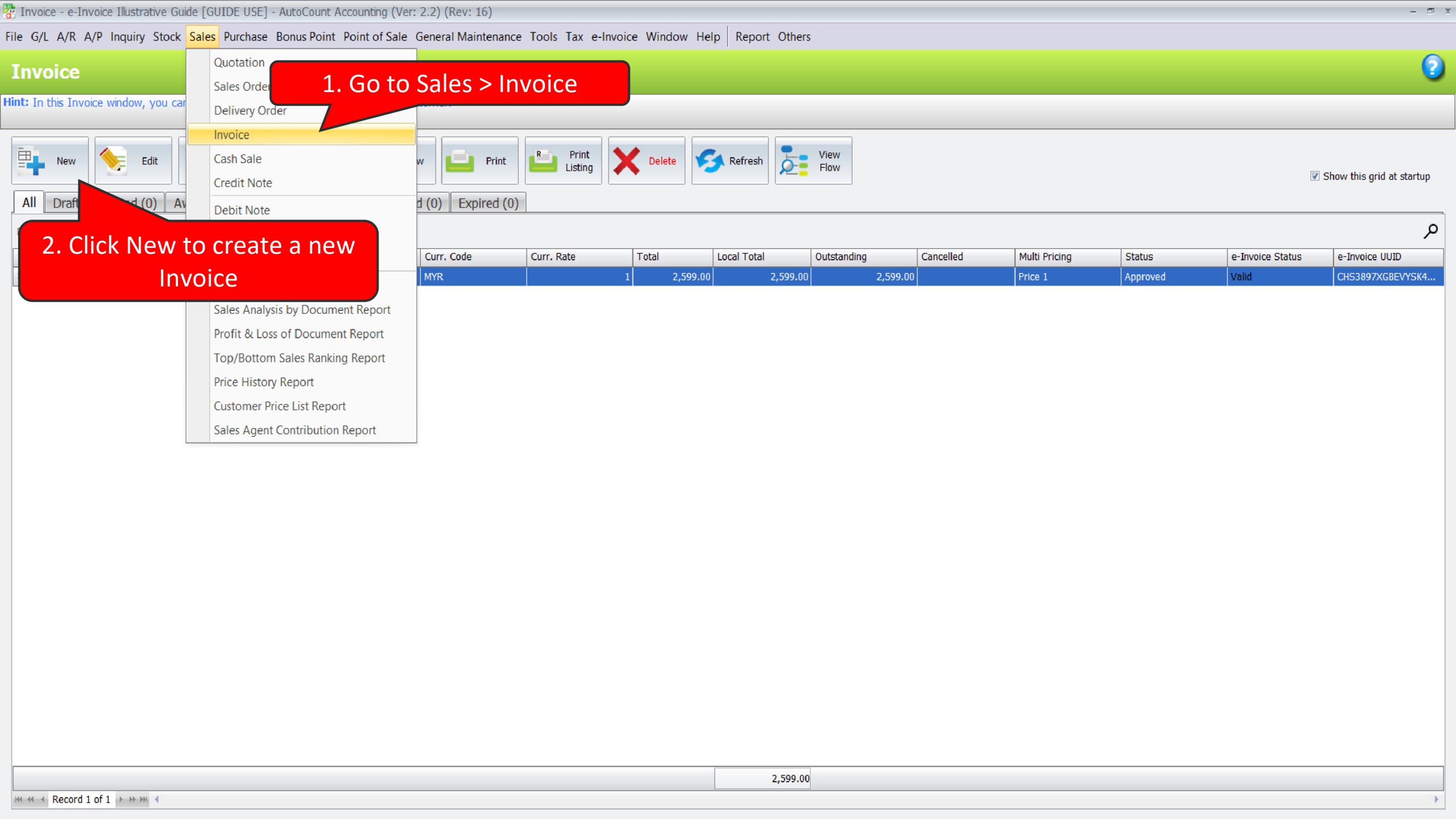

This guide will show case how can you use AutoCount Accounting 2.2 on scenarios that is being highlighted in LHDN e-Invoice Illustrative Guide

*Some scenarios that are not related with software will be skipped

*This guide is based on e-Invoice Illustrative Guide as updated on 11 September 2024

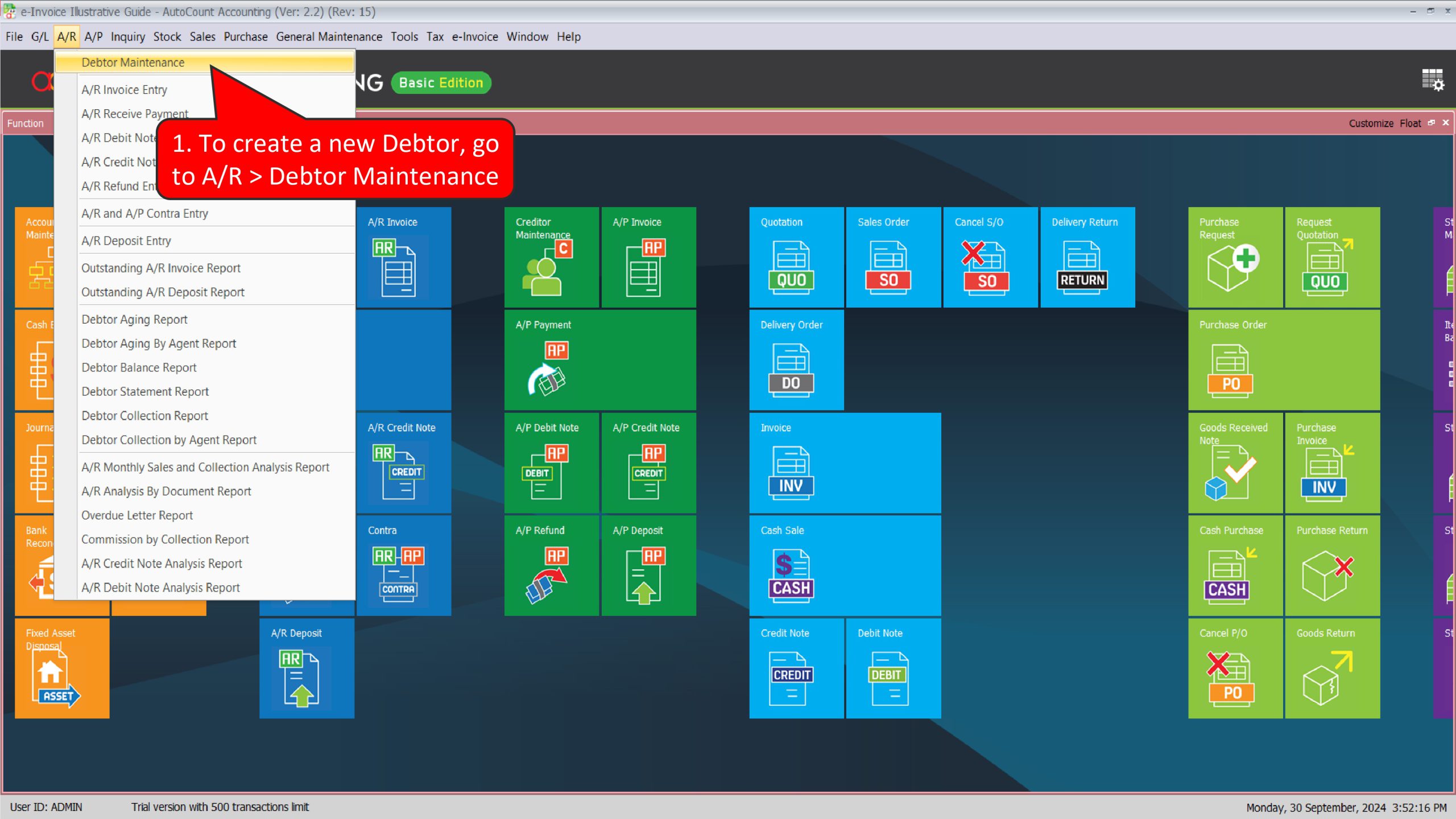

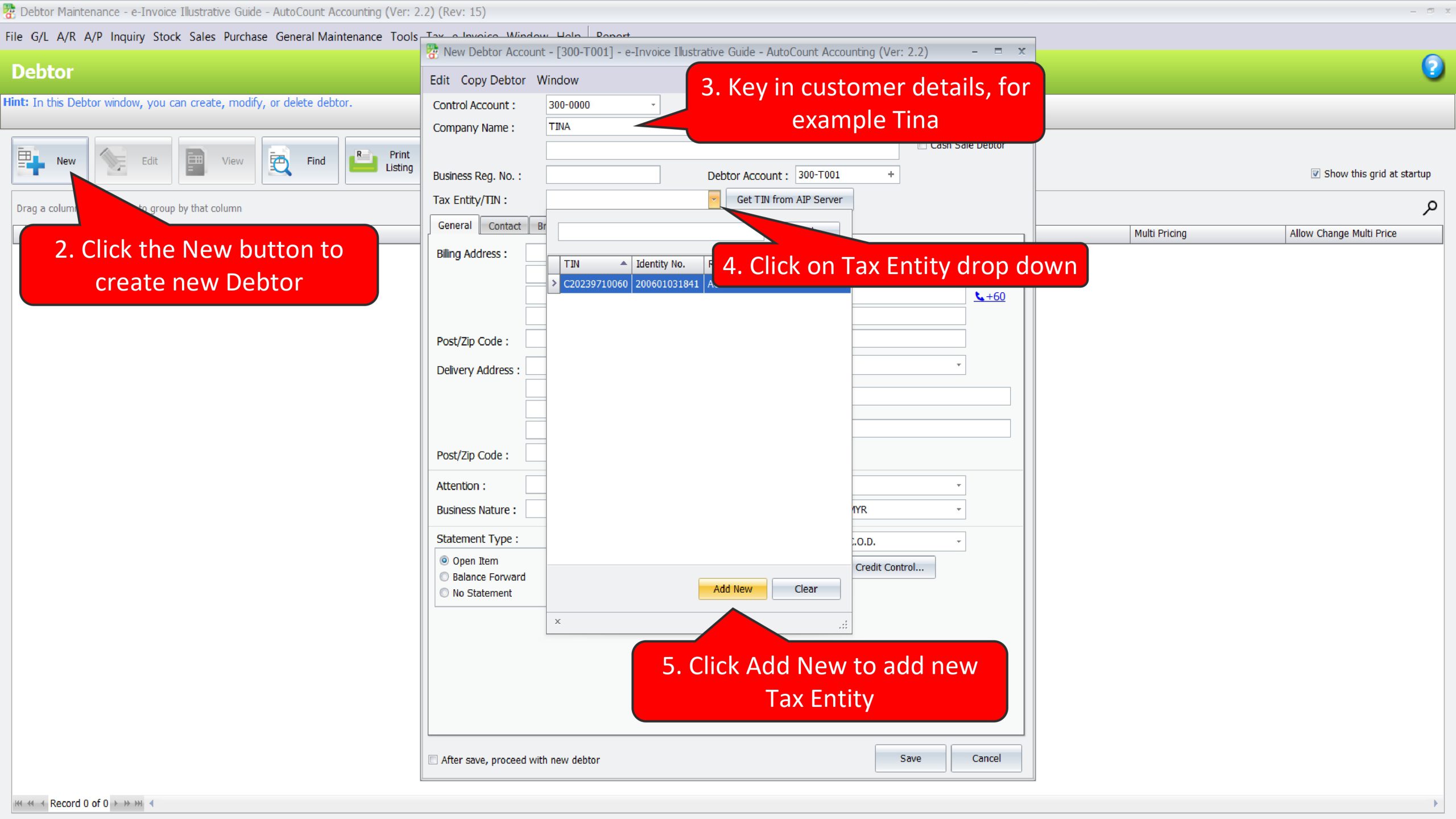

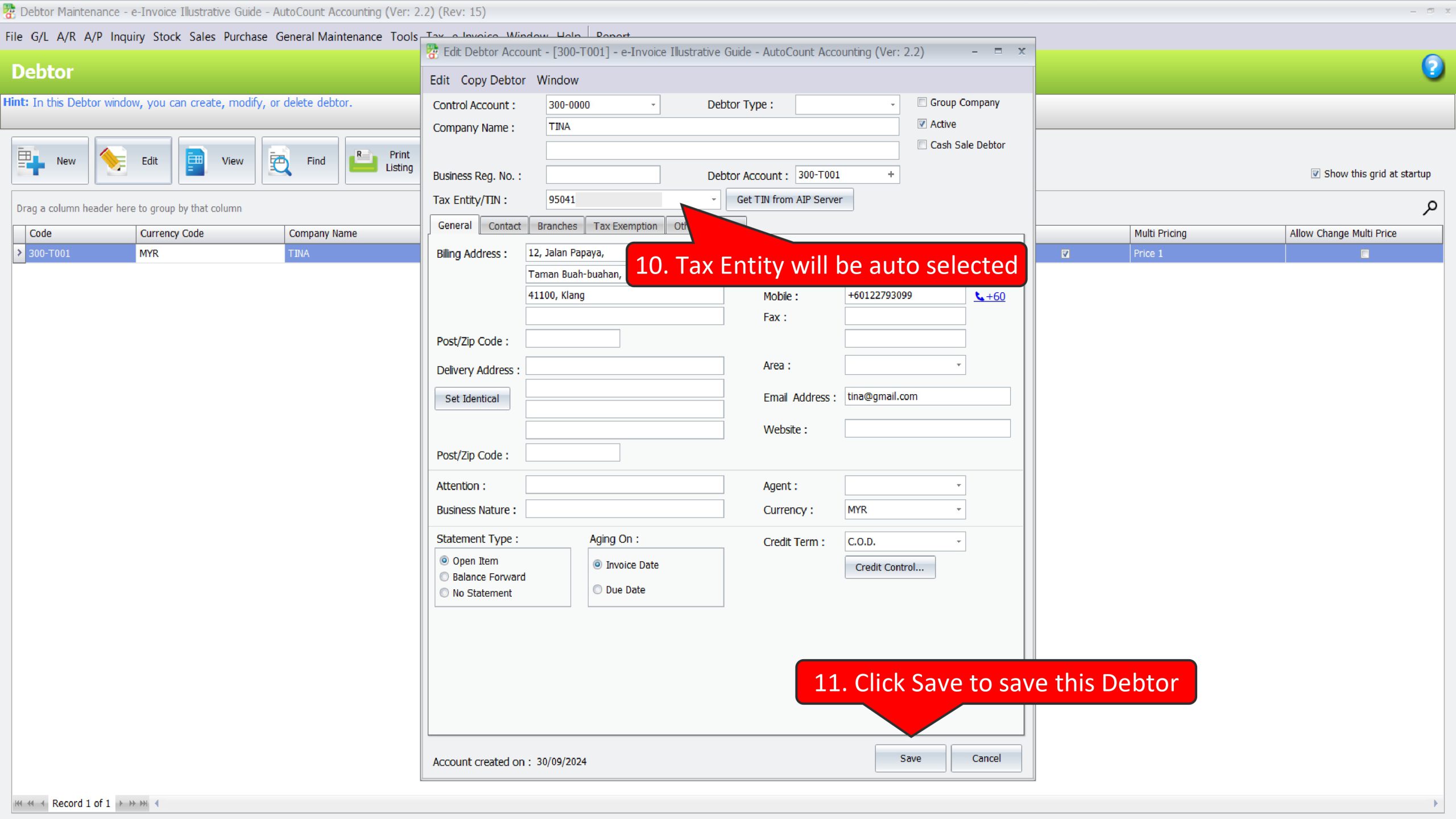

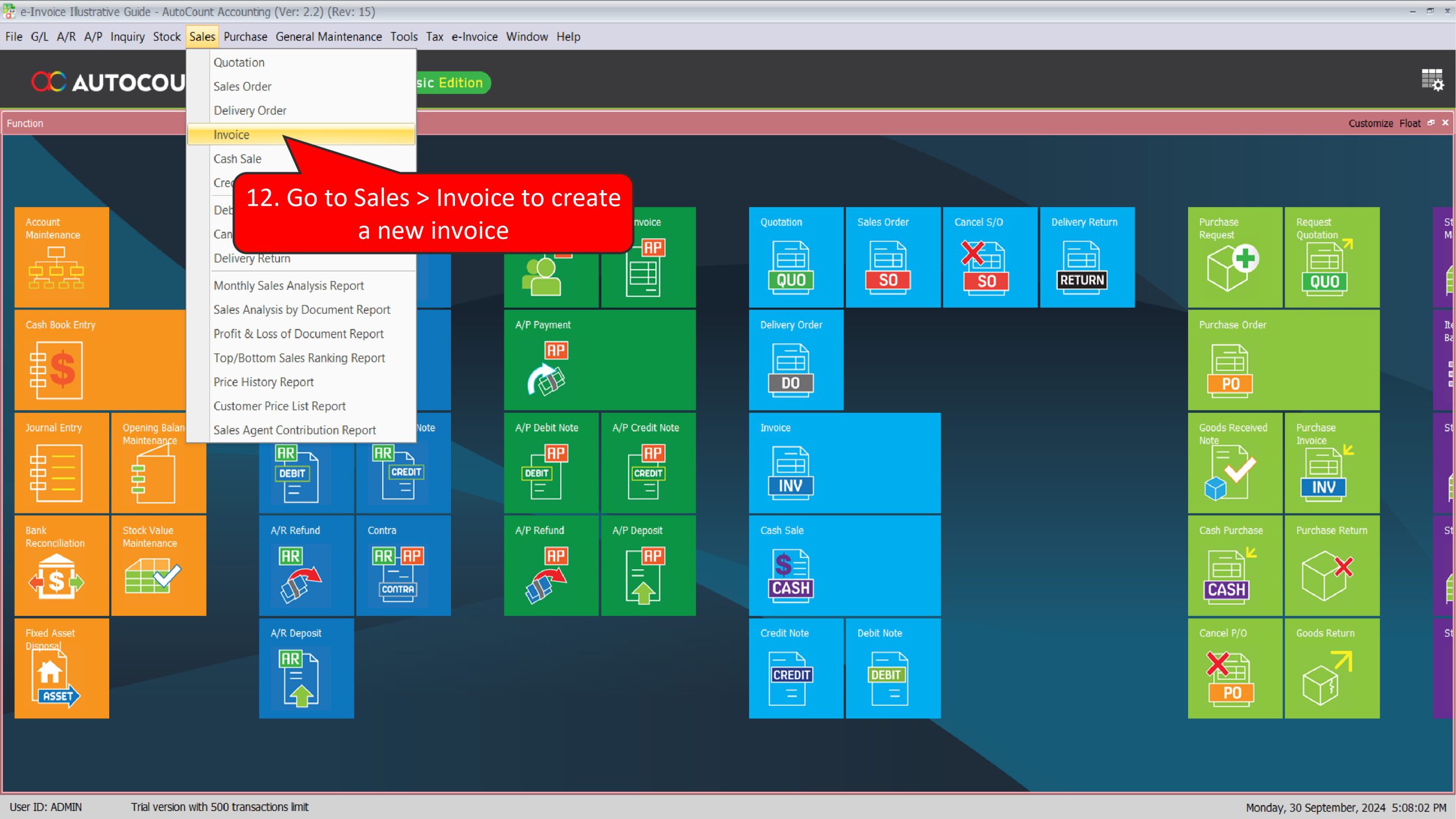

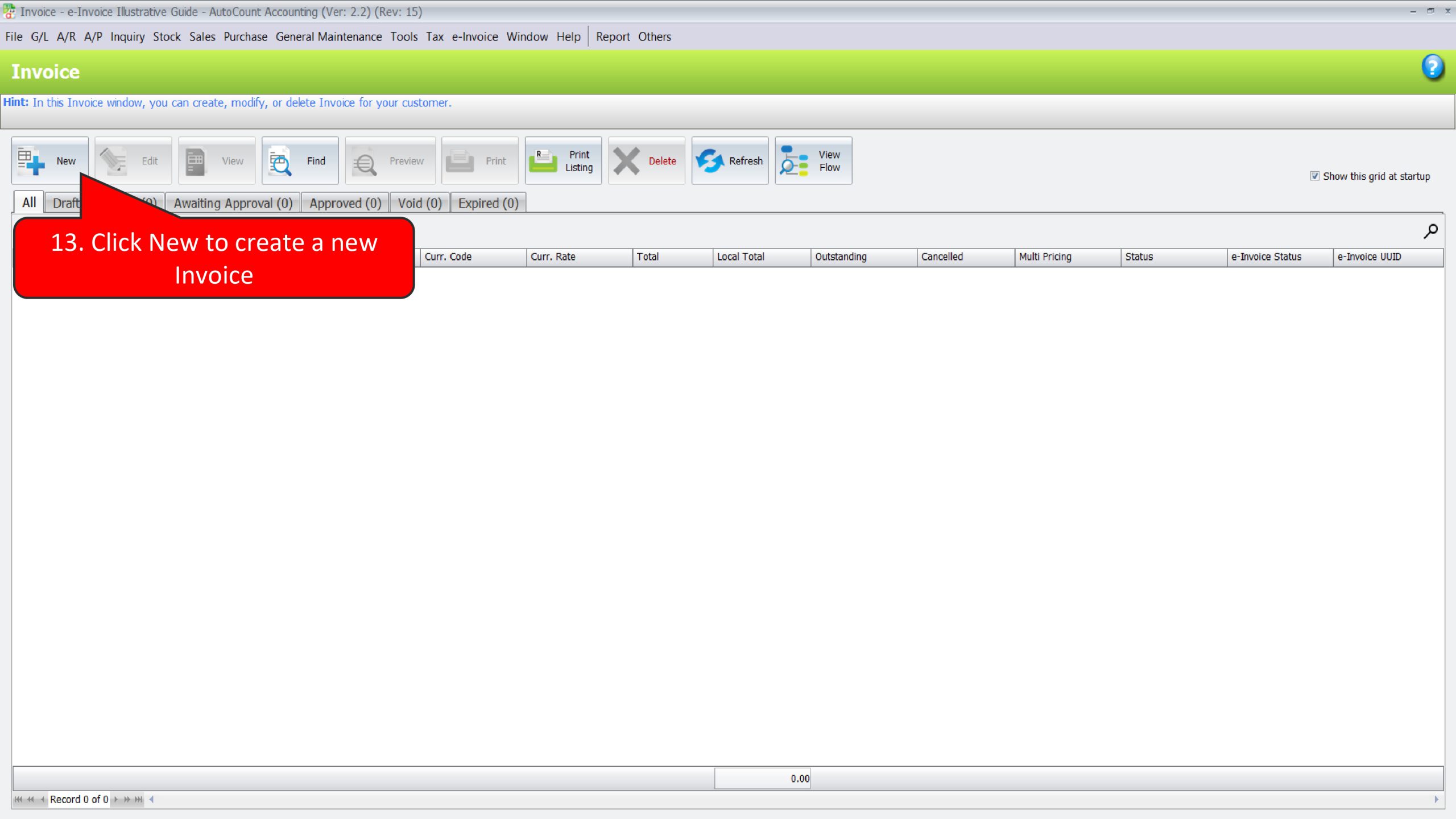

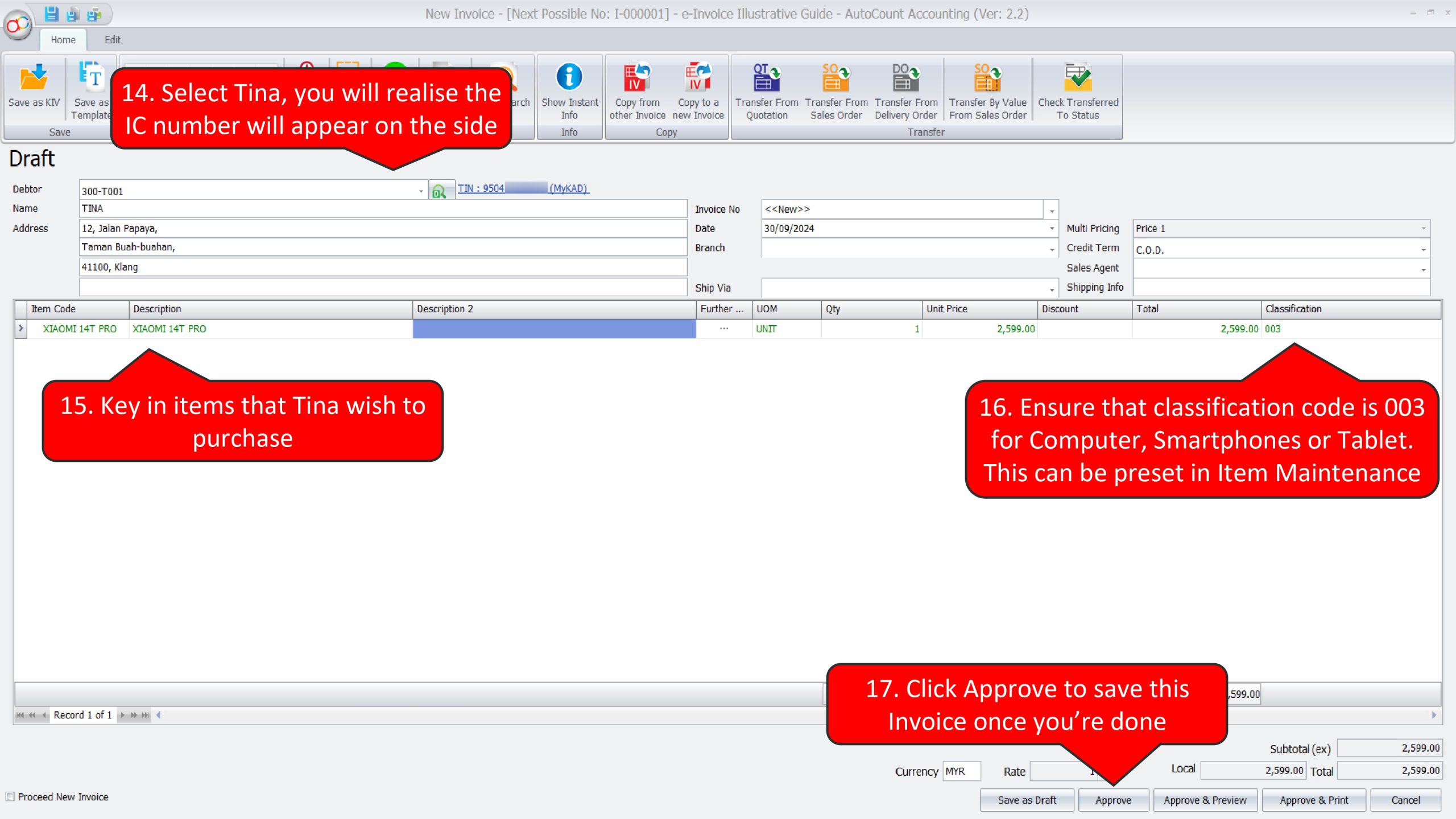

Illustration 5: Malaysian individual Buyers have the option to provide TIN or Malaysian Identification Number upon creation of e-Invoice #

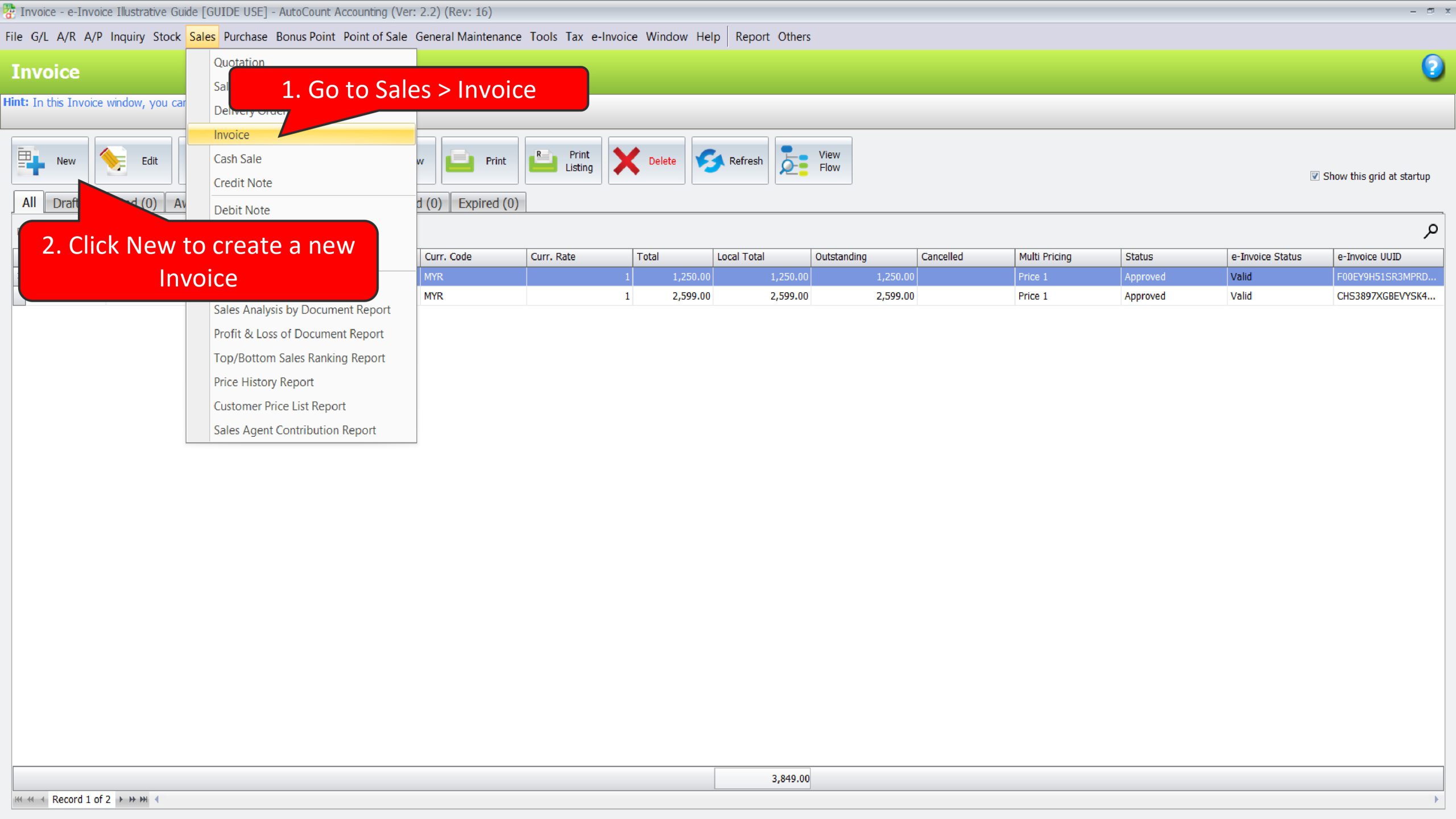

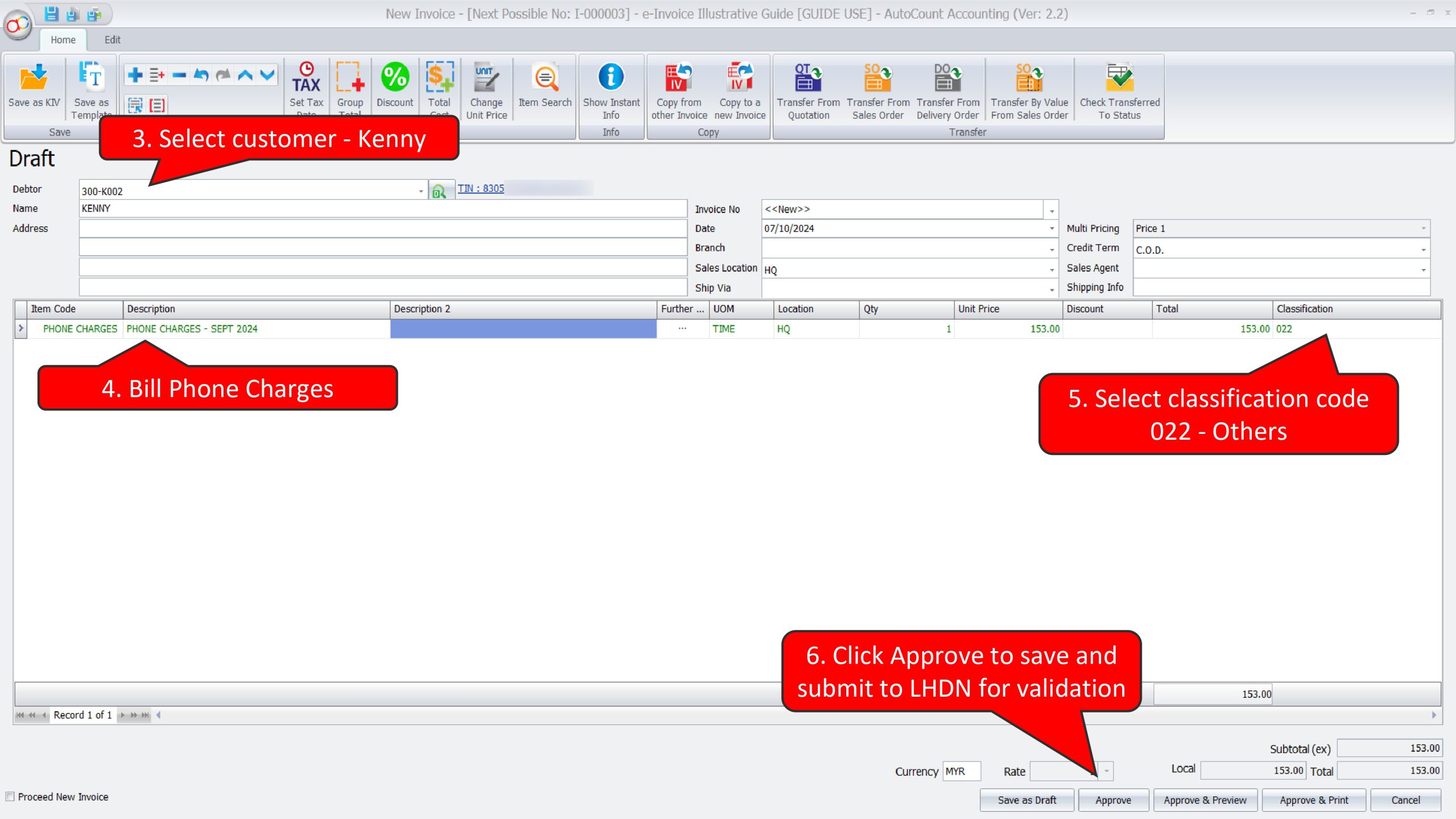

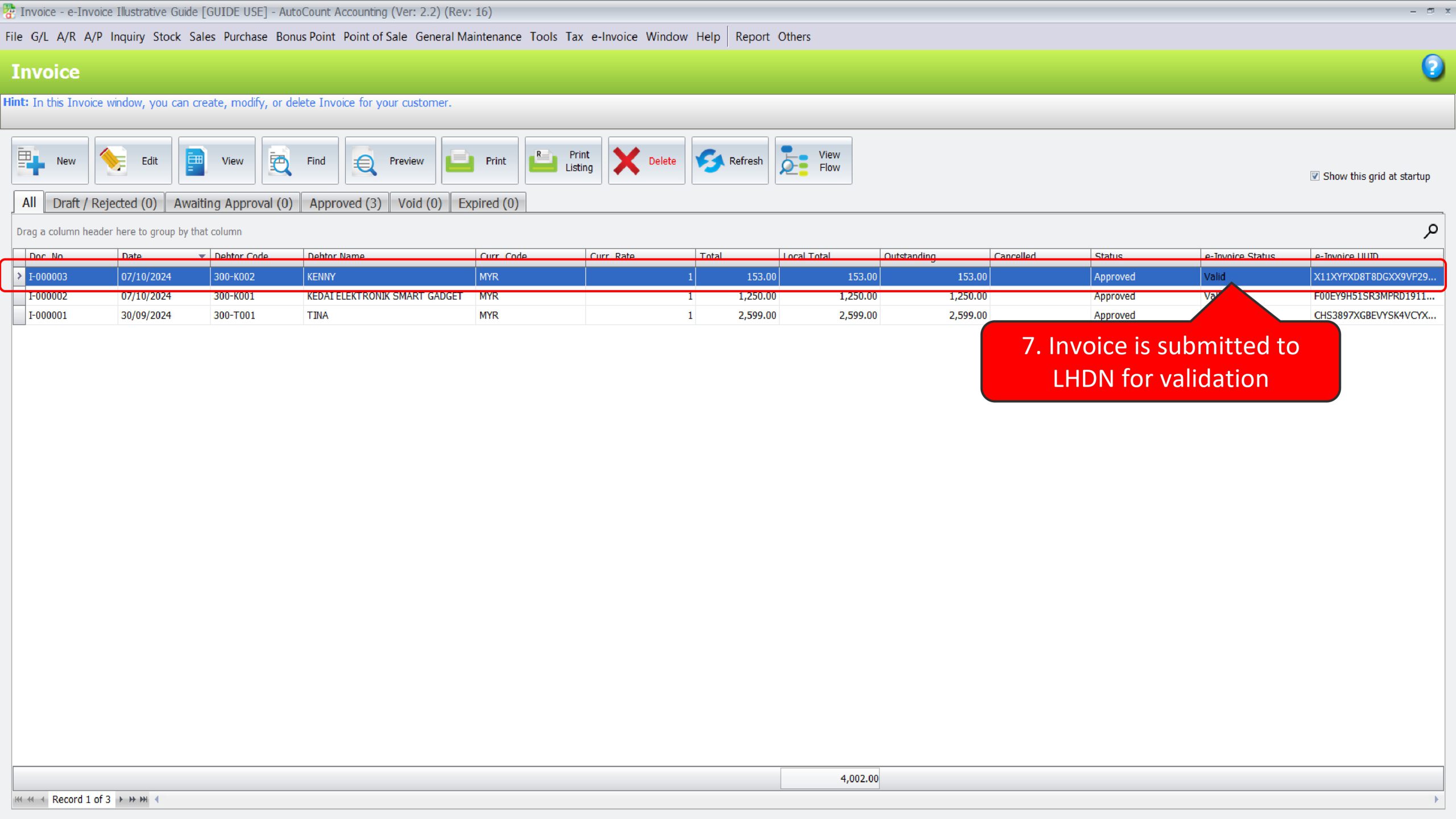

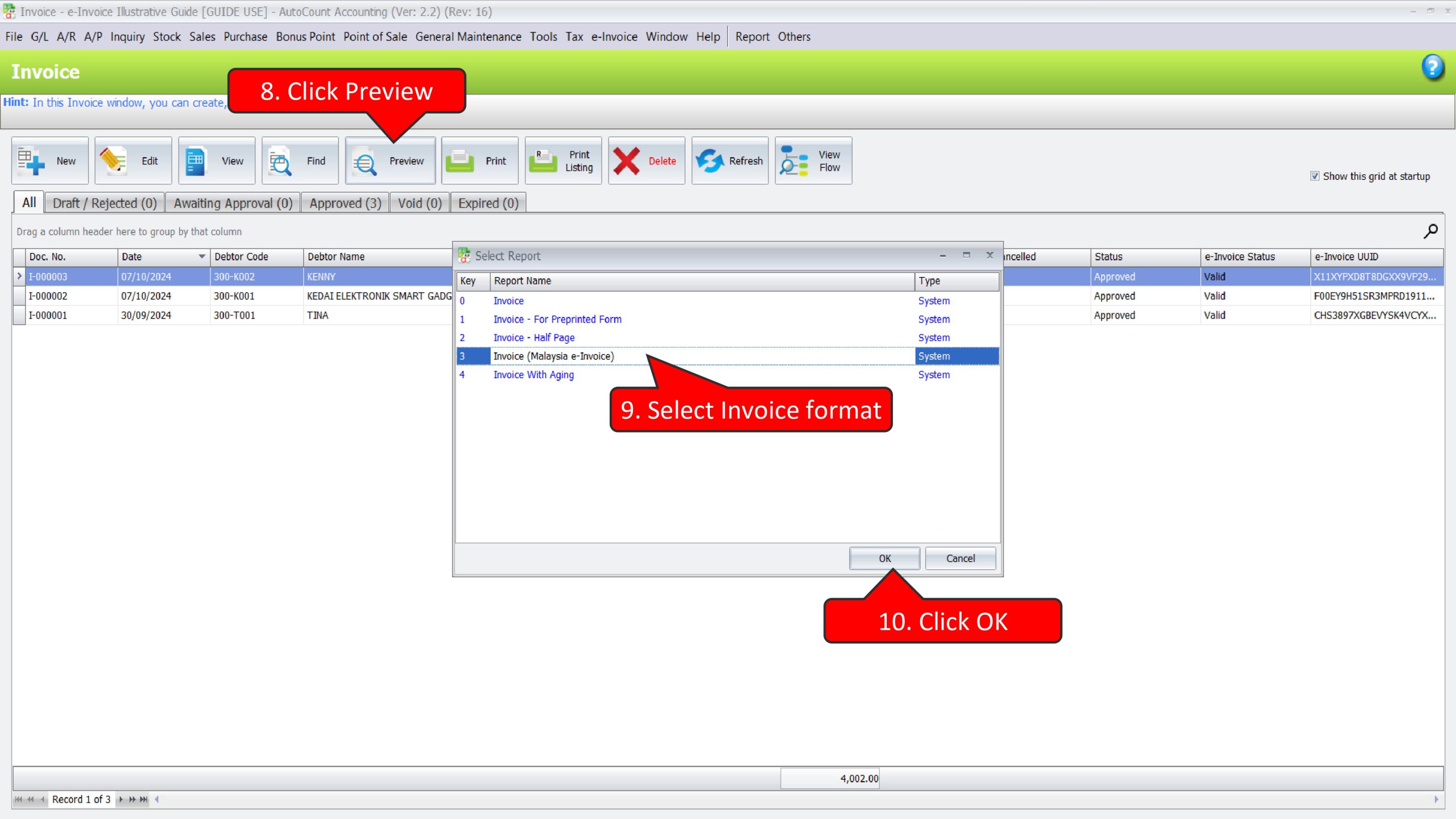

2 methods to handle such scenario:

- Using Invoice, issue to individual Debtor

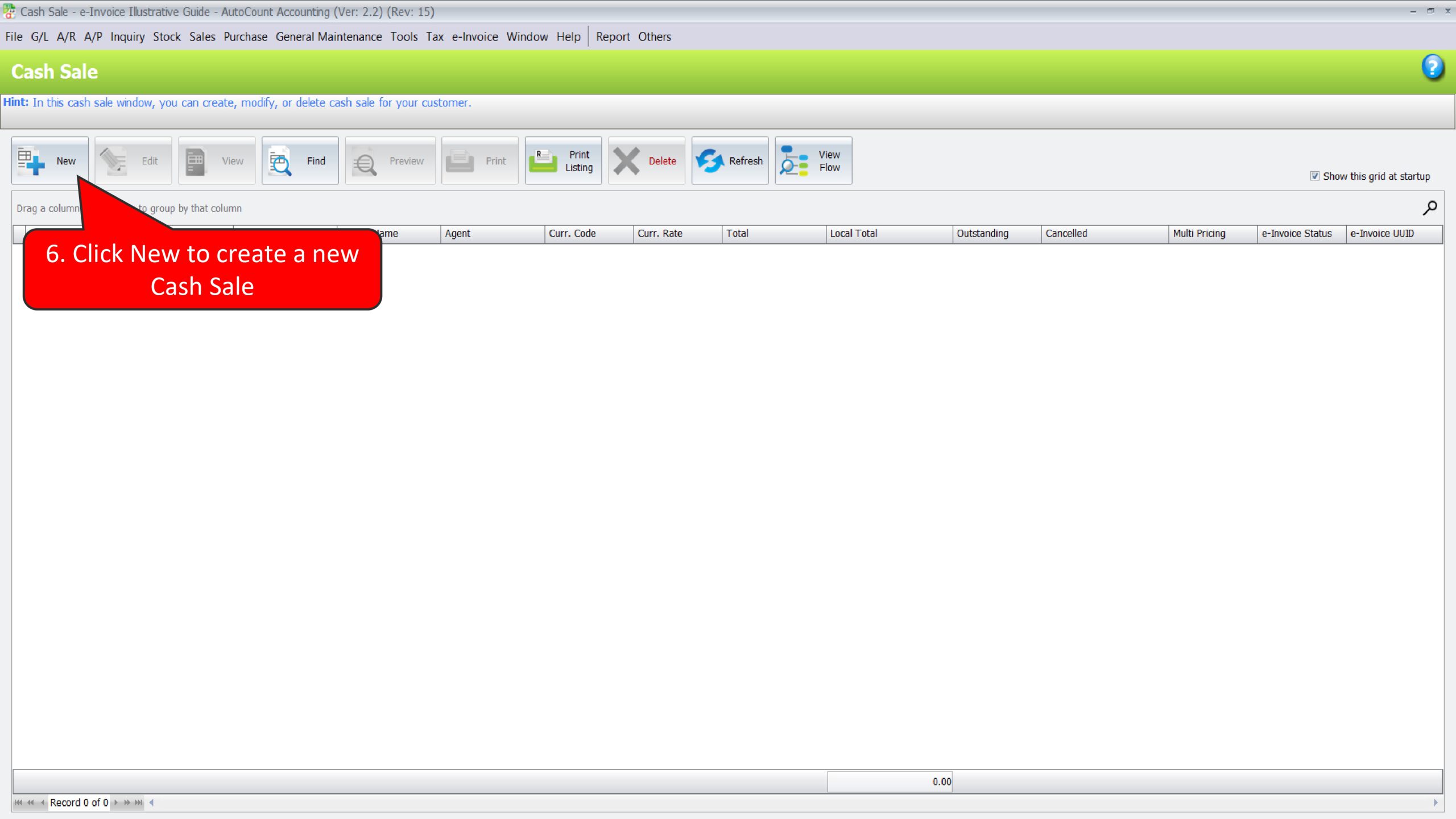

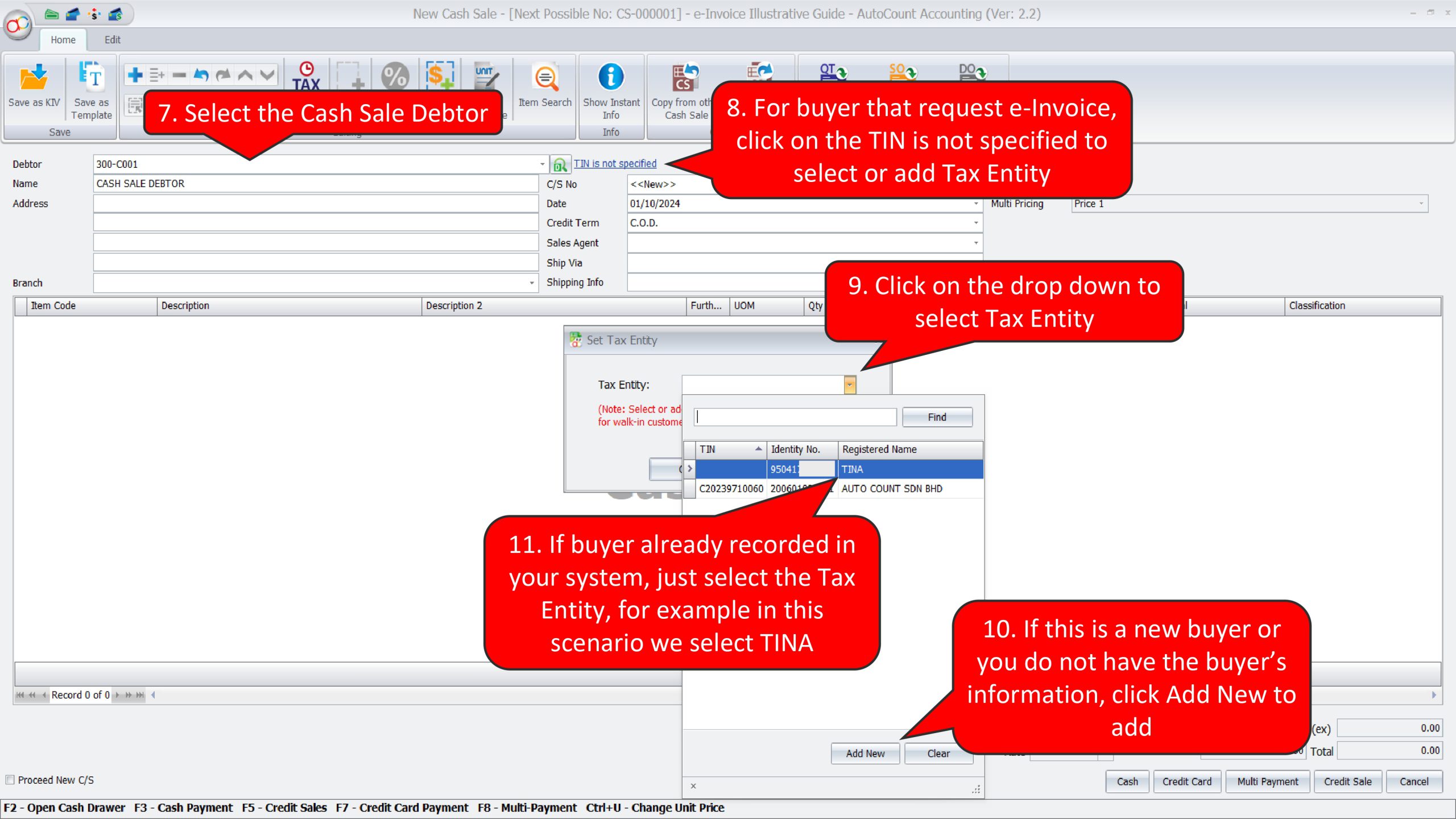

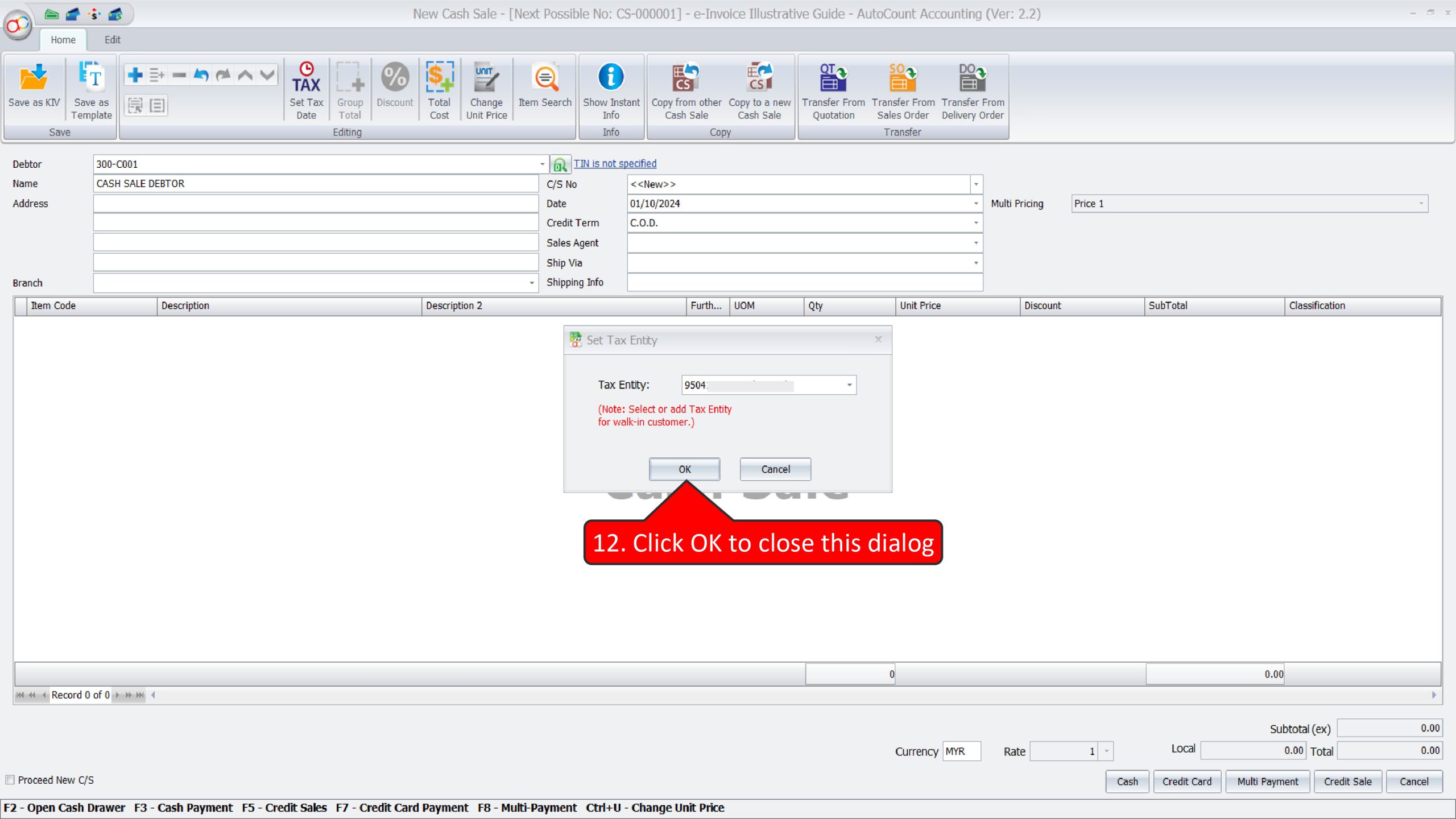

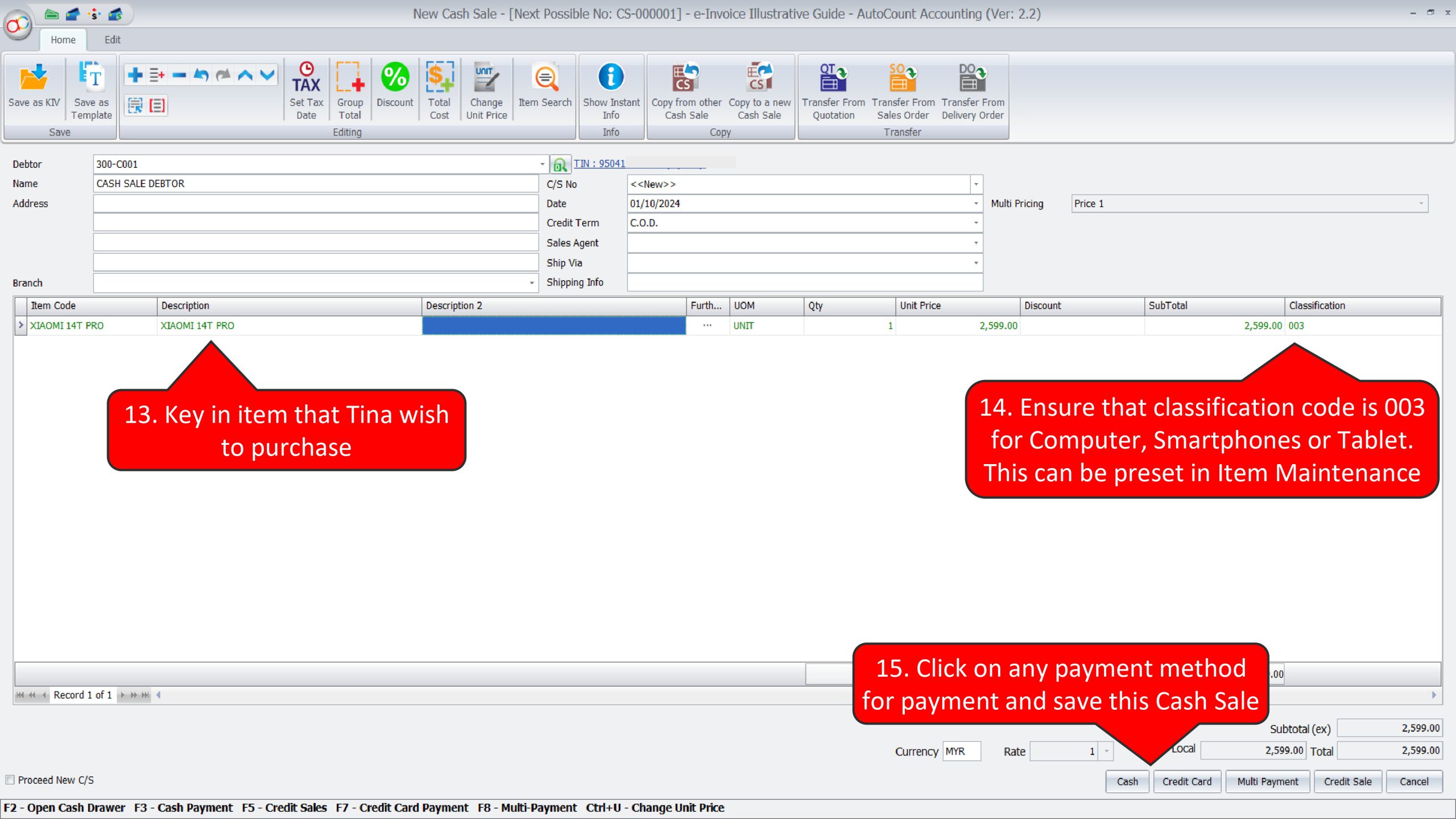

- Using Cash Sale, issue to general Cash Sale Debtor

Method 1: Using Invoice, issue to individual Debtor

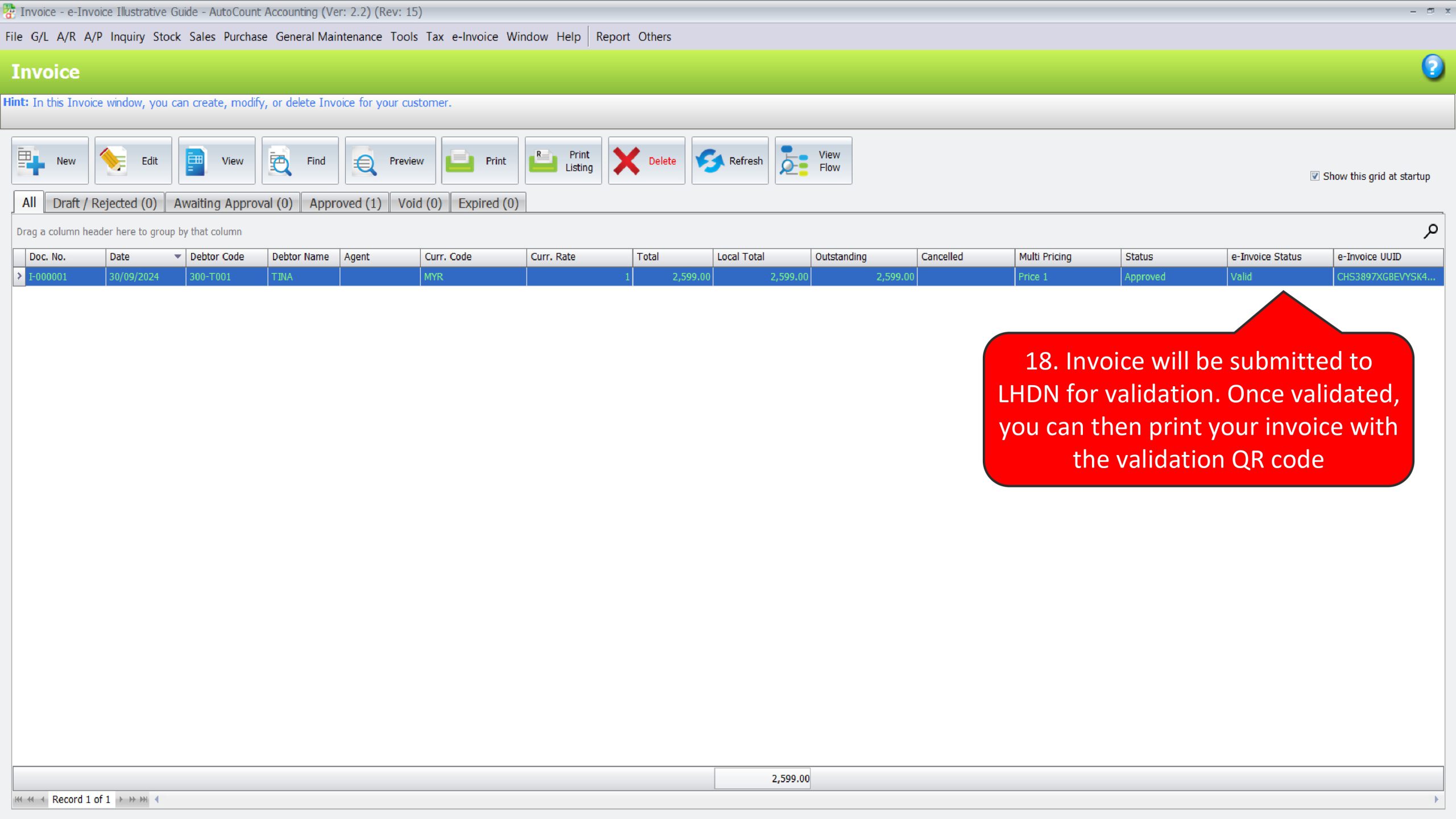

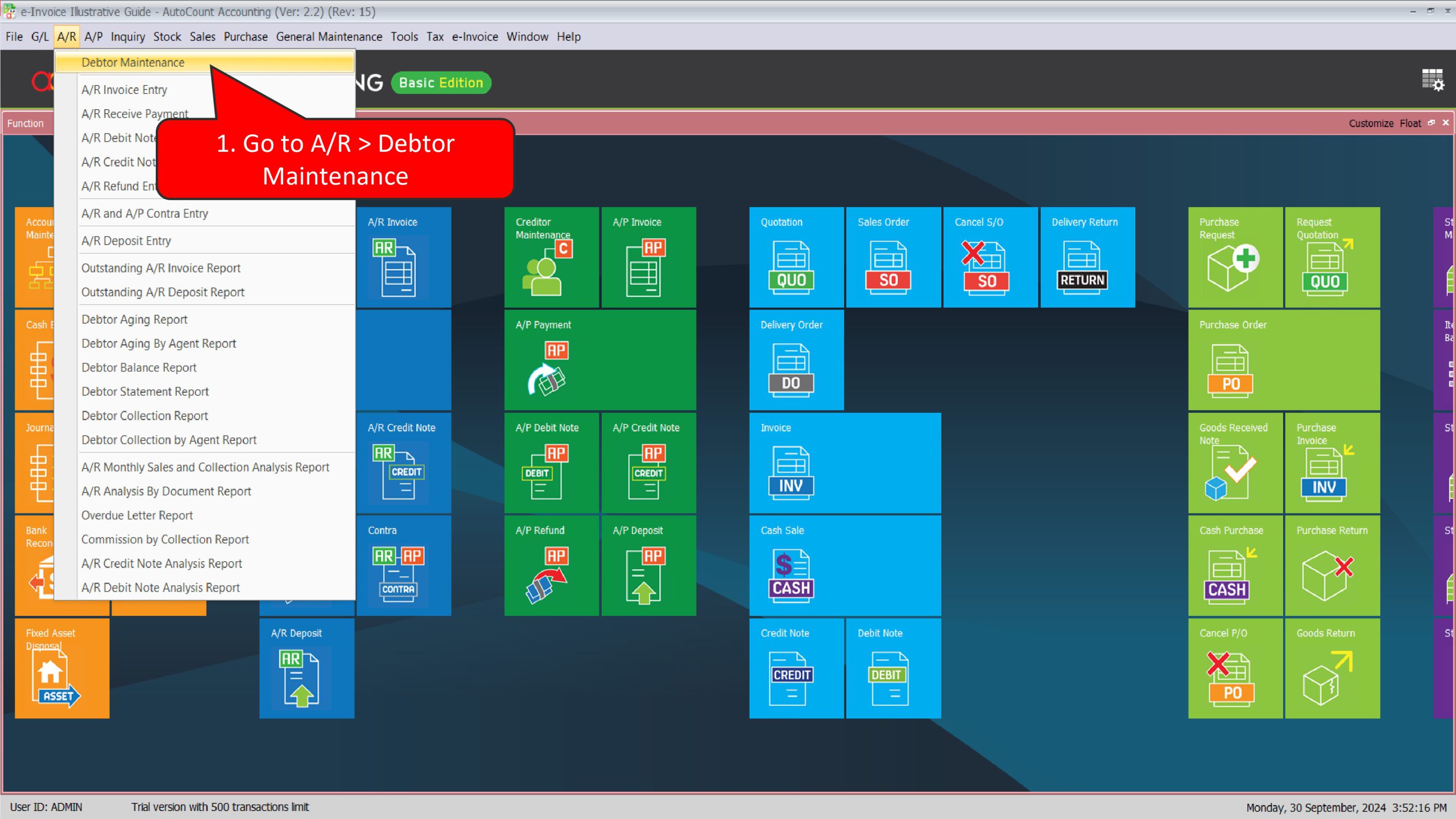

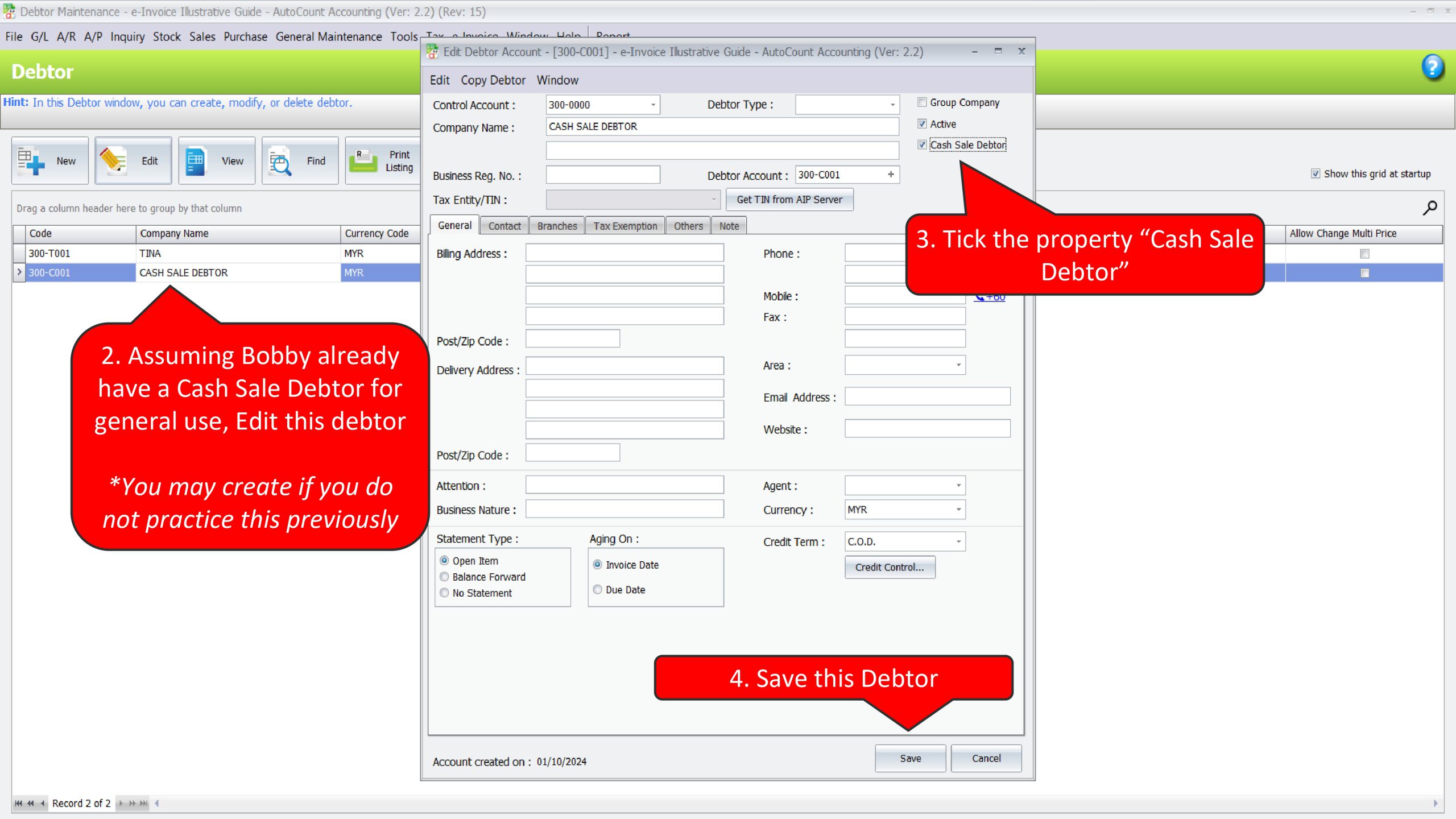

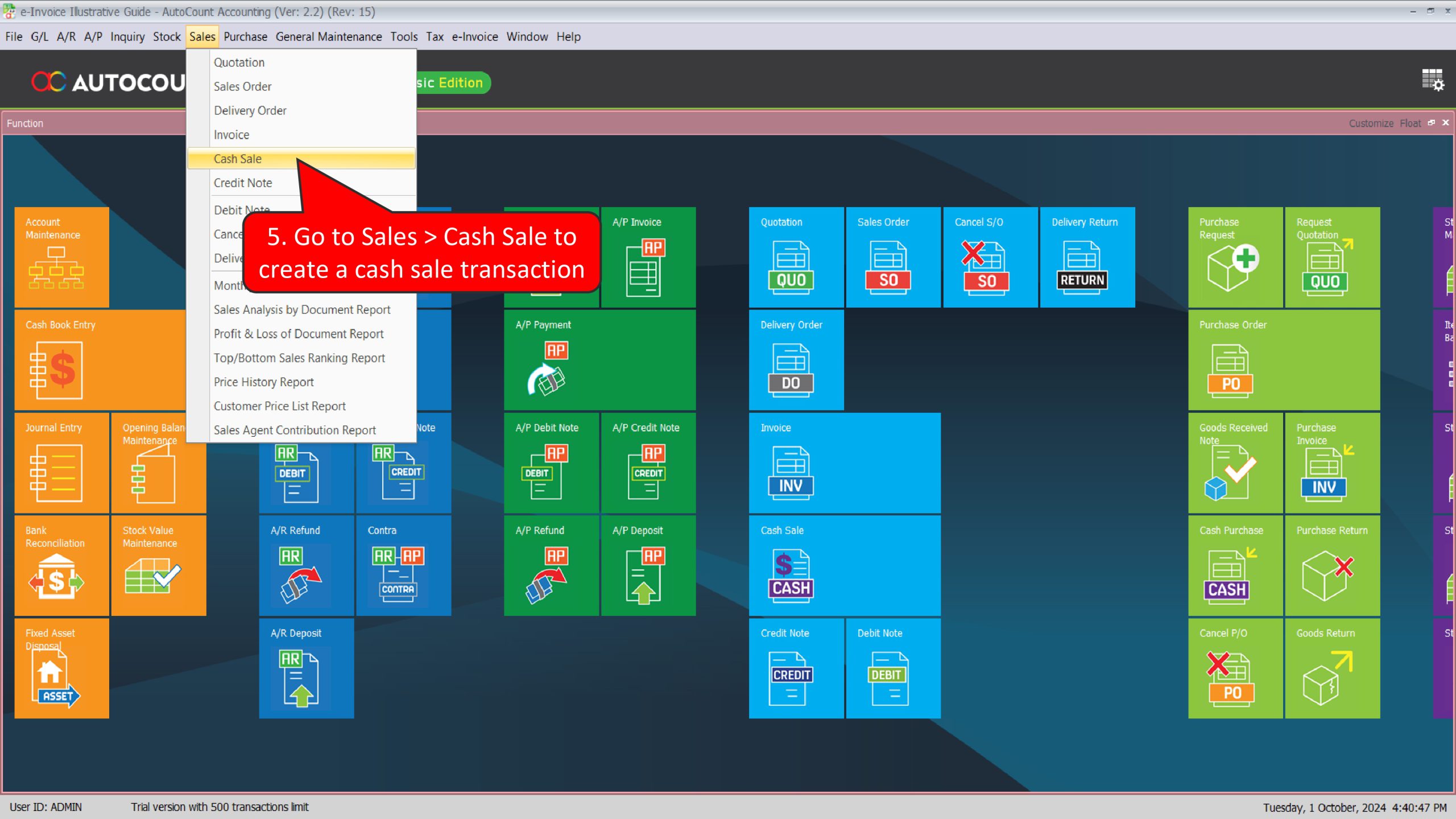

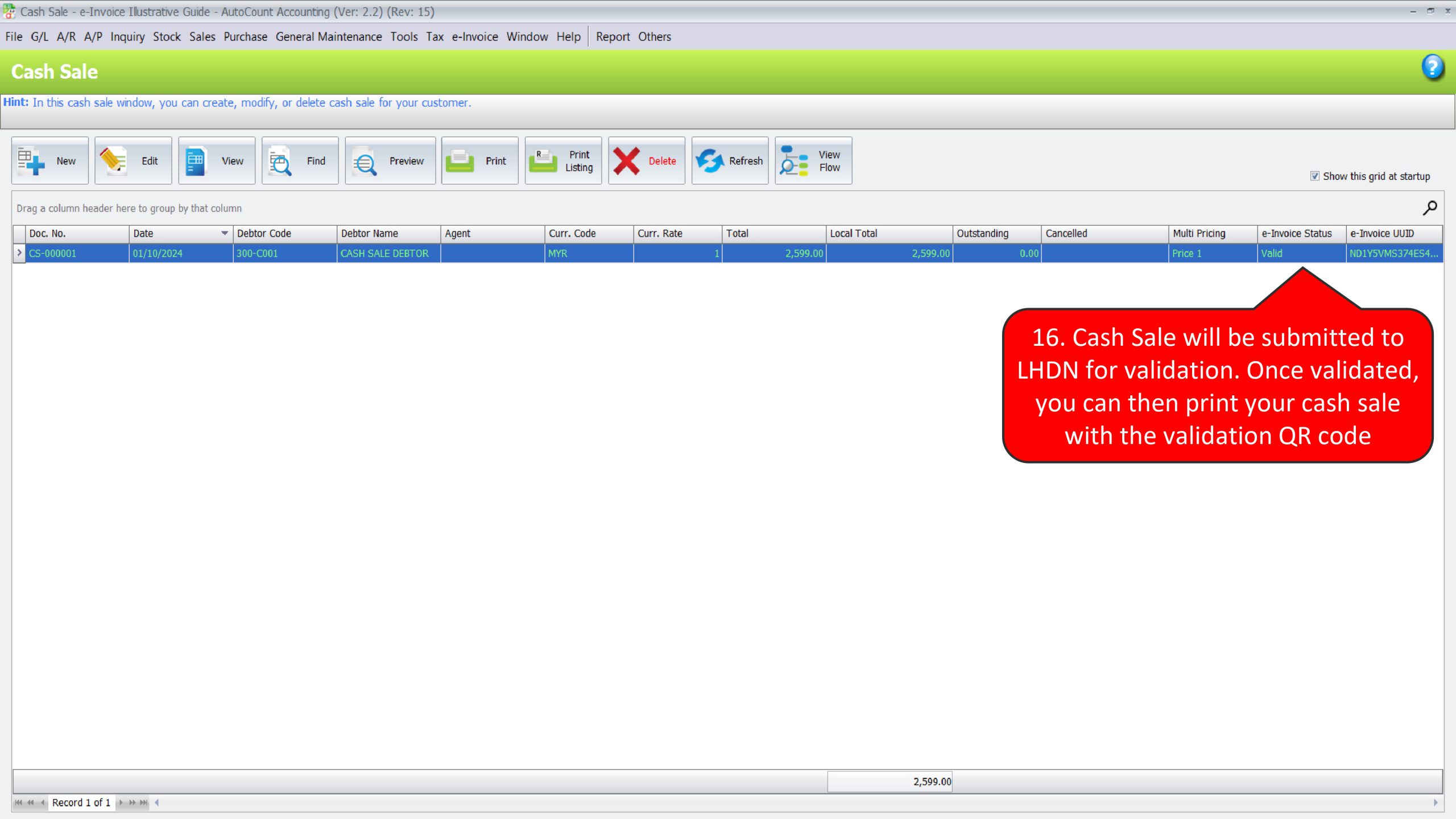

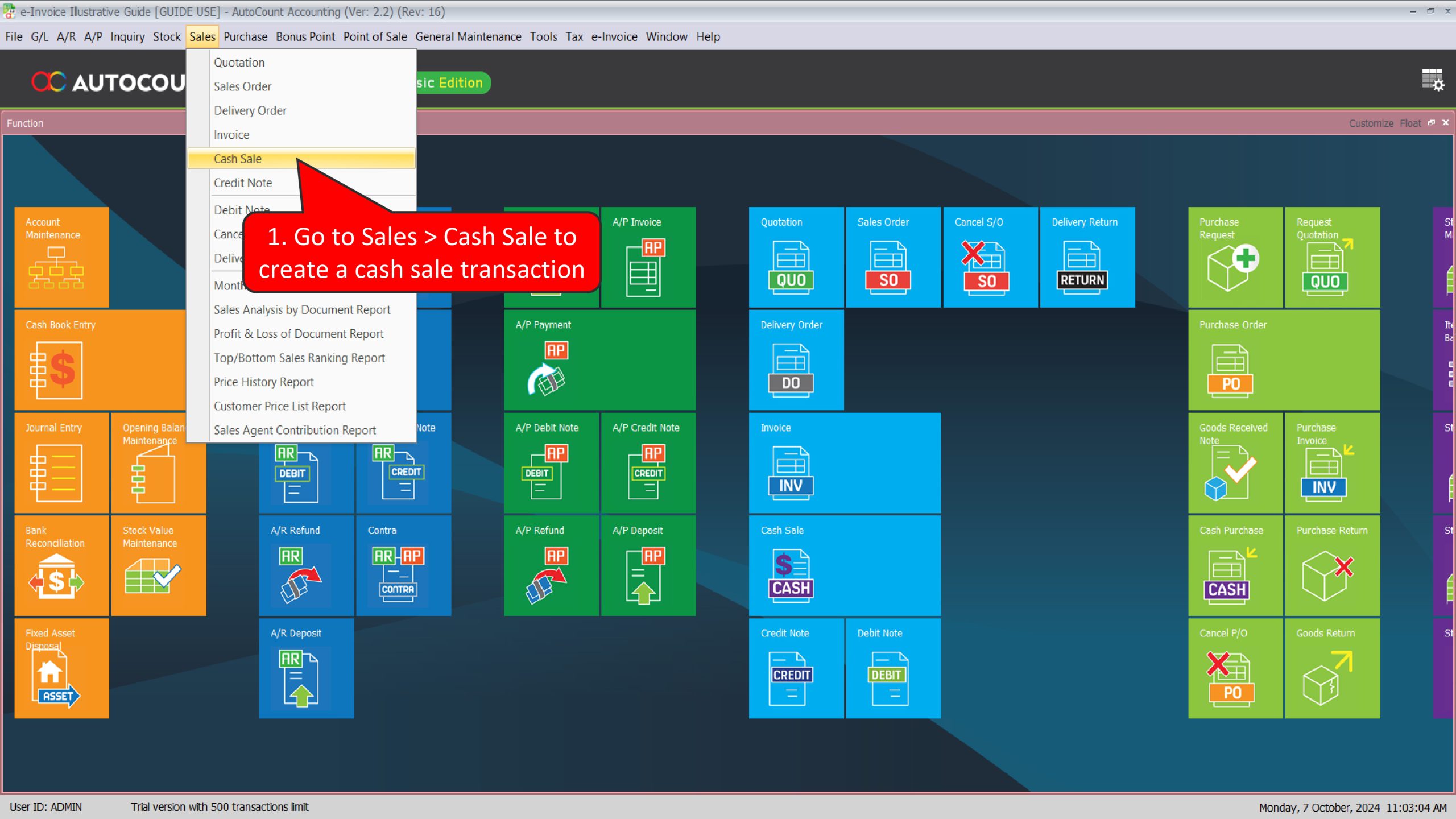

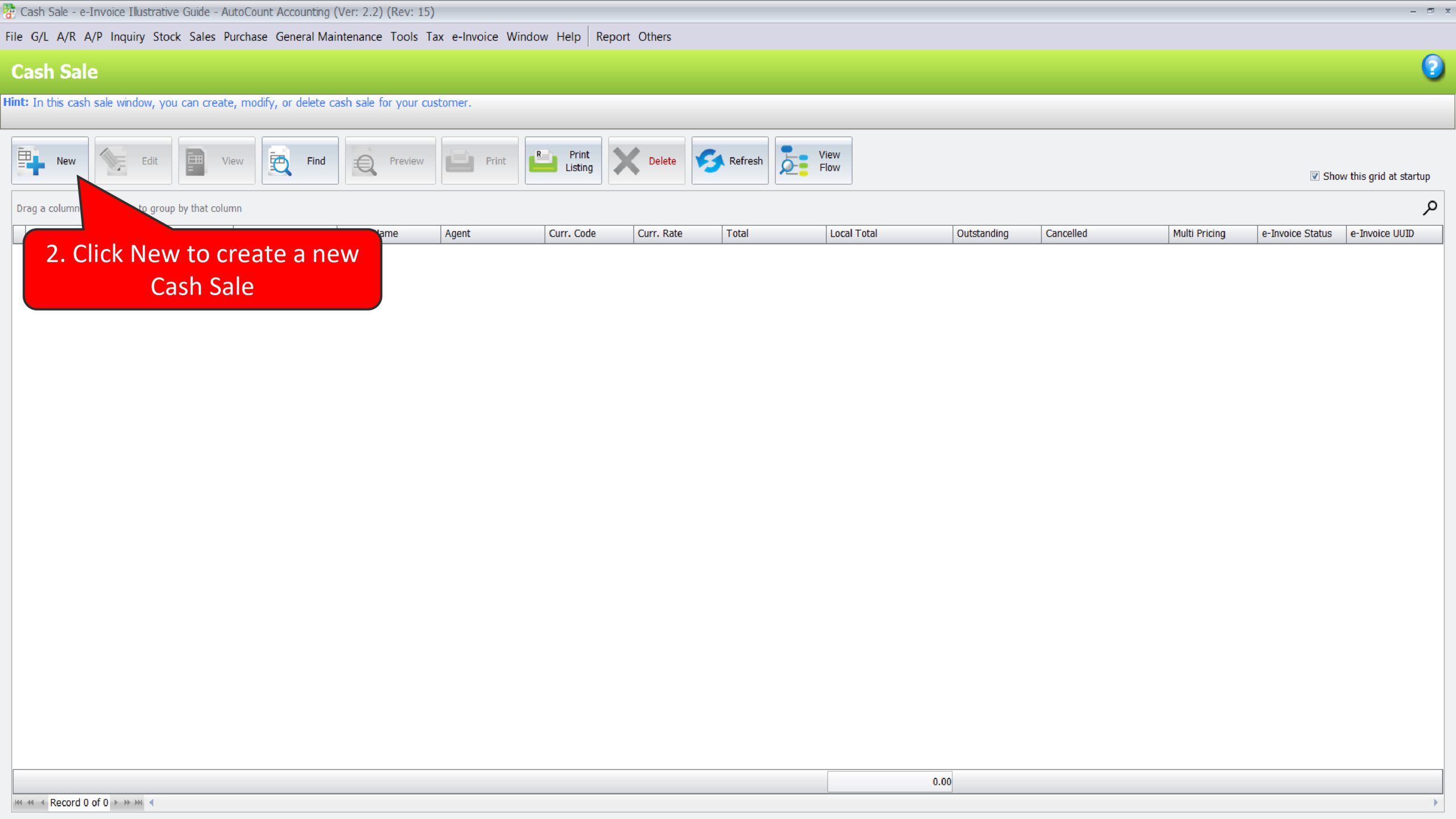

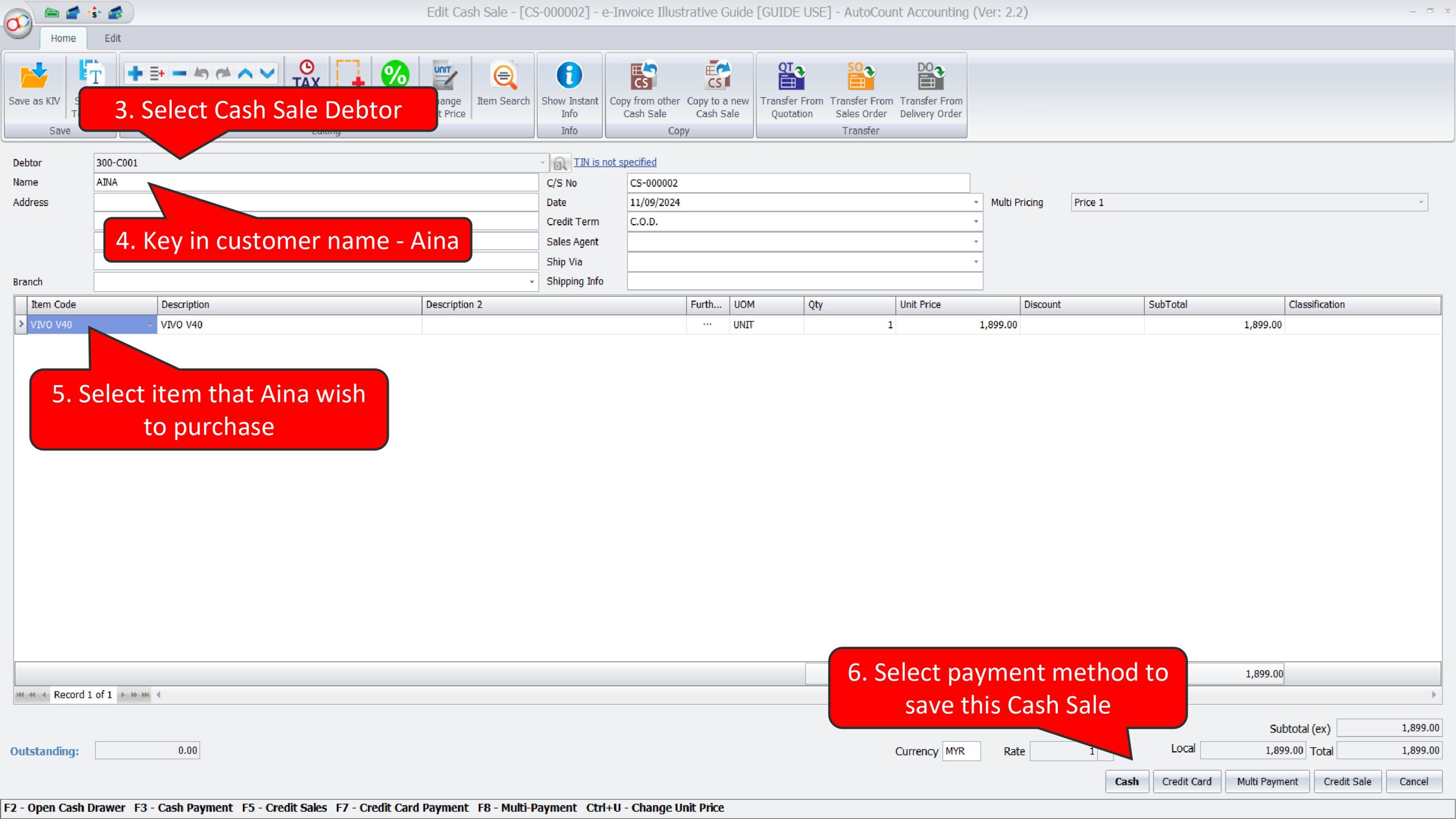

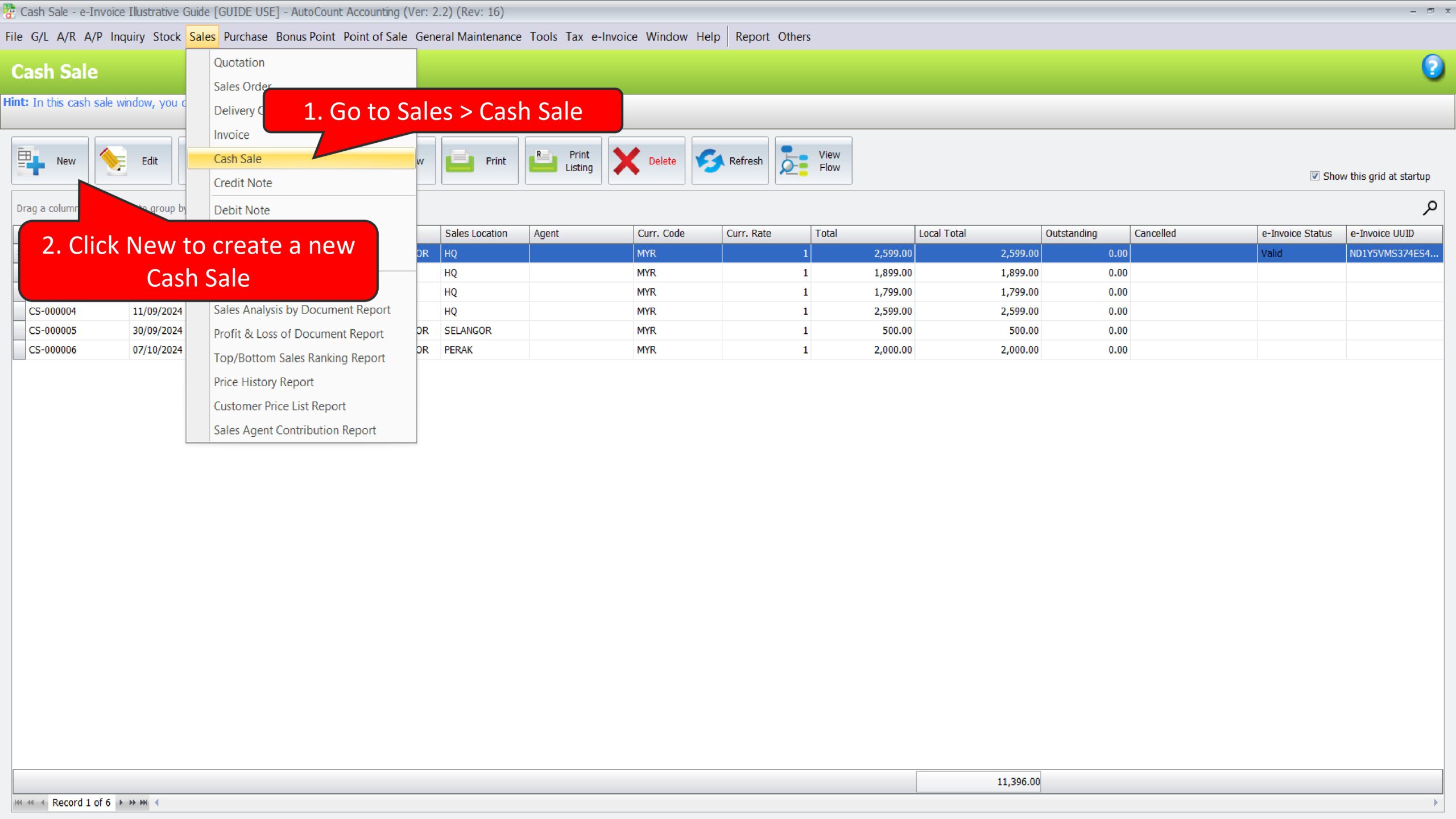

Method 2: Using Cash Sale, issue to general Cash Sale Debtor

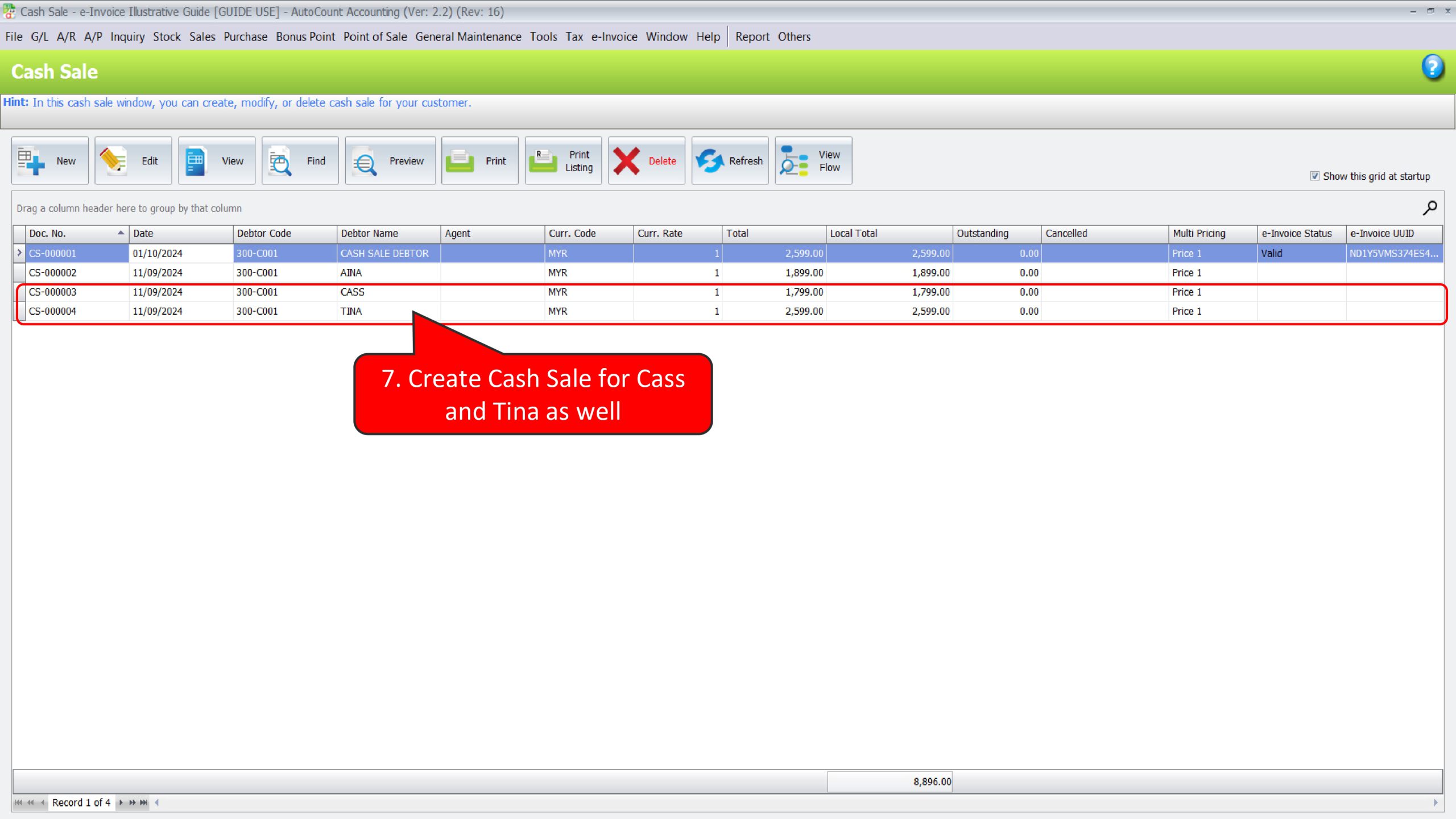

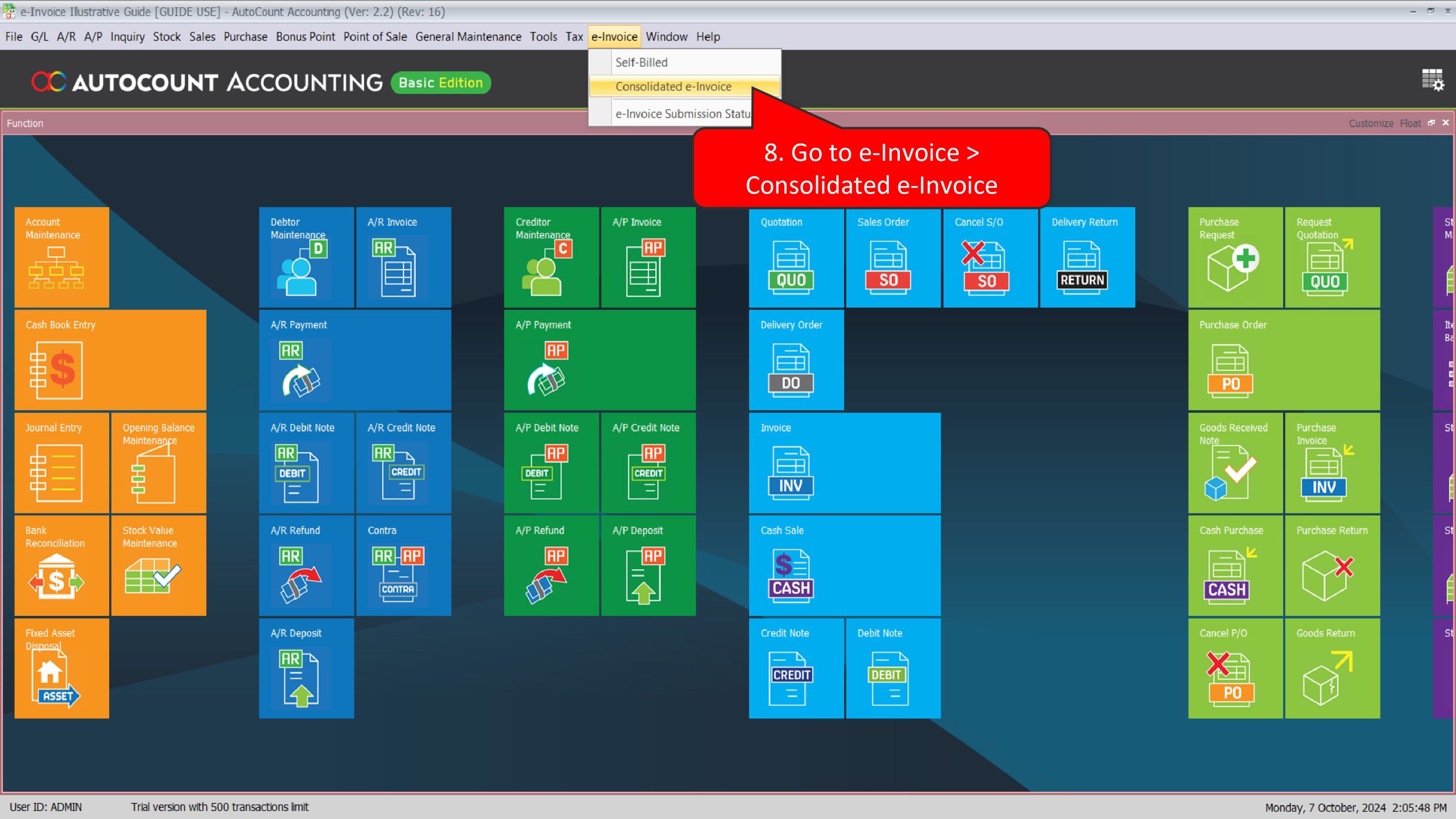

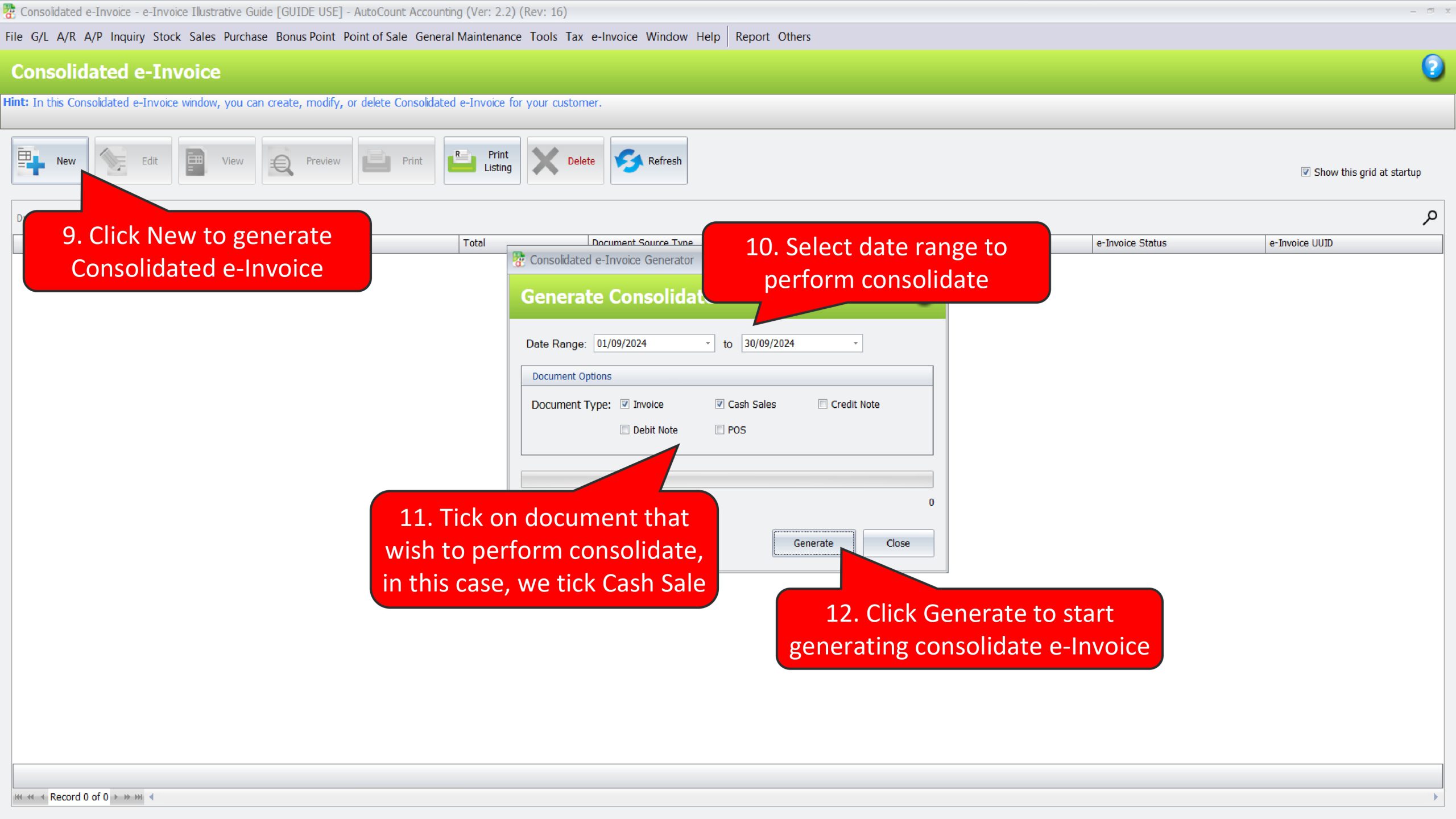

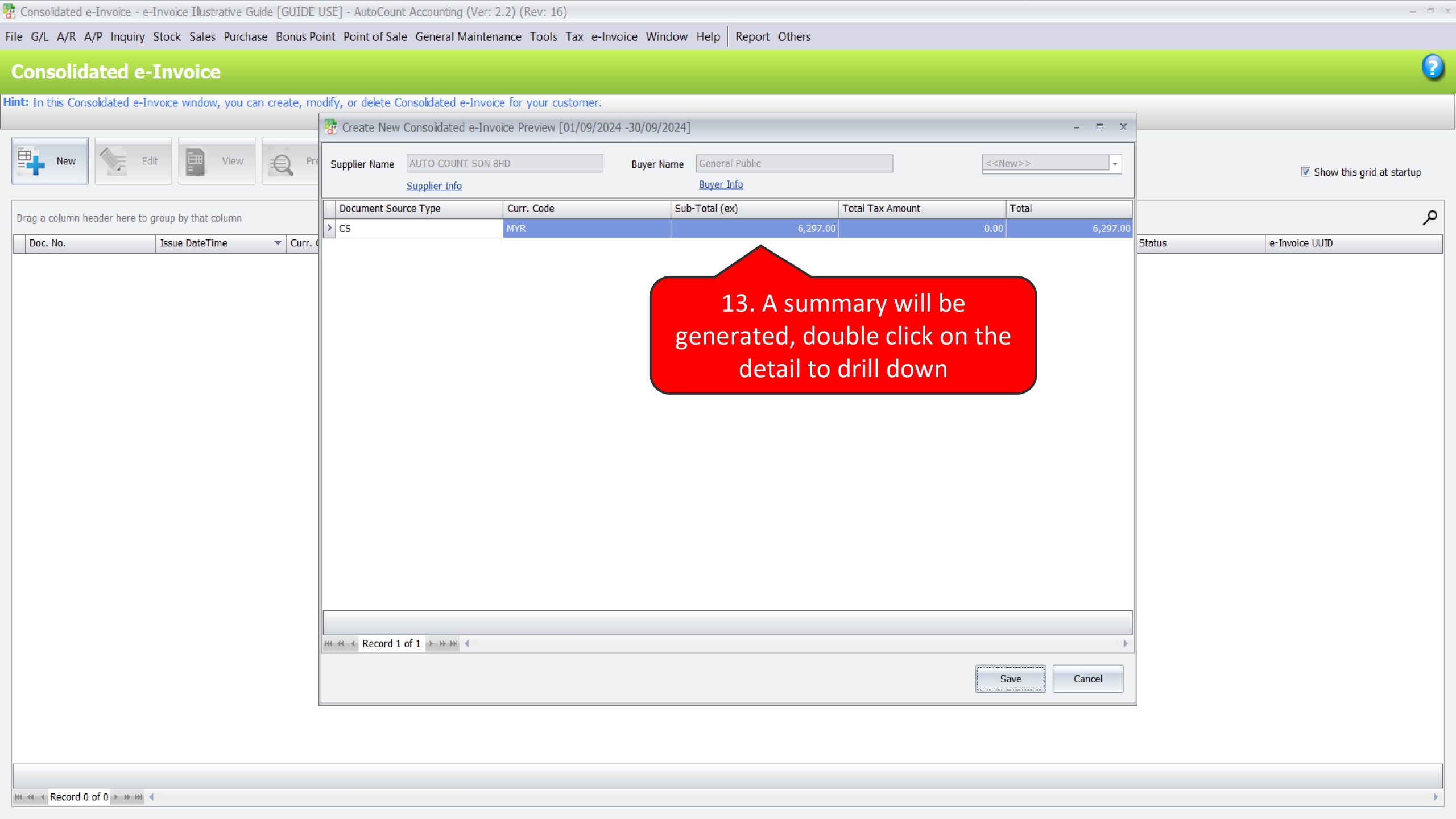

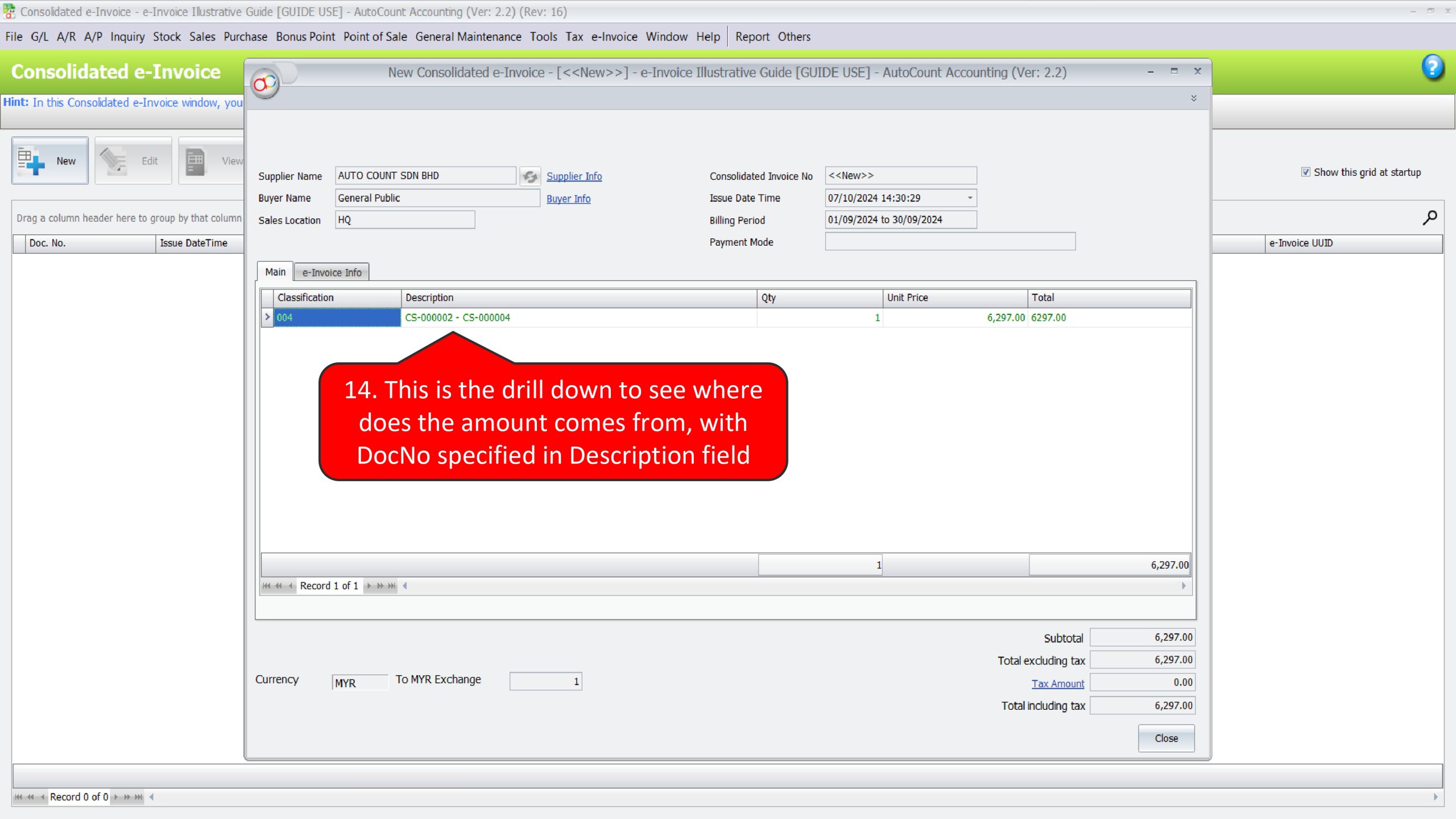

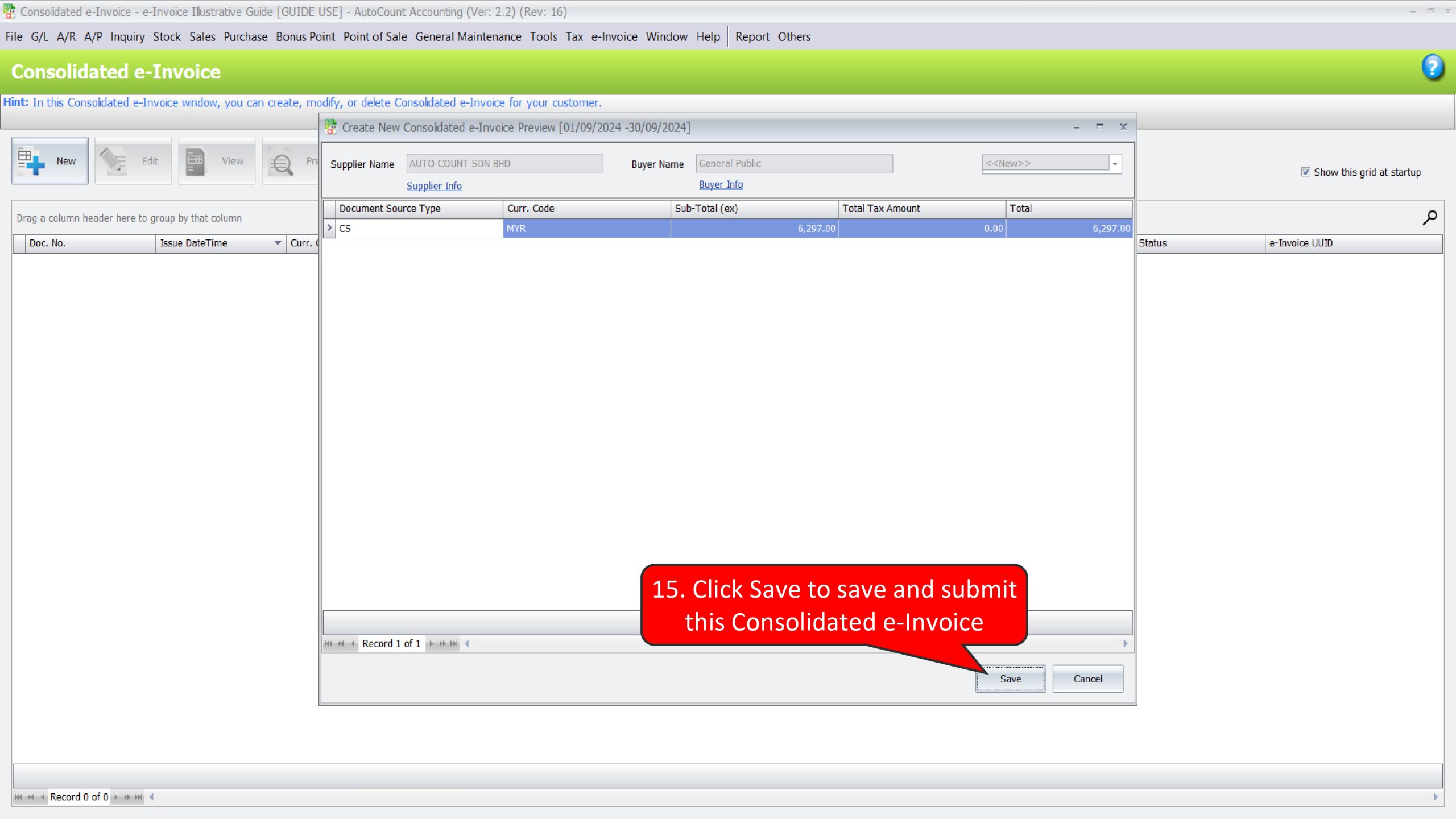

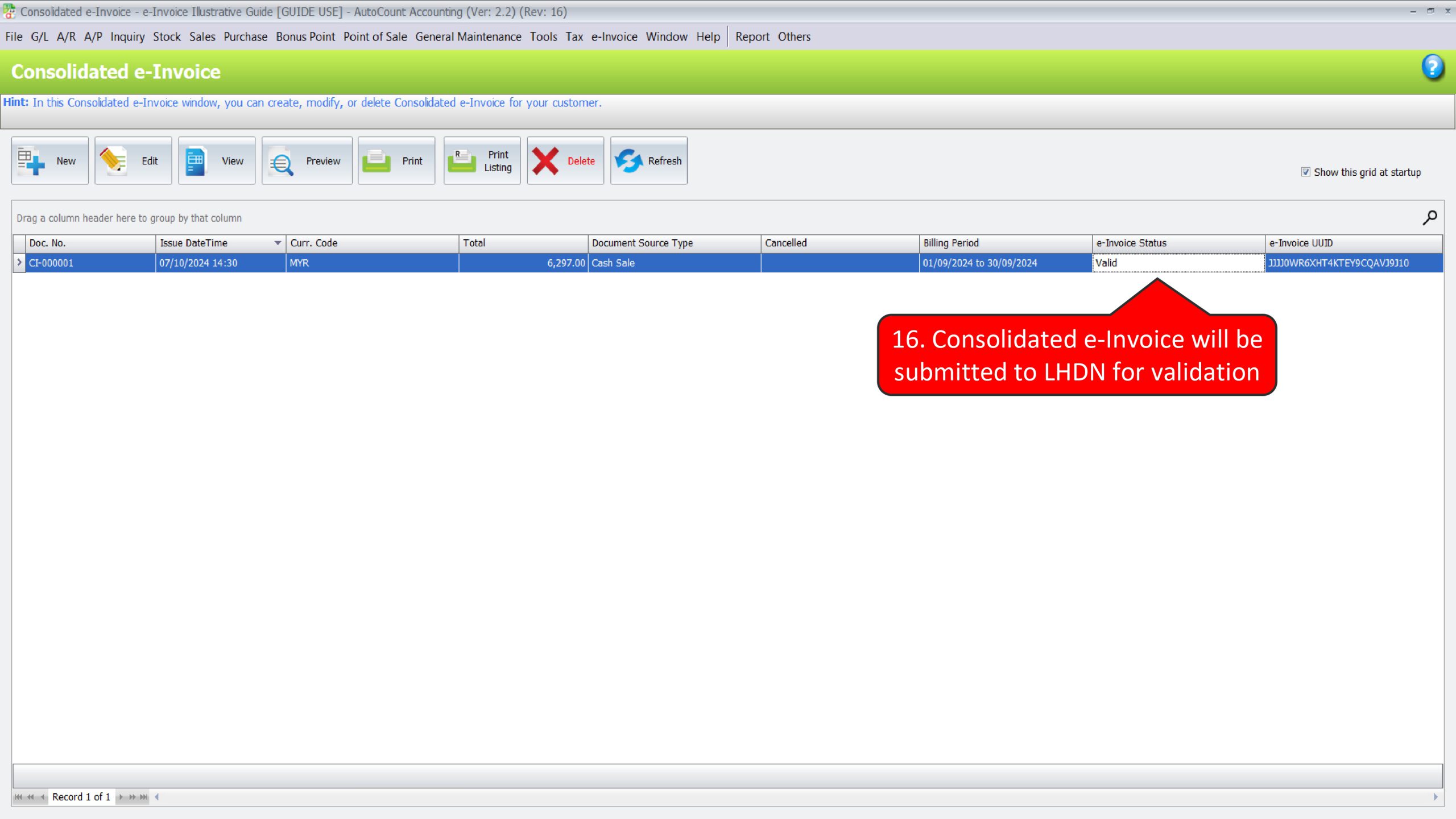

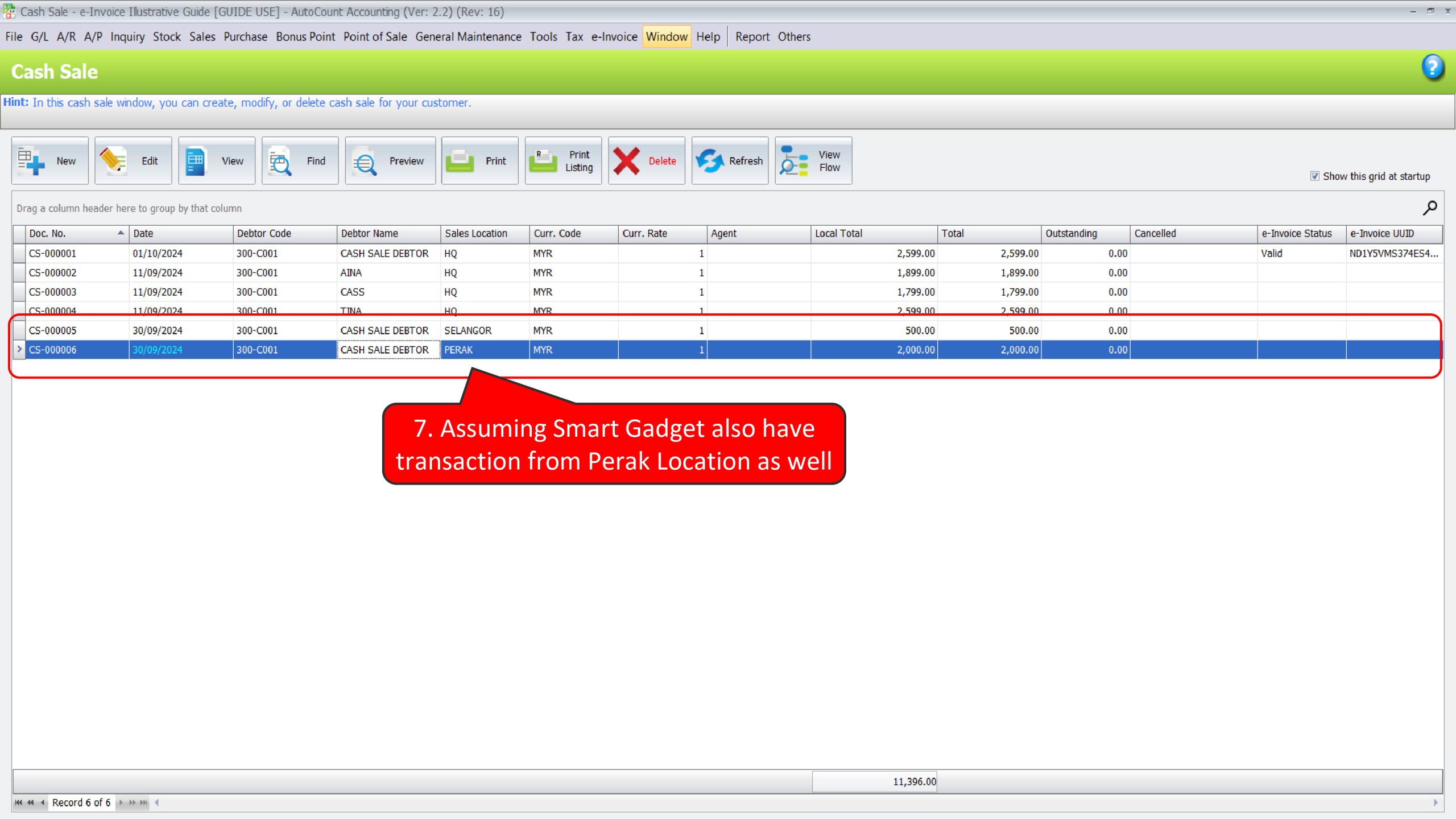

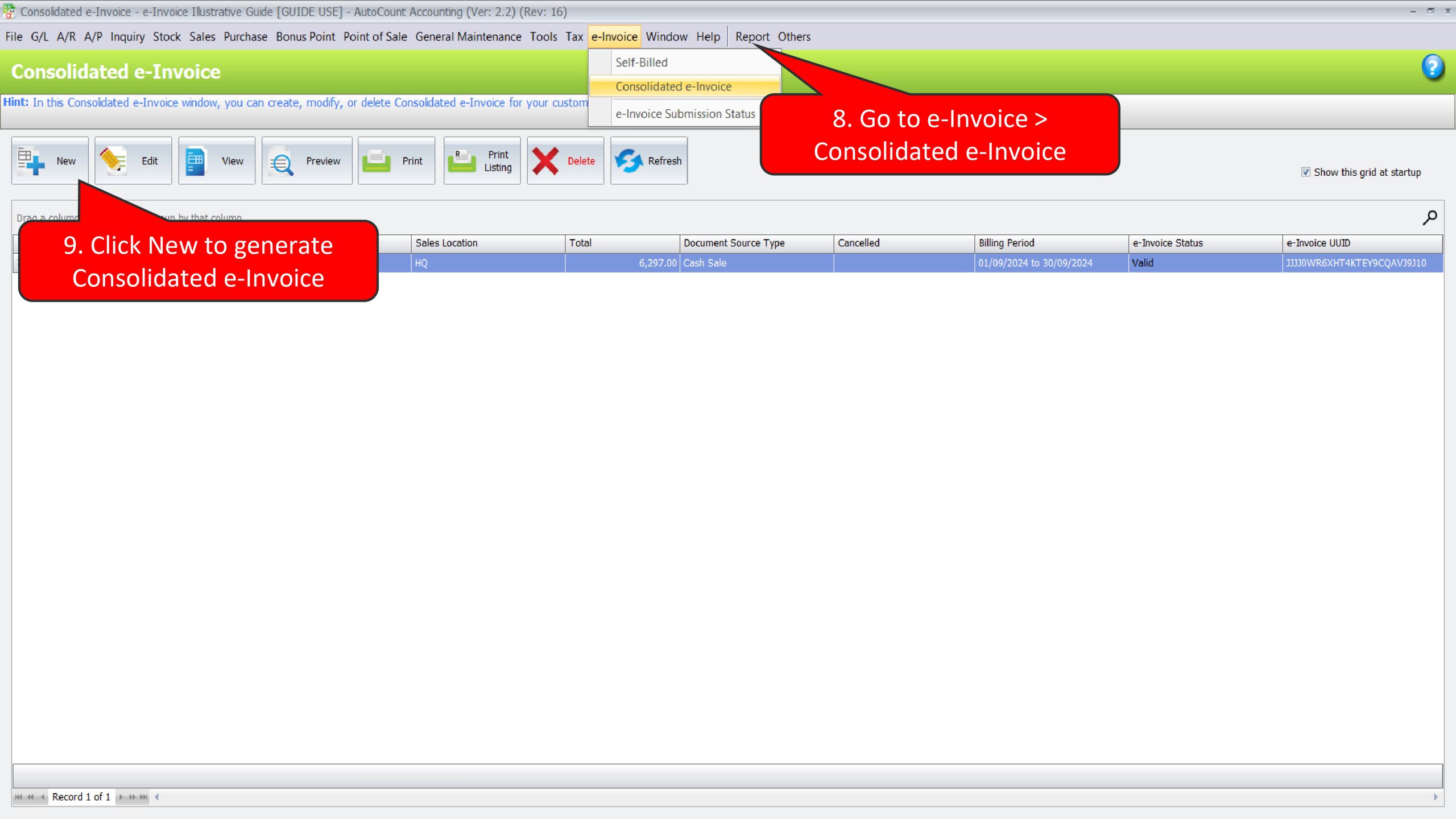

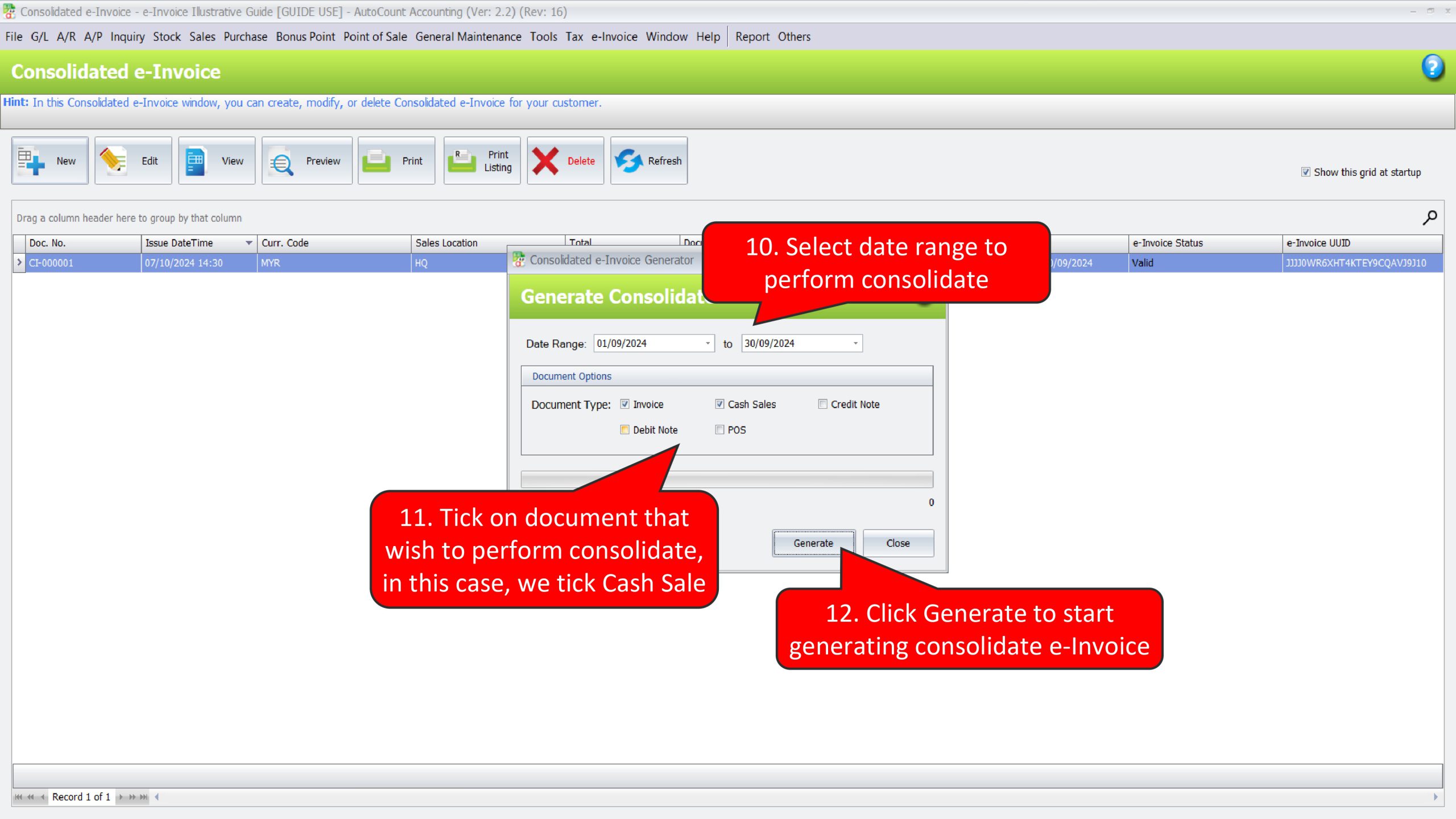

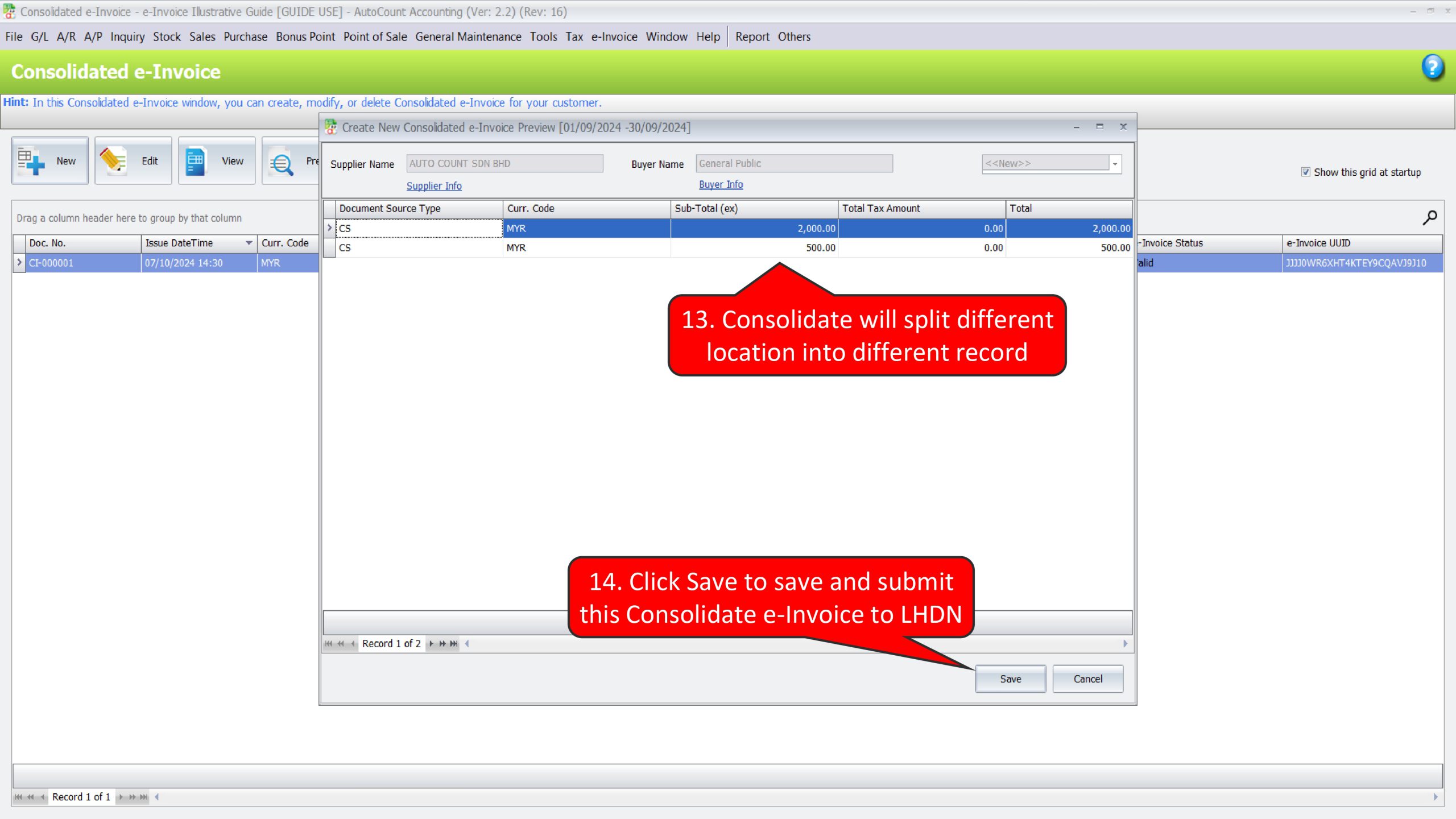

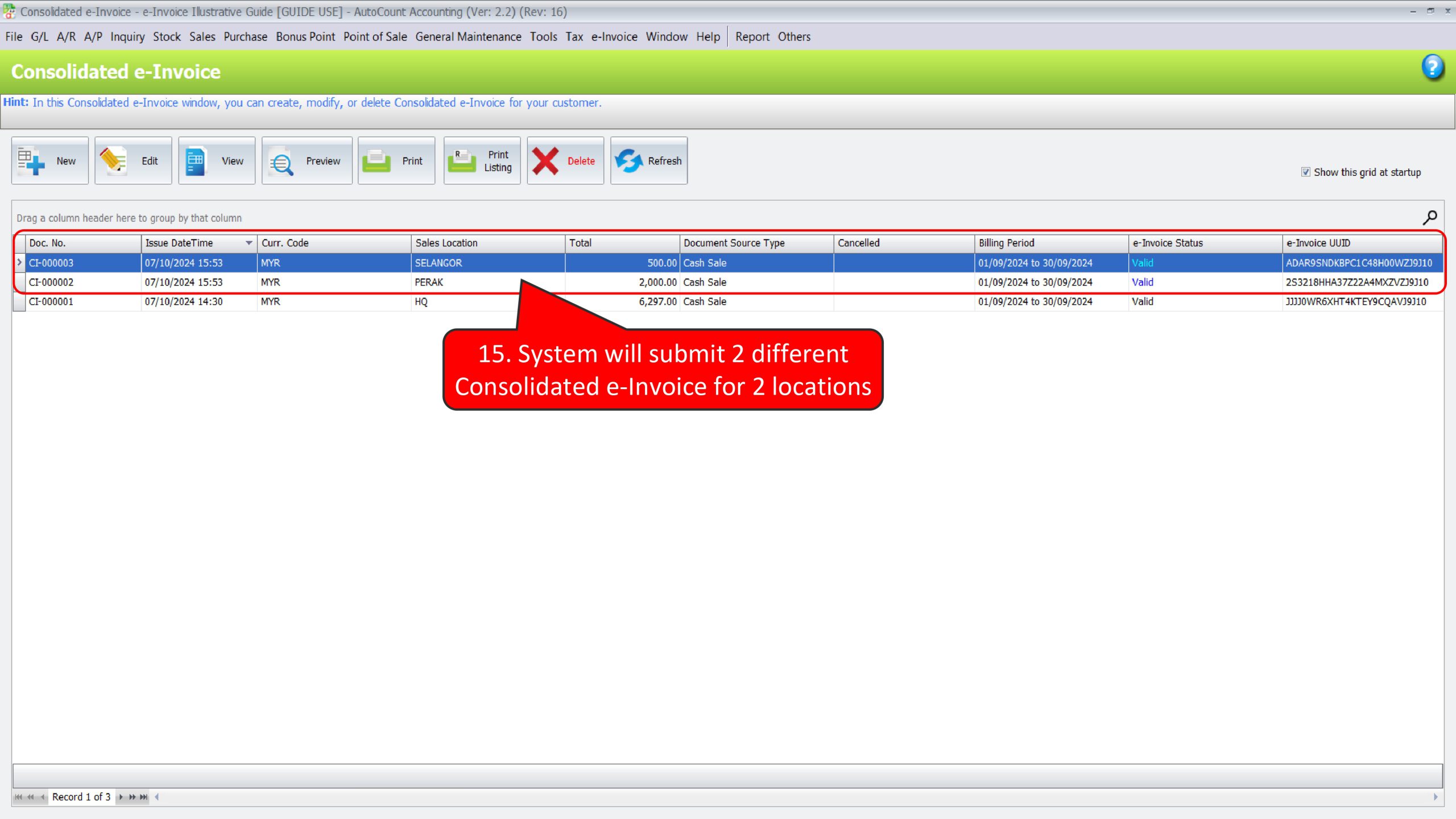

Illustration 8: Where Buyers do not require an e-invoice, Seller is required to submit consolidated e-Invoice #

Illustration 9: Where a landlord conducts business, landlord is required to issue e-Invoice to tenant, including utility charges issued to landlord #

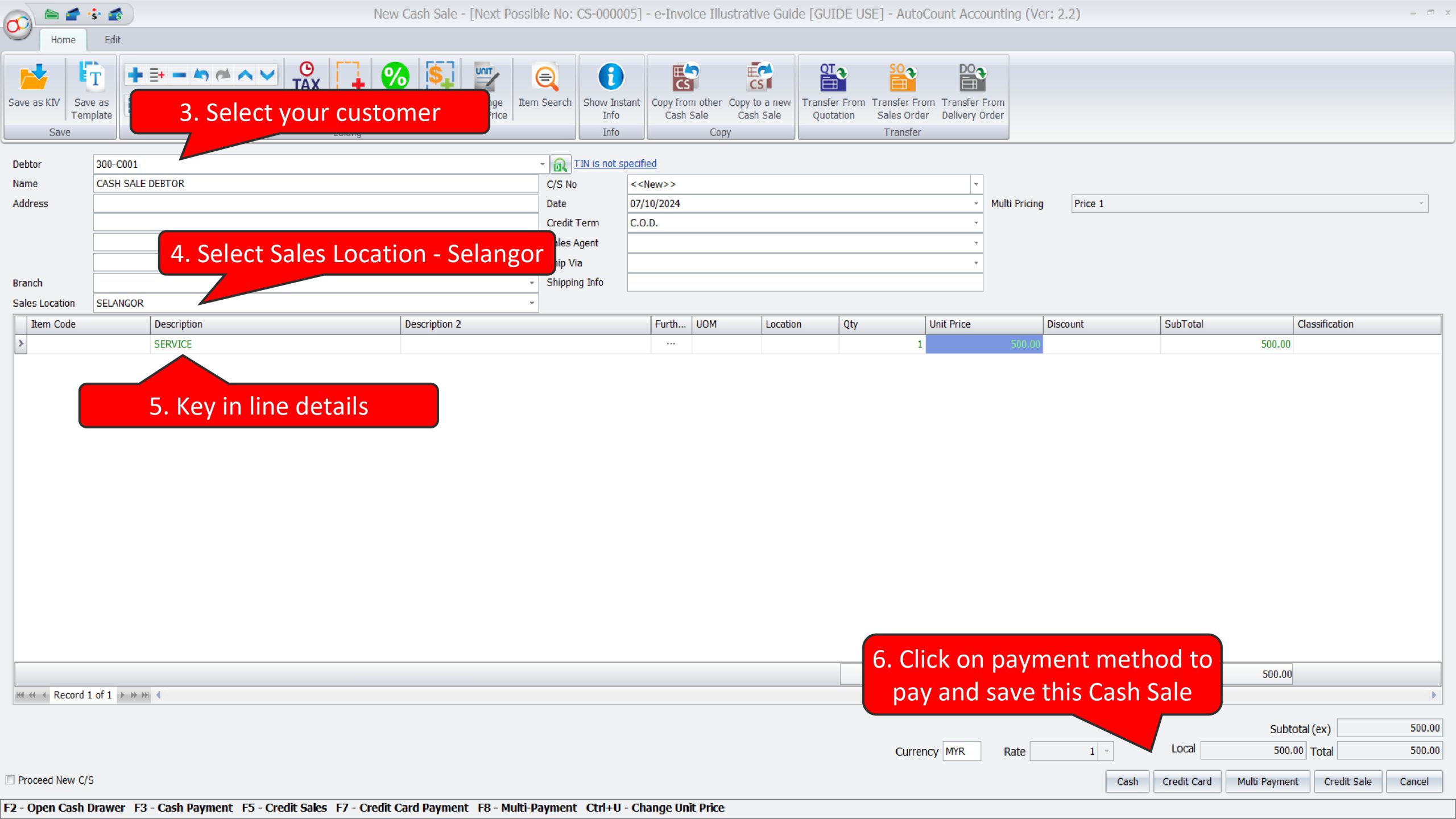

Illustration 10: Sellers with multiple branches can choose how they would like to consolidate their e-Invoices #

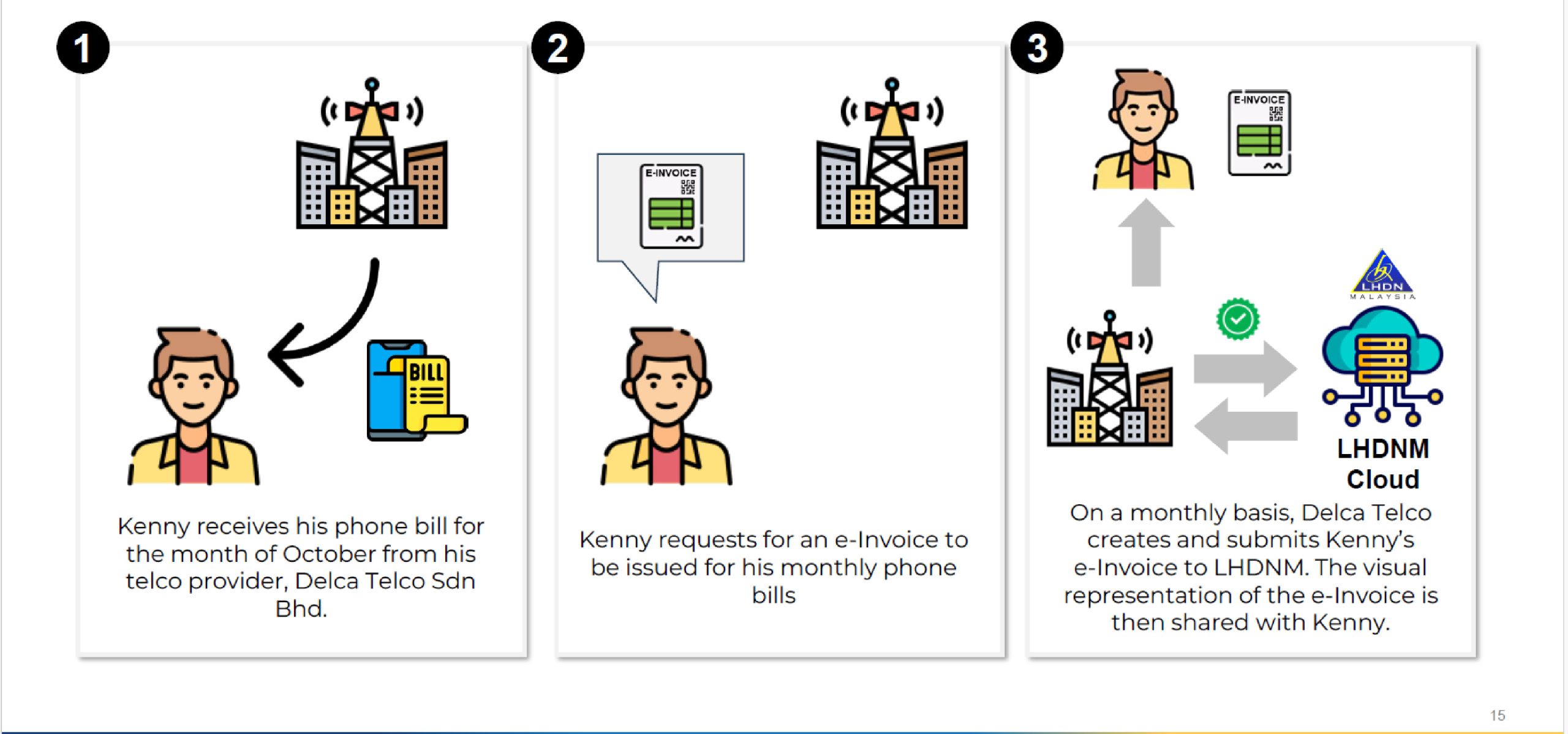

Illustration 11: Sellers that issue statements / bills on a periodic basis are required to issue e-Invoices #

Illustration 12: e-Invoices issued for bills on periodic basis may include adjustments to statements / bills from a prior period, such as rebates #

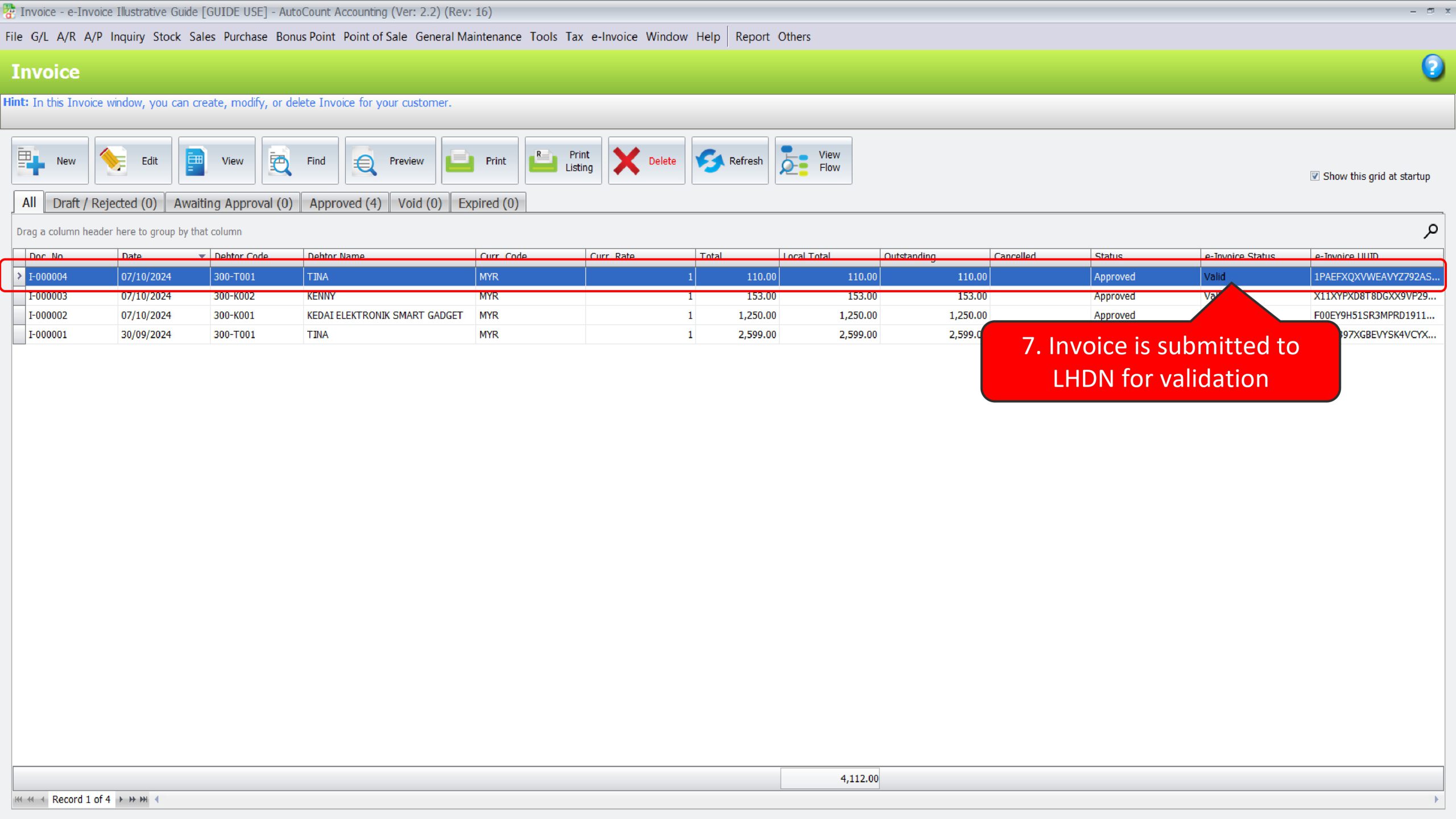

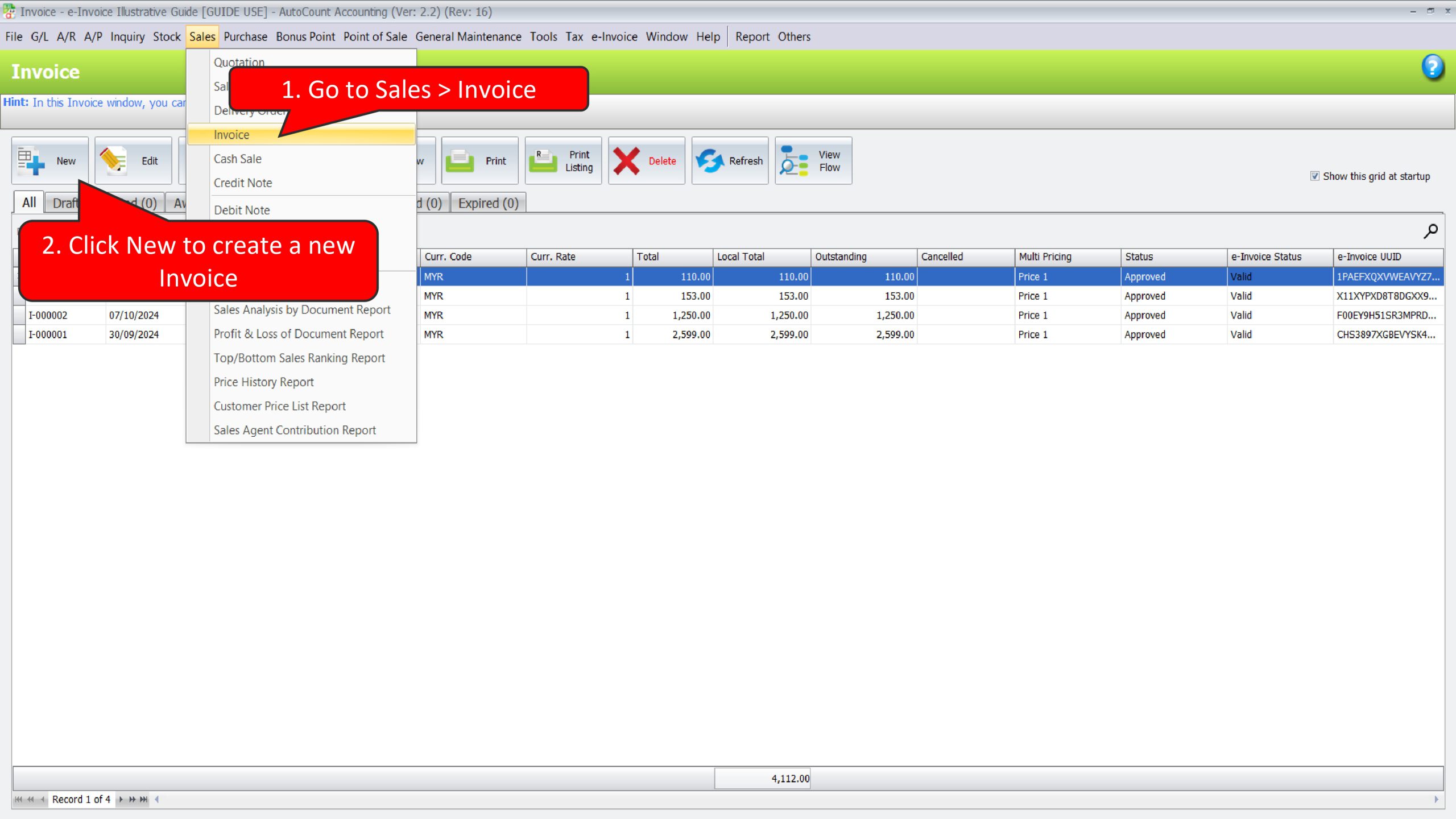

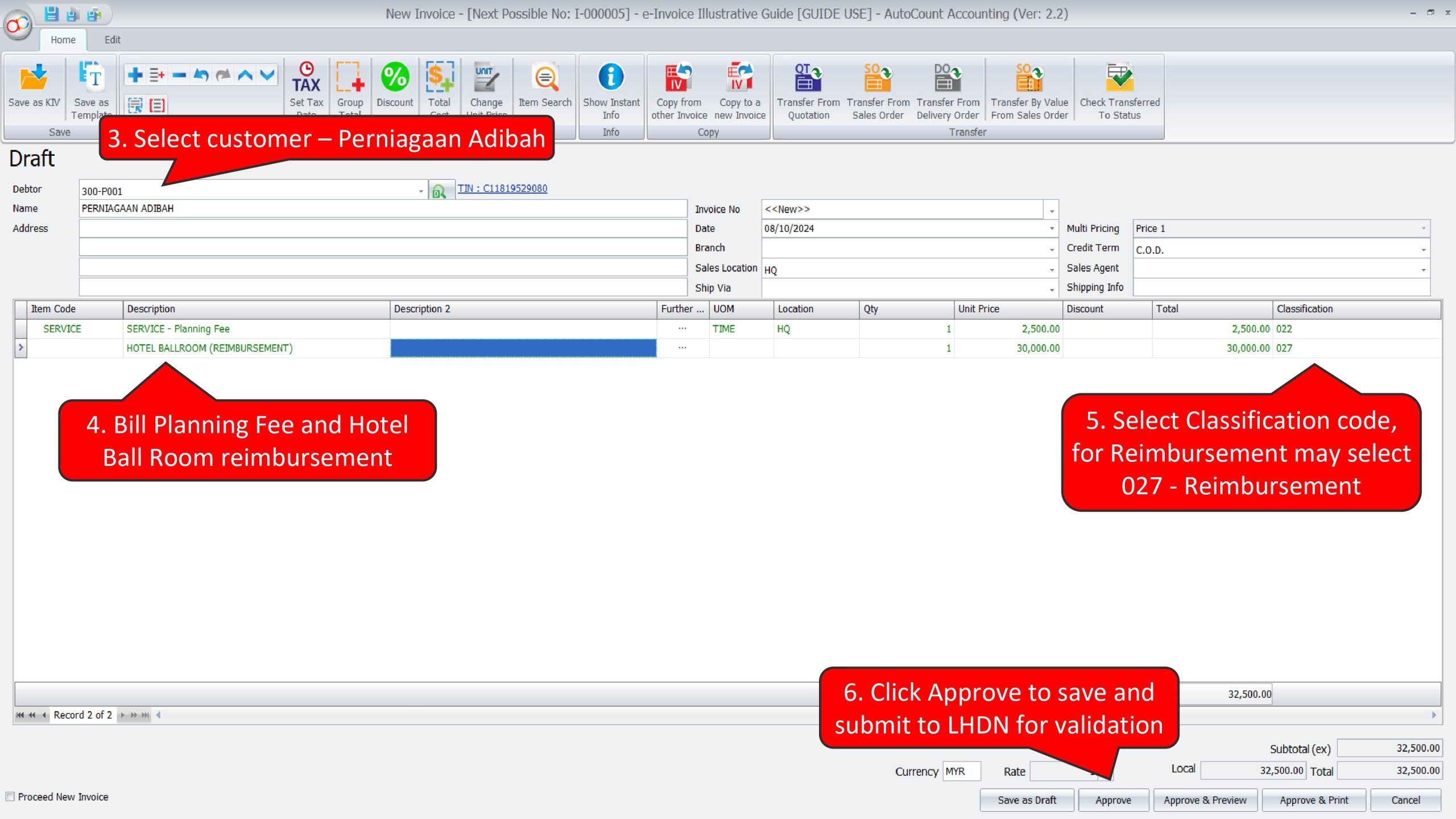

Illustration 13: A single e-Invoice that includes the service fee and costs is issued to the Buyer (where e-Invoices are issued to the seller) #

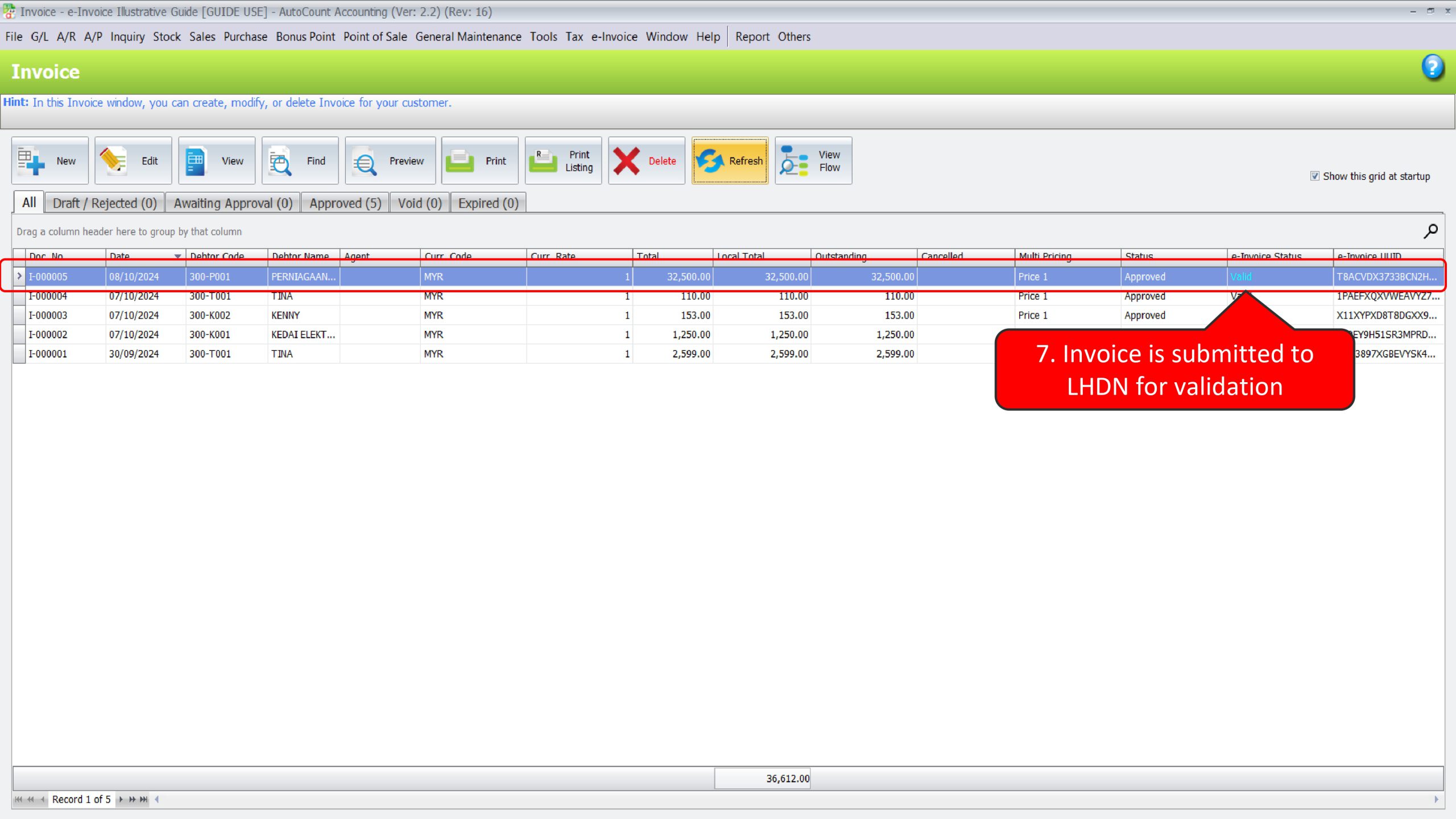

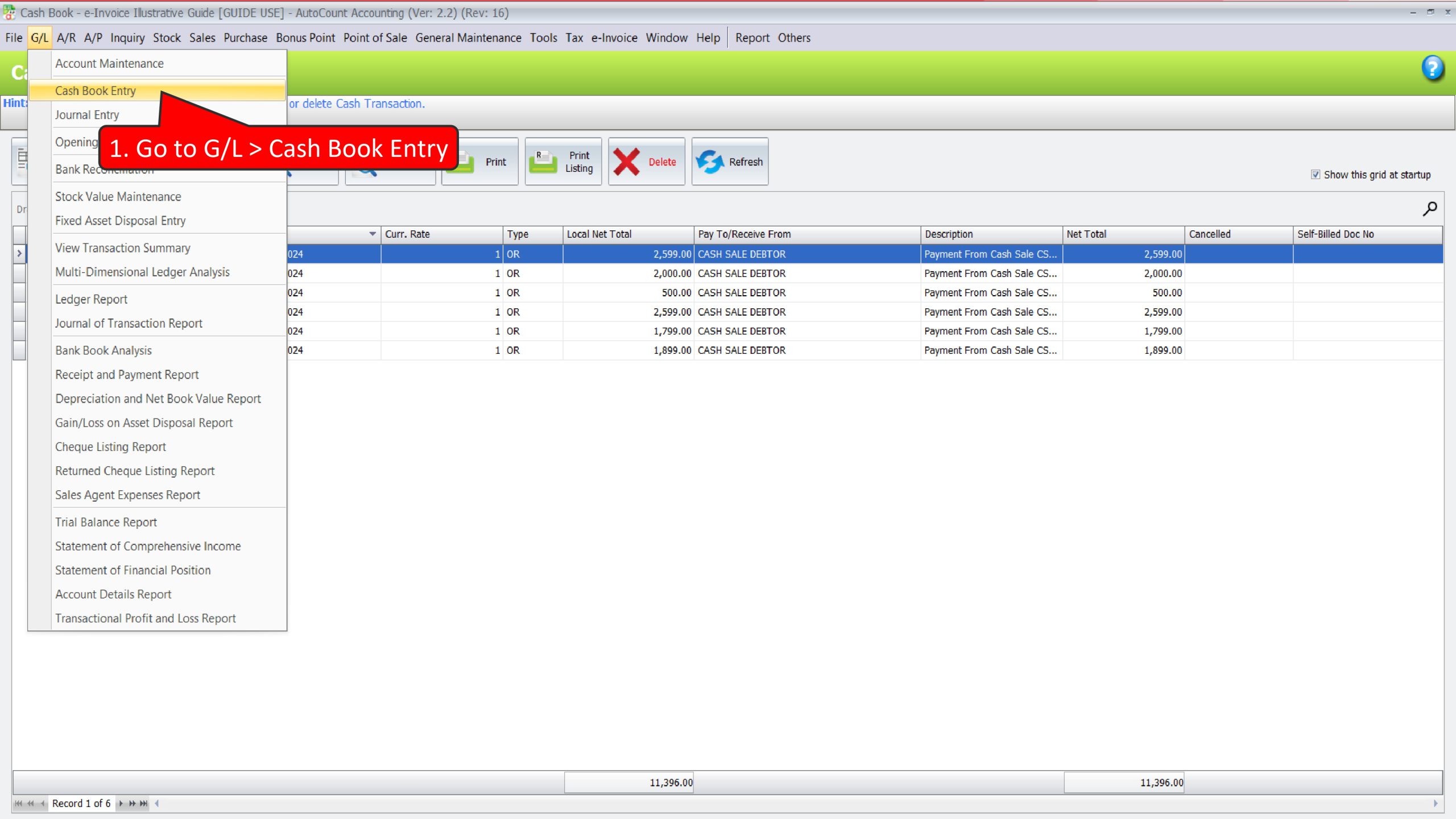

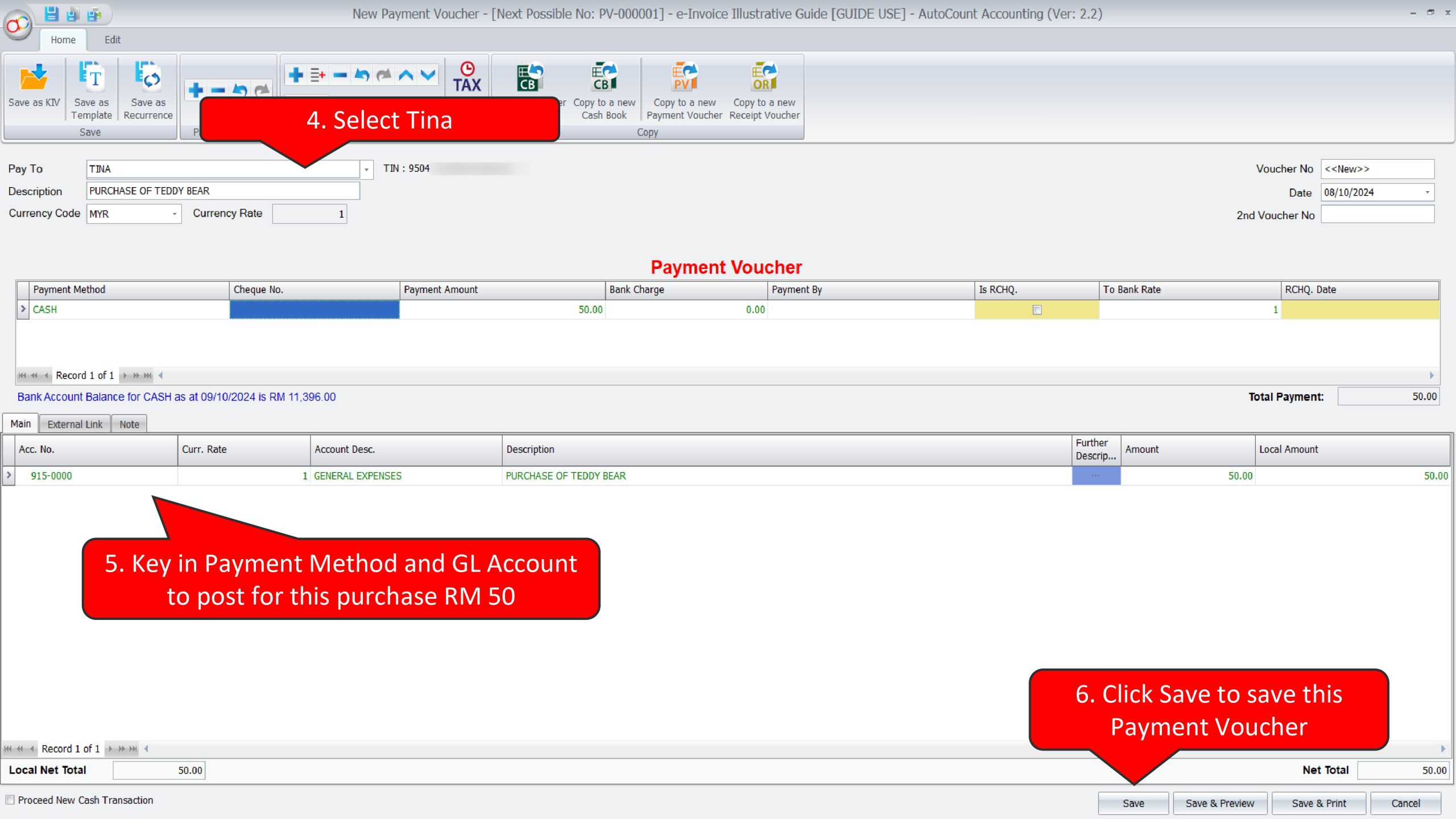

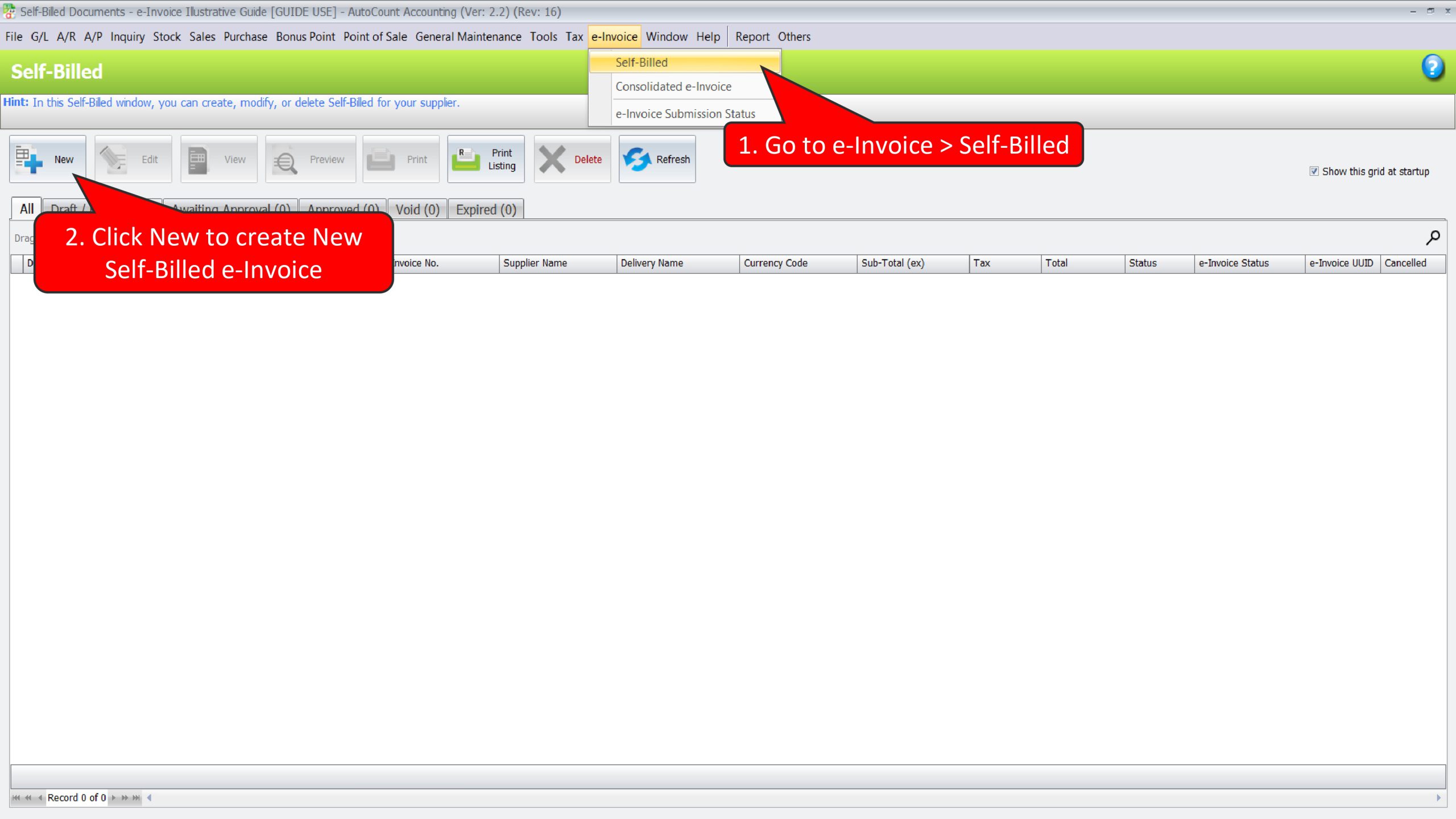

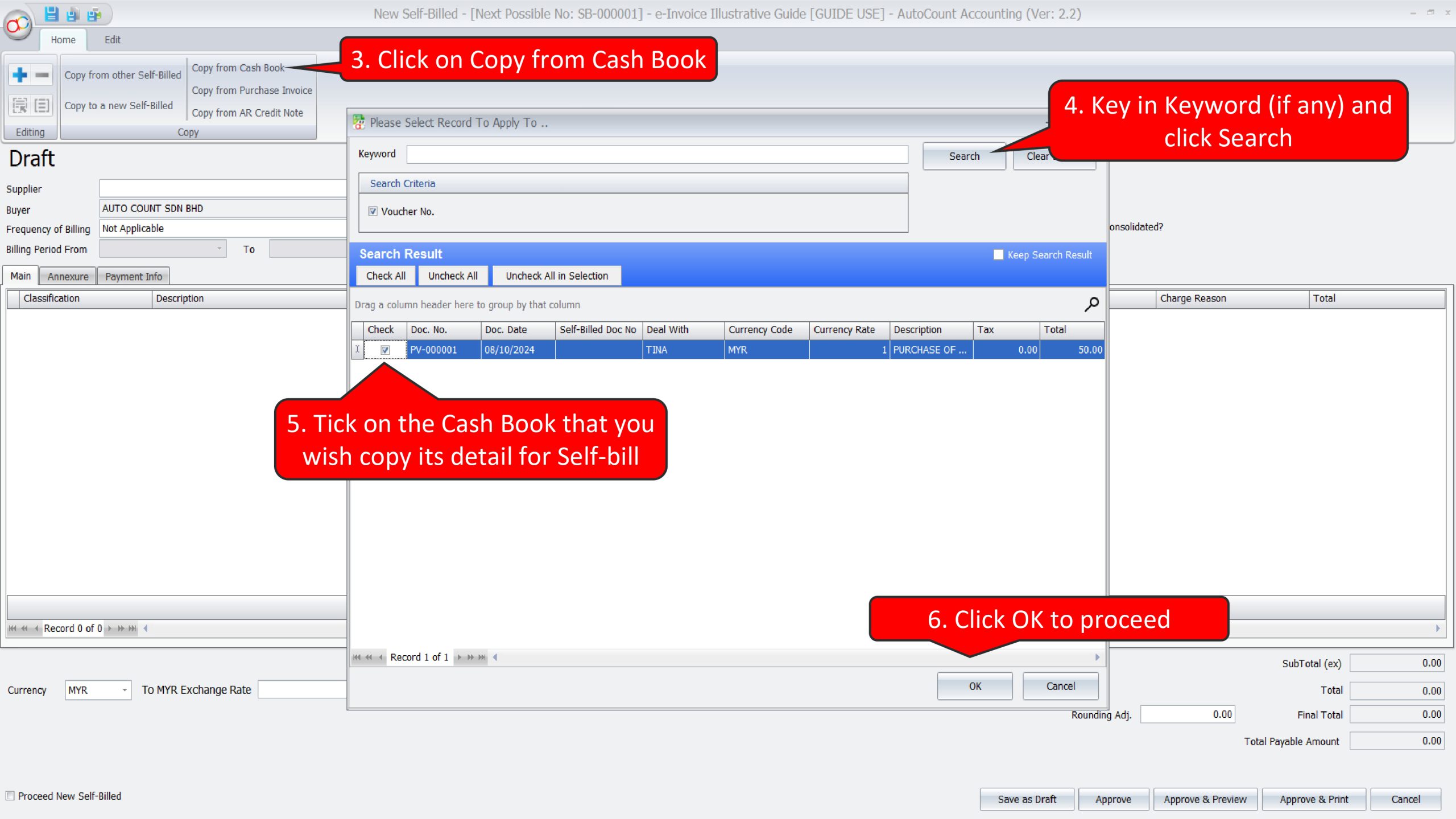

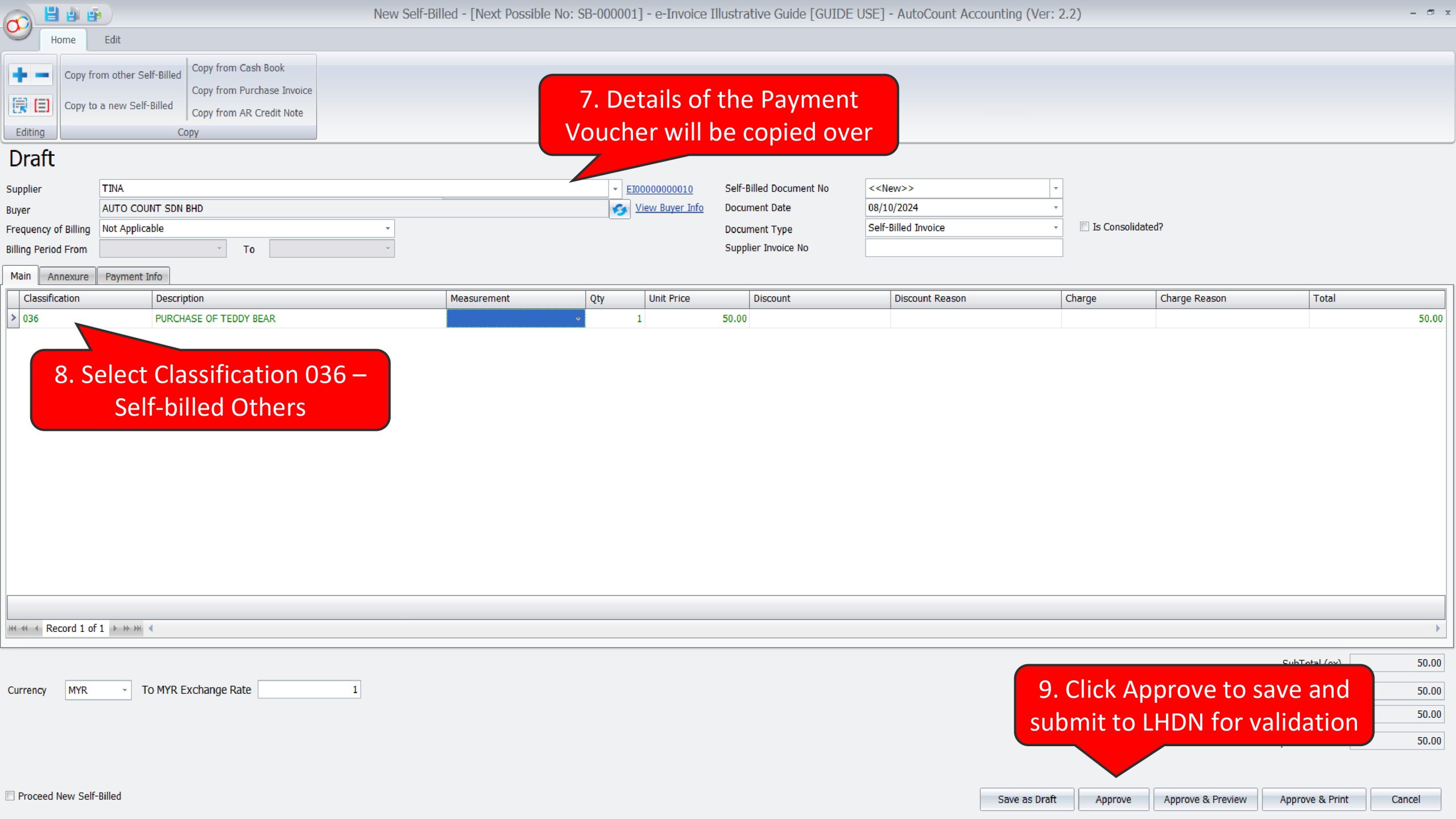

Illustration 16: Buyer need to issue a self-billed e-Invoice when purchasing products from an individual who is not conducting a business #

In this scenario, Kedai Permainan Cuddle Bear needs to perform 2 actions in AutoCount Acoounting:

- Create a Payment Voucher to record this purchase from Tina

- Create a Self-Bill e-Invoice to submit and report this expenses to LHDN

Create a Payment Voucher to record this purchase from Tina

Create a Self-Bill e-Invoice to submit and report this expenses to LHDN

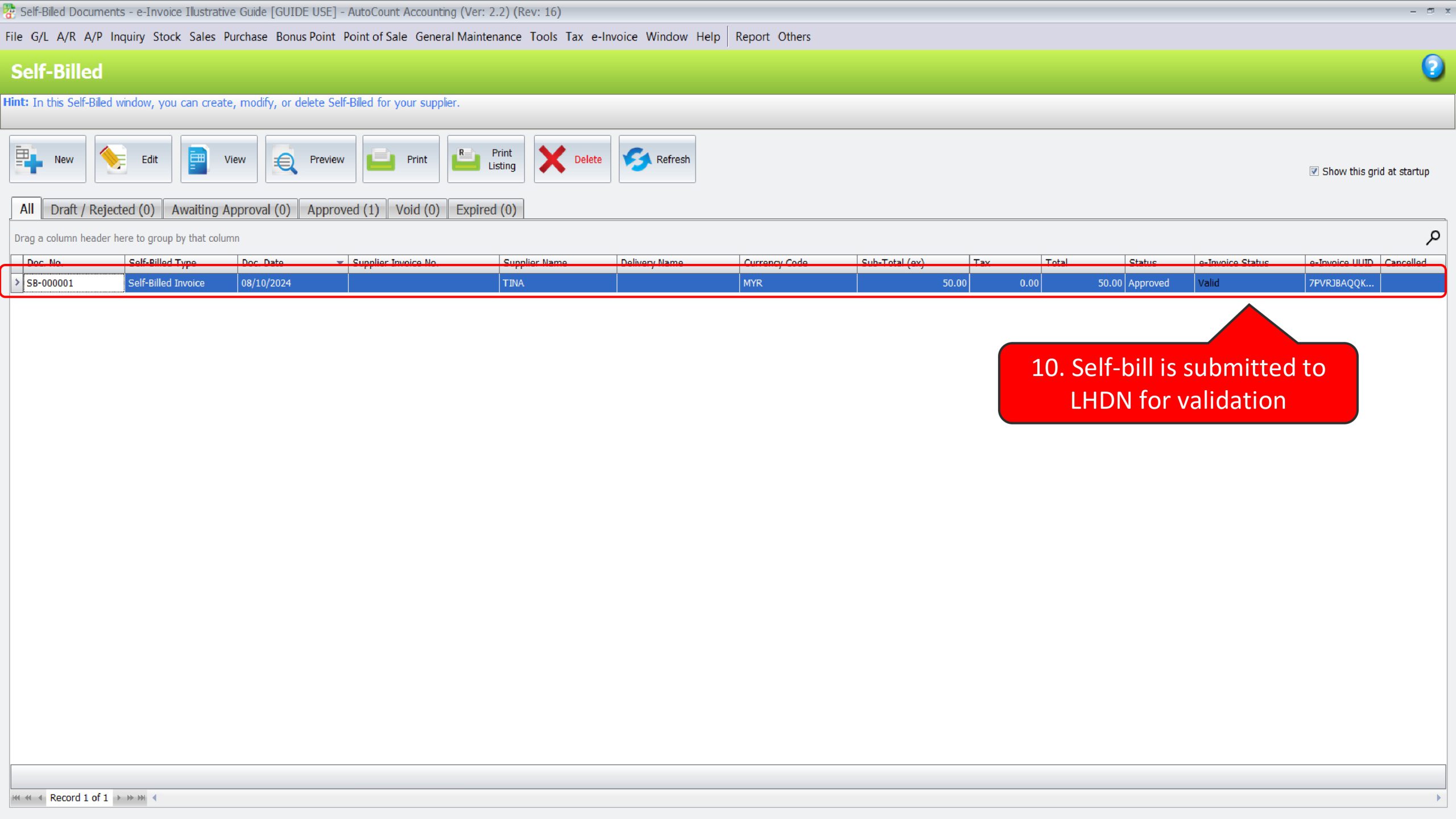

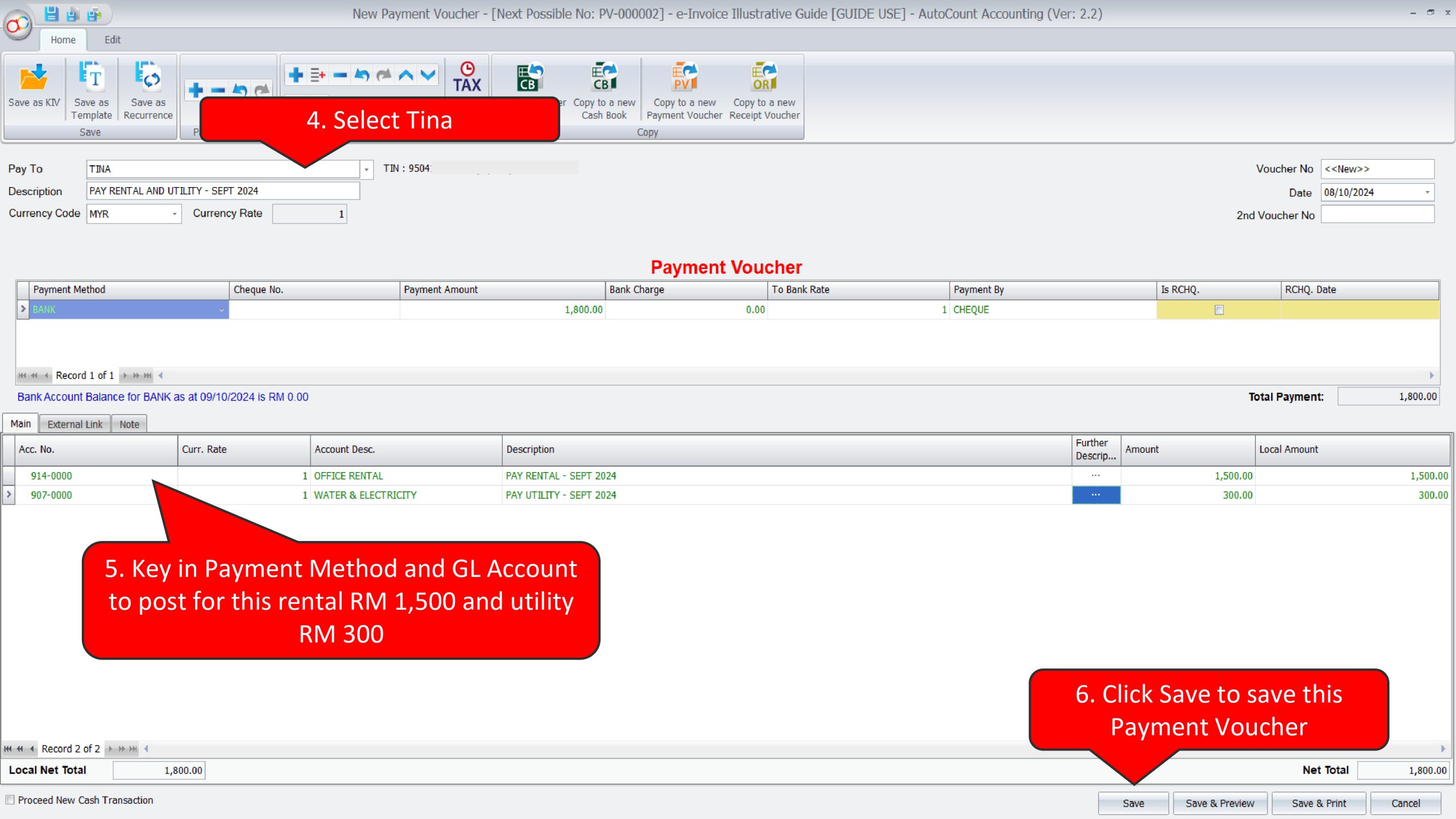

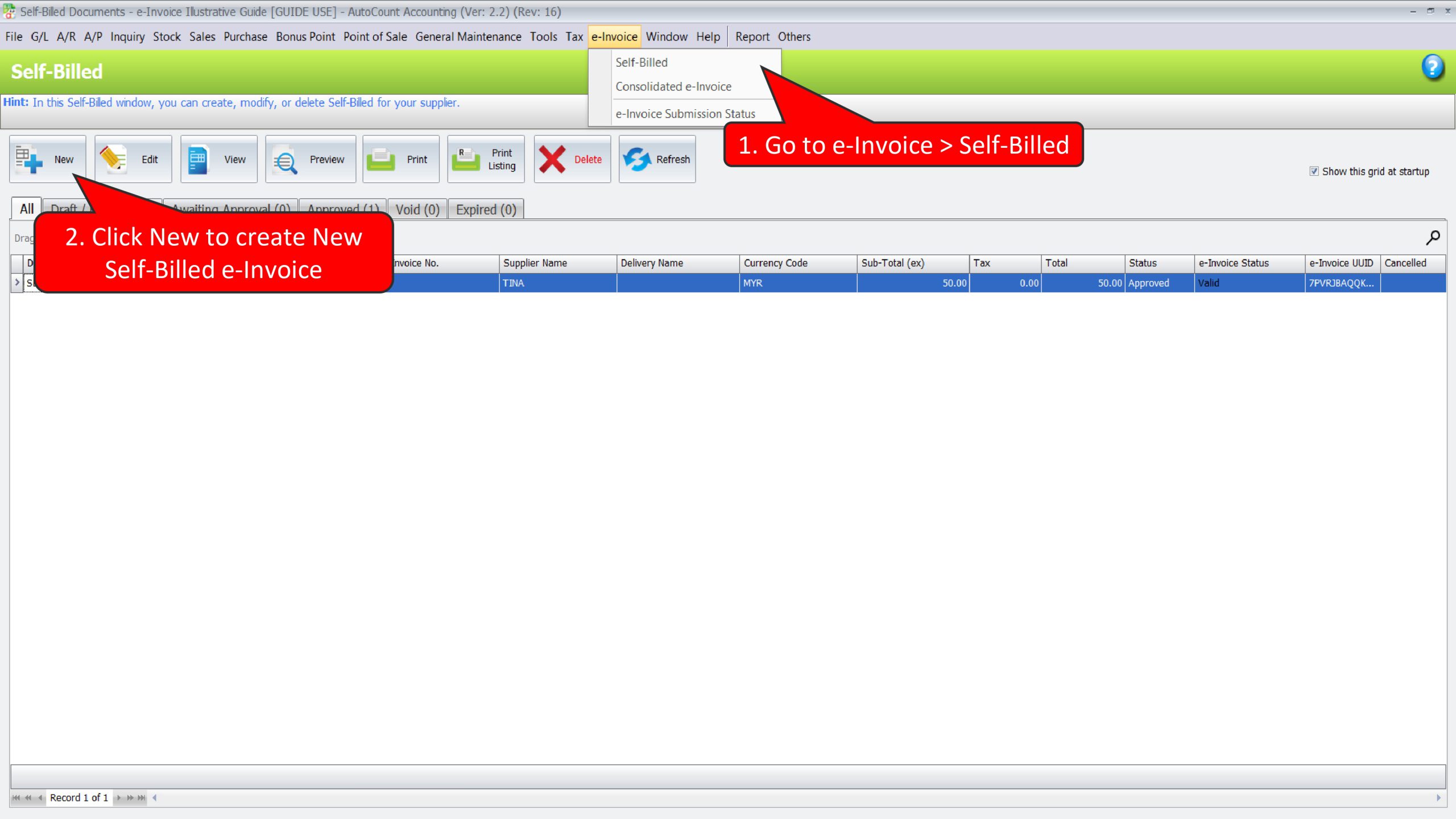

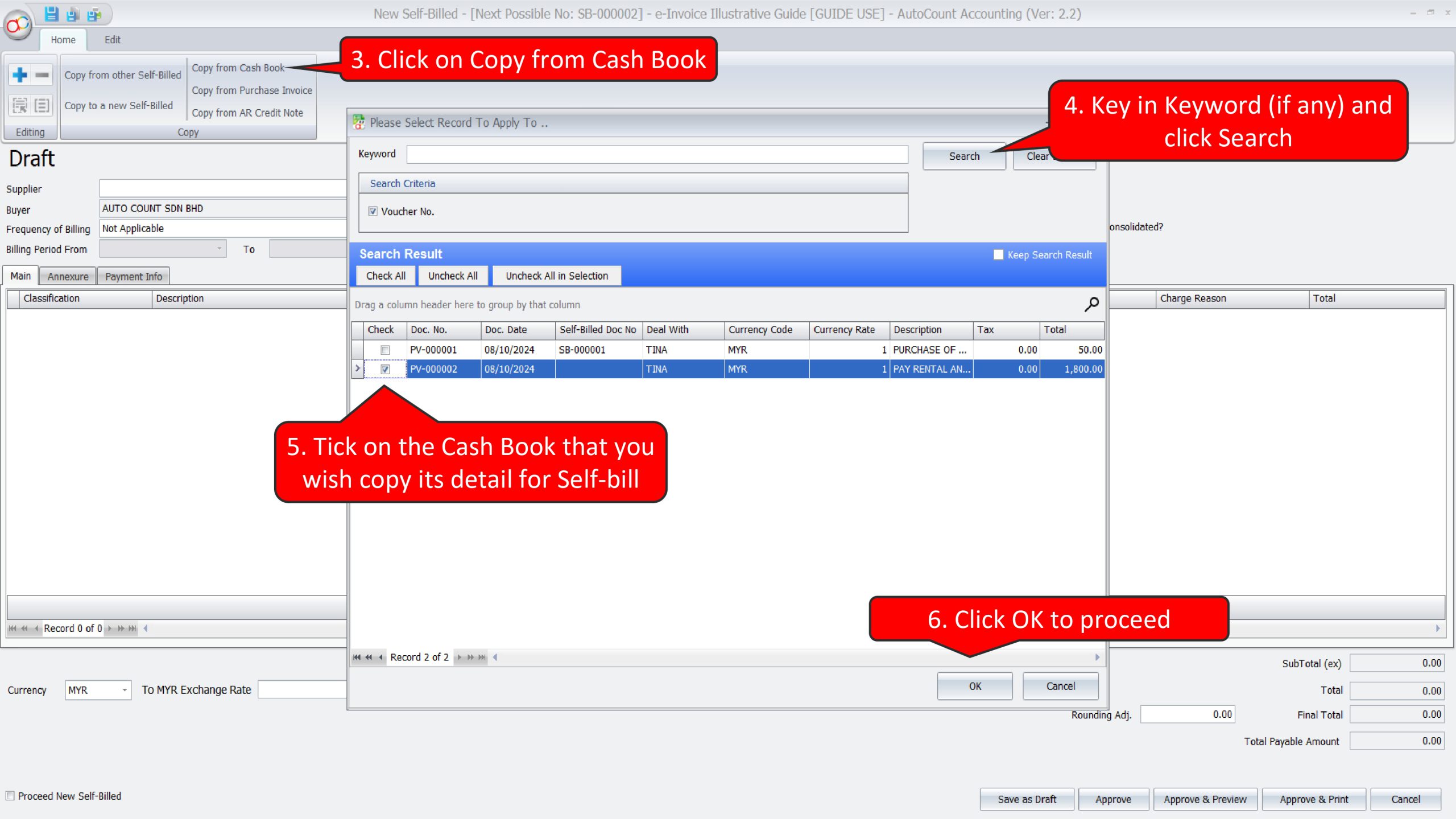

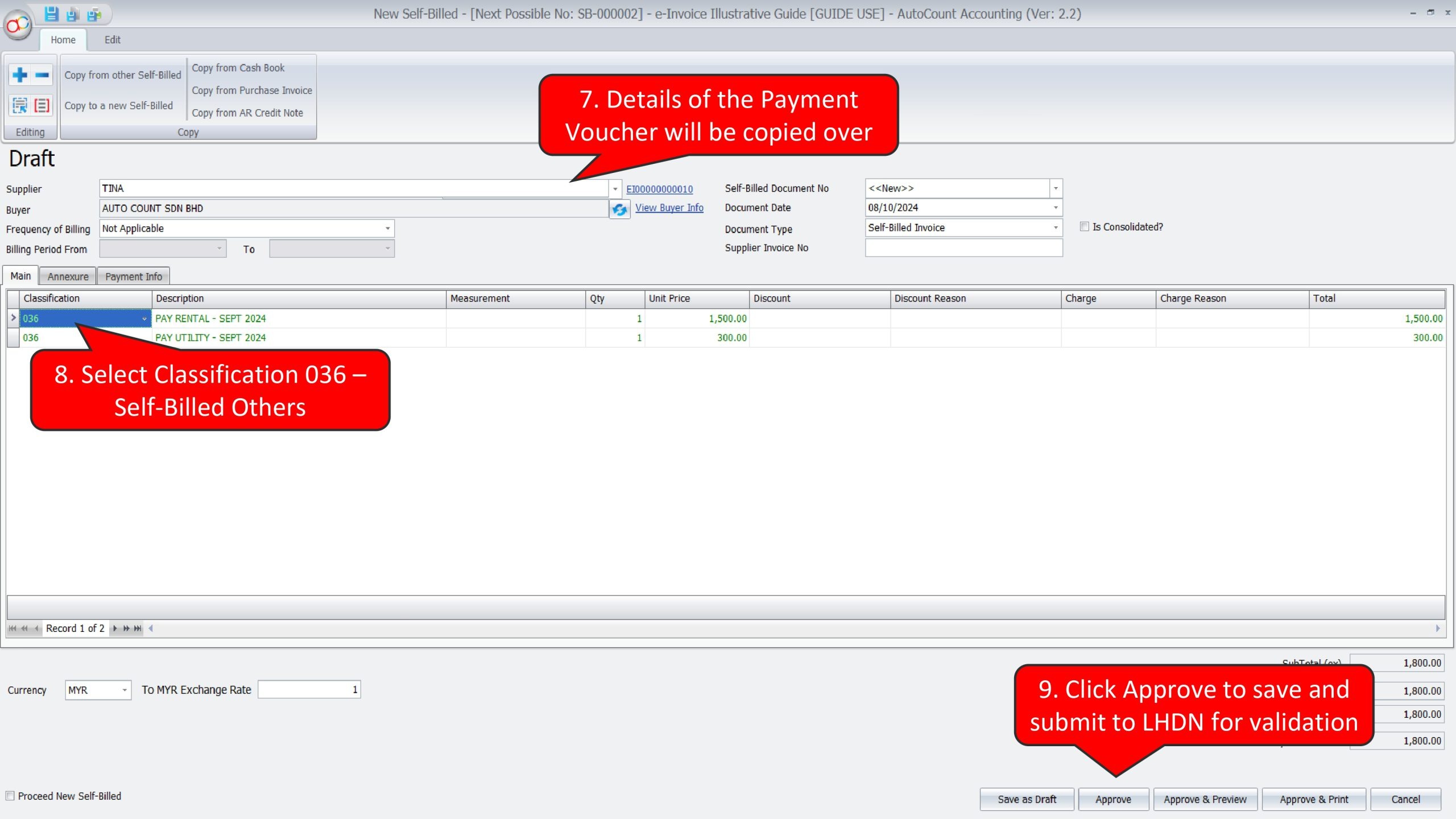

Illustration 17: Business tenants have to issue self-billed e-Invoice on rental and utility bills if landlord does not conduct business #

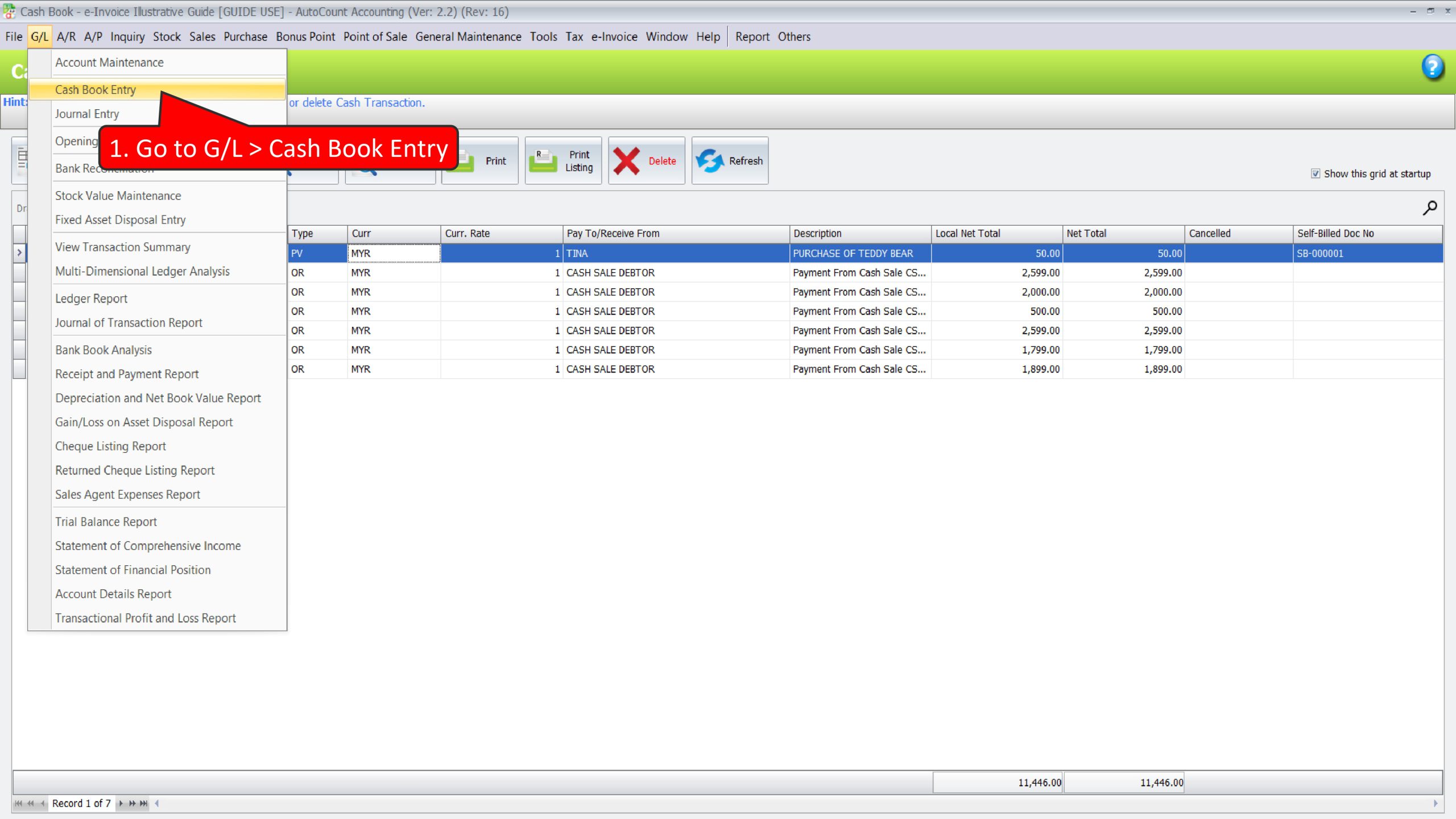

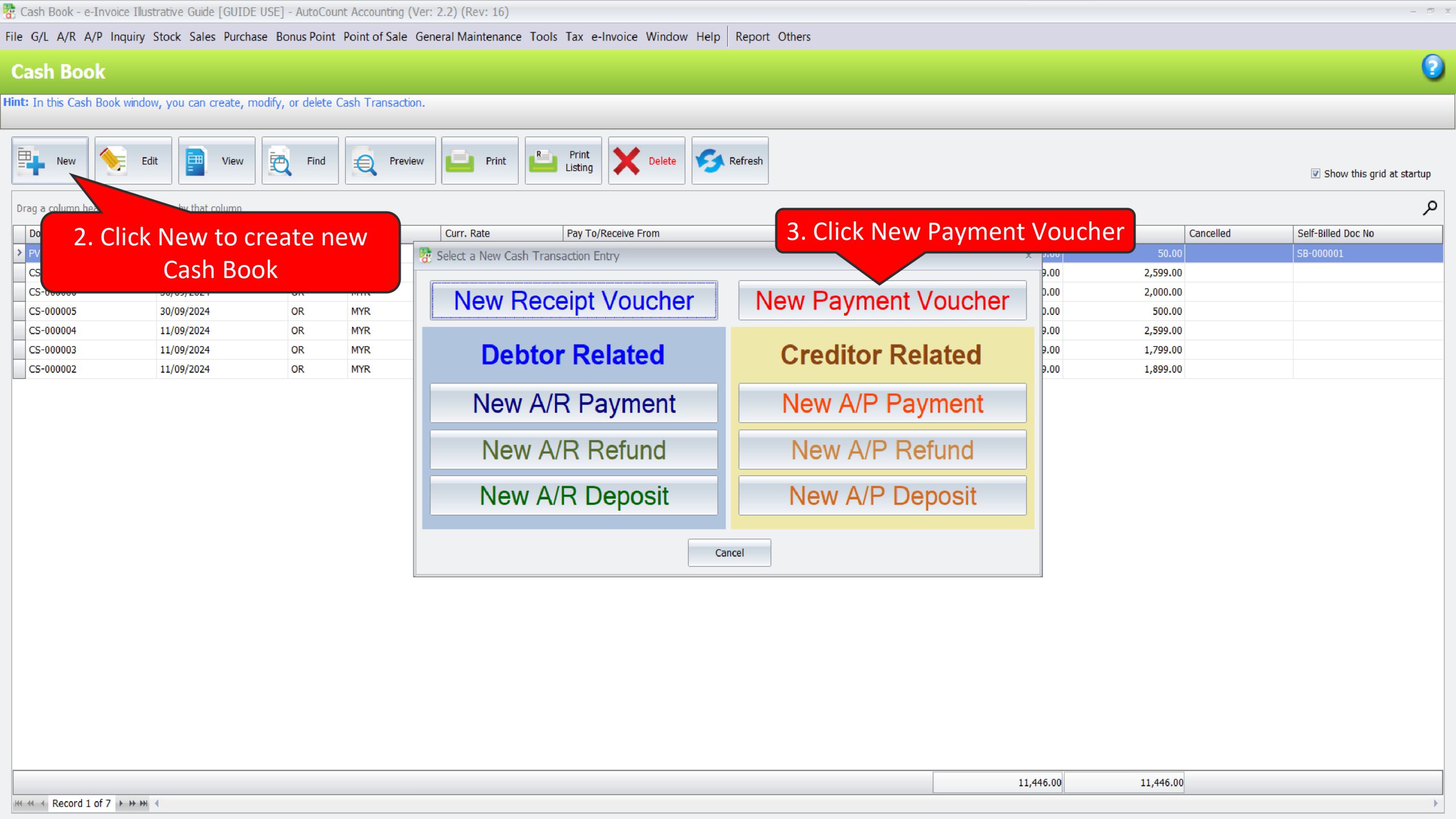

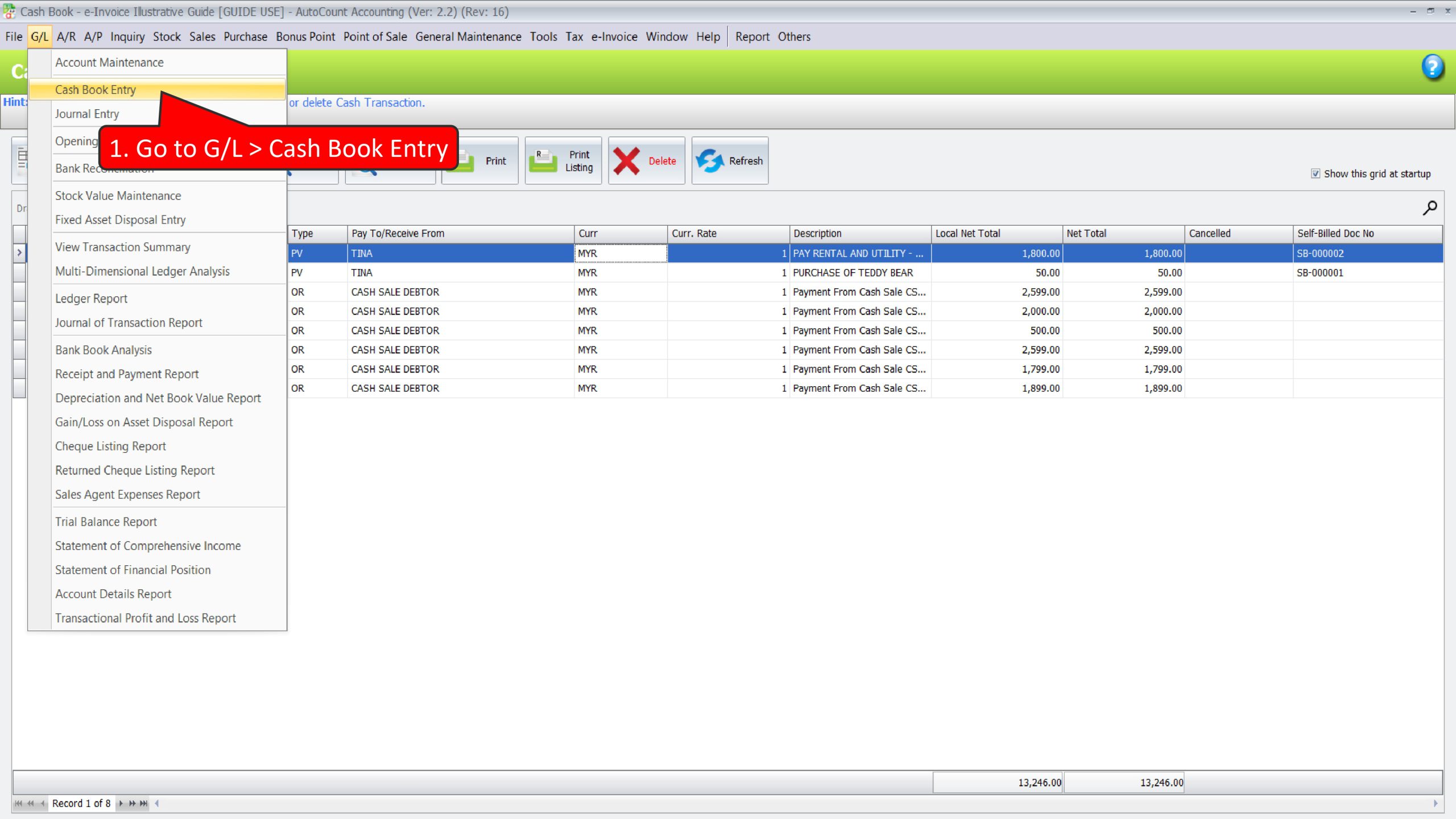

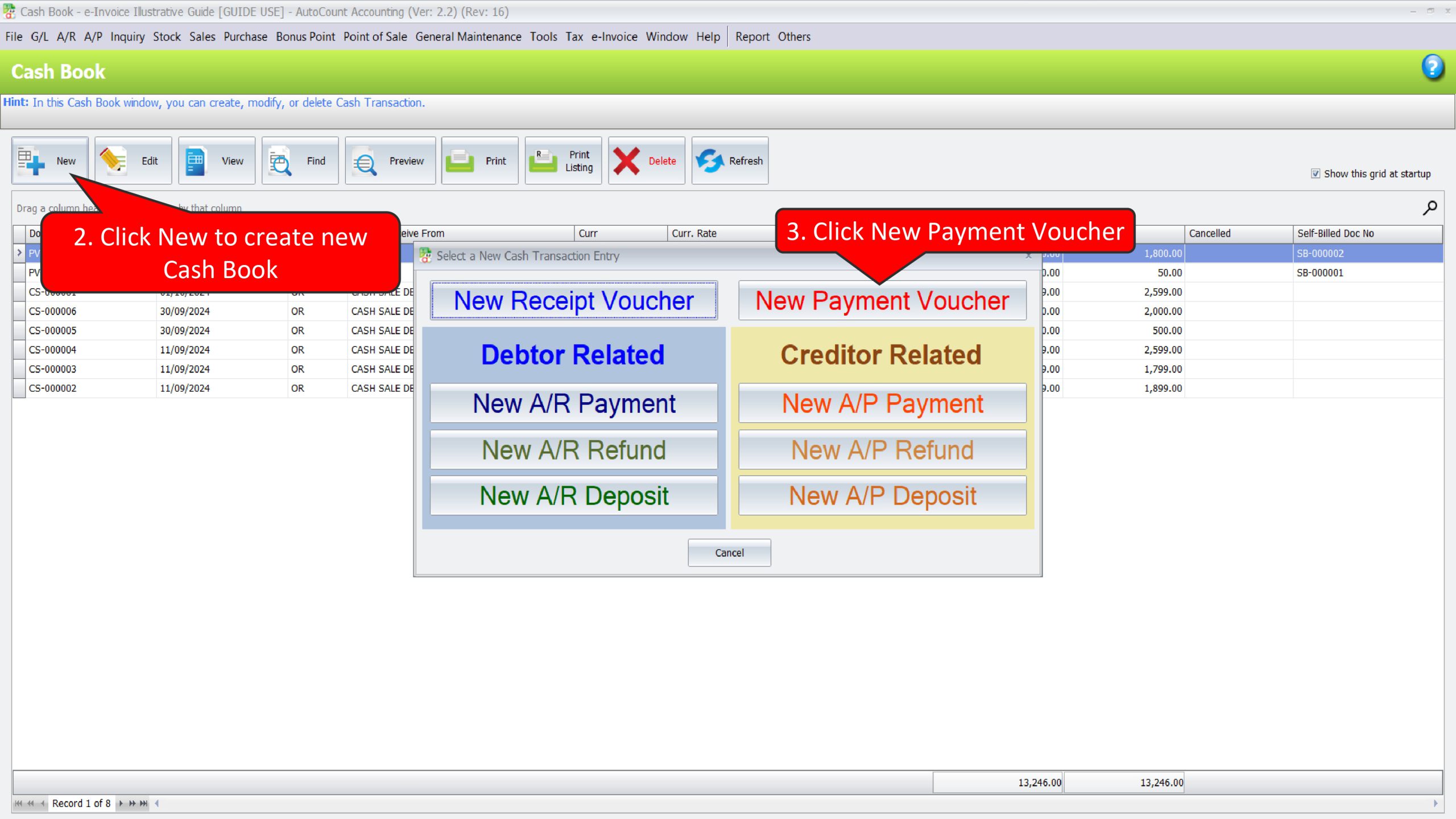

In this scenario, Kedai Elektronik Smart Gadget needs to perform 2 actions in AutoCount Accounting:

- Create a Payment Voucher to record rental and utility payment to Tina

- Create a Self-Bill e-Invoice to submit and report this expenses to LHDN

Create a Payment Voucher to record rental and utility payment to Tina

Create a Self-Bill e-Invoice to submit and report this expenses to LHDN

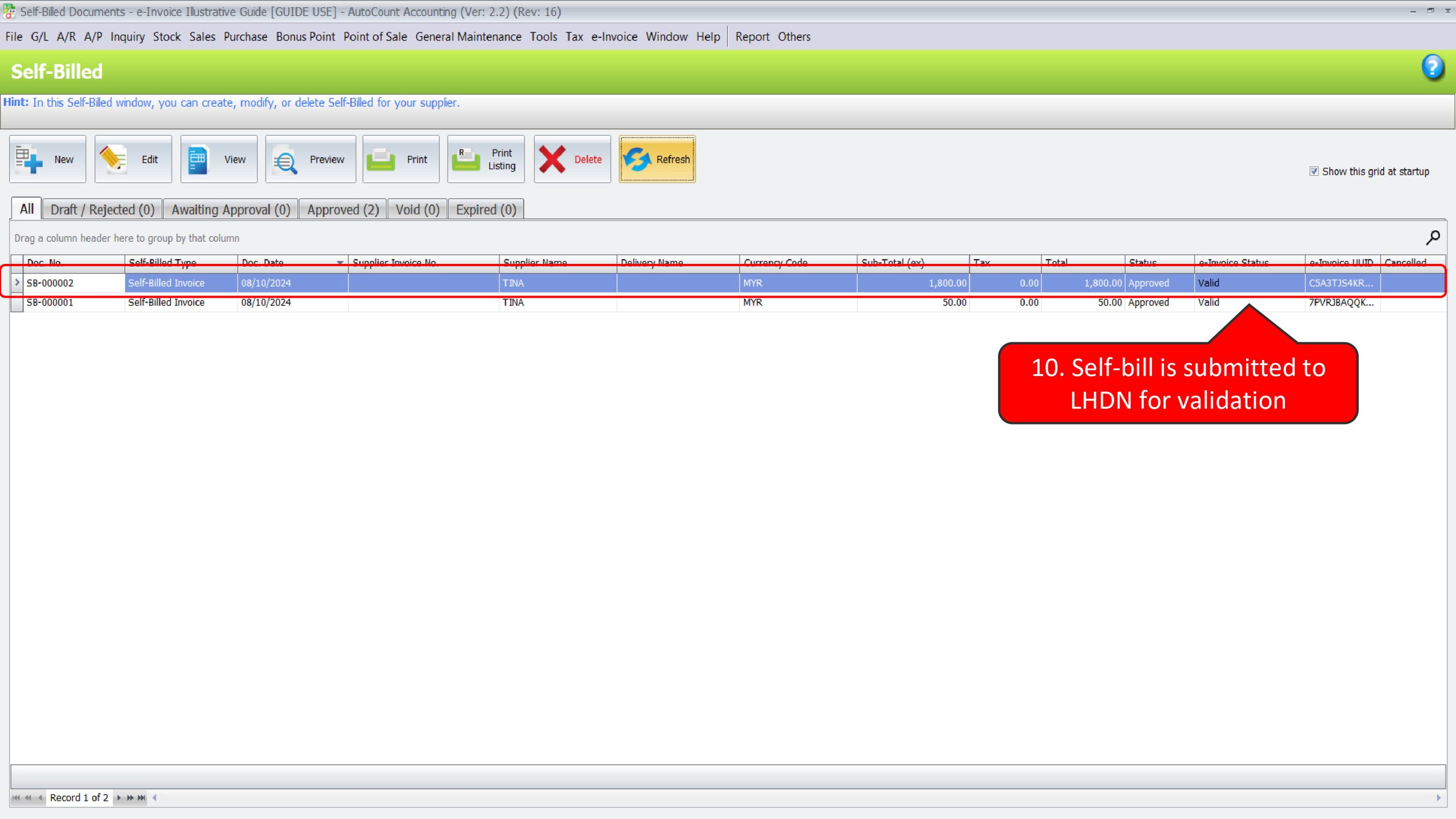

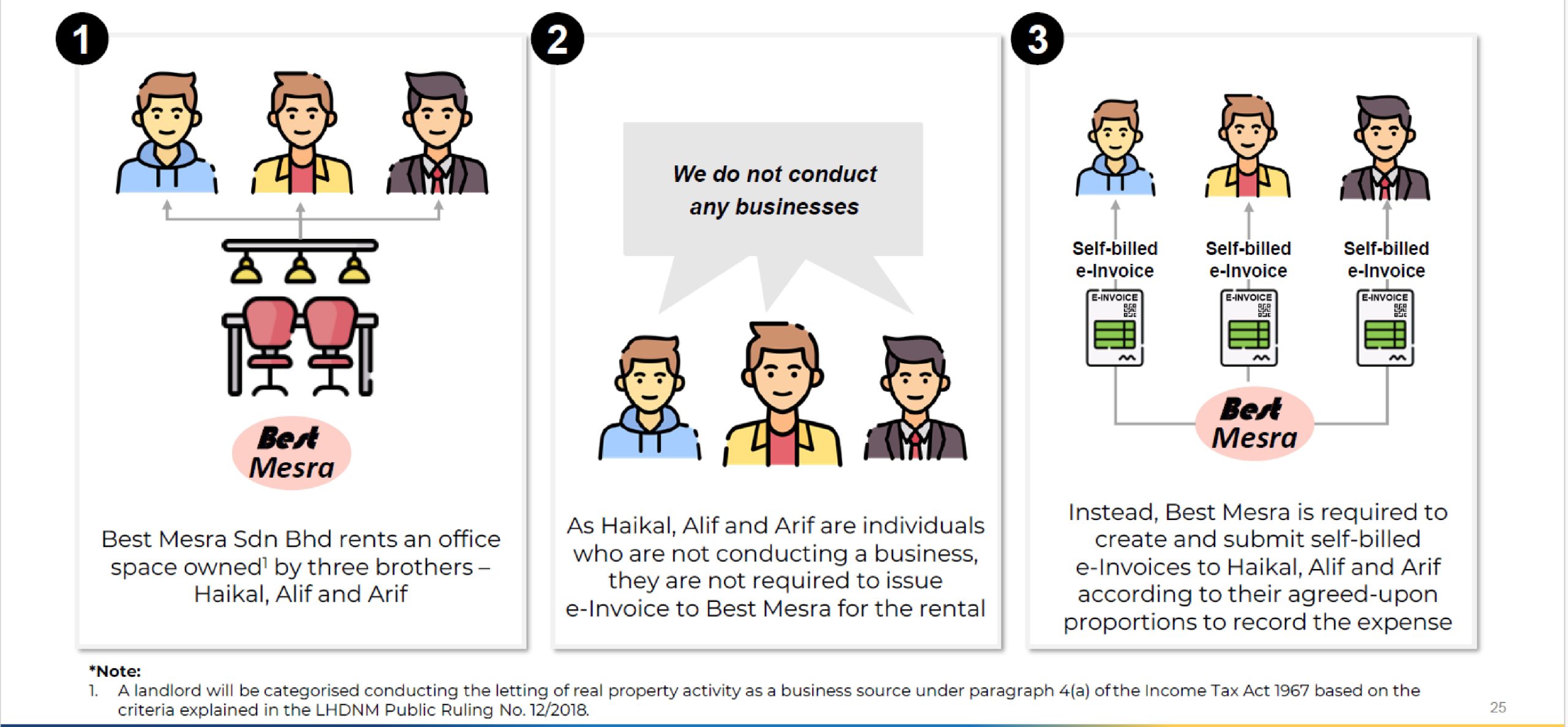

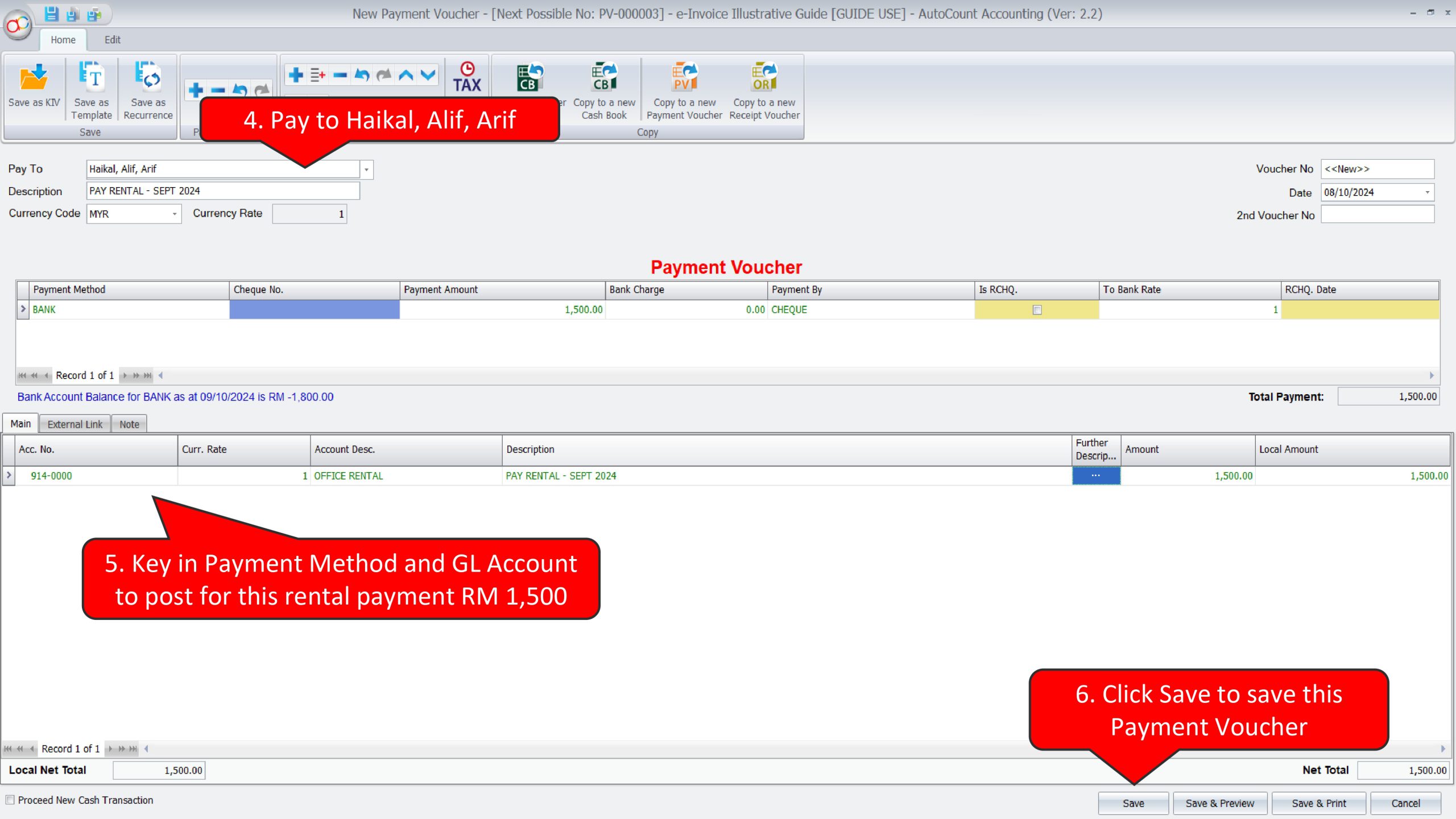

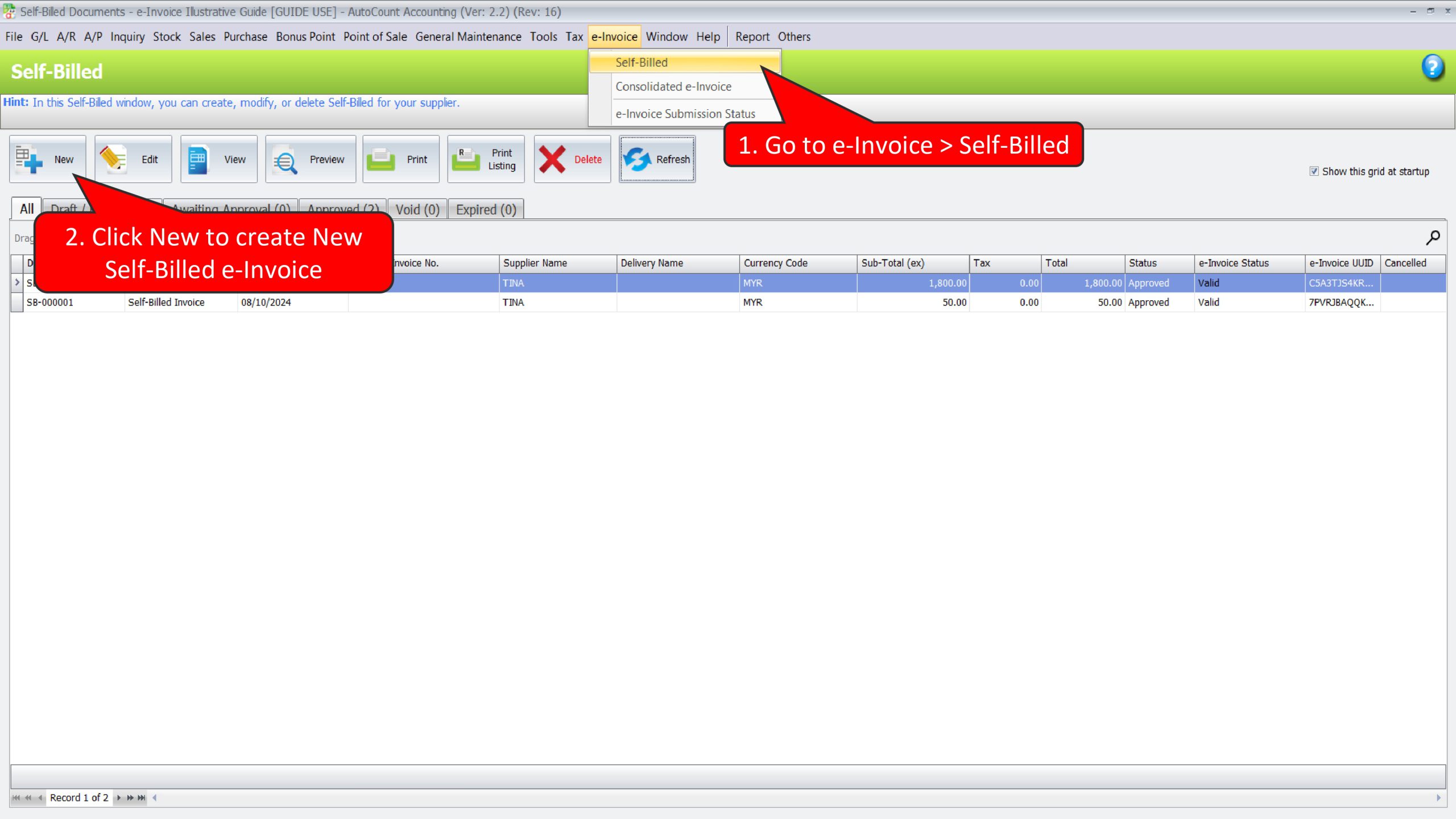

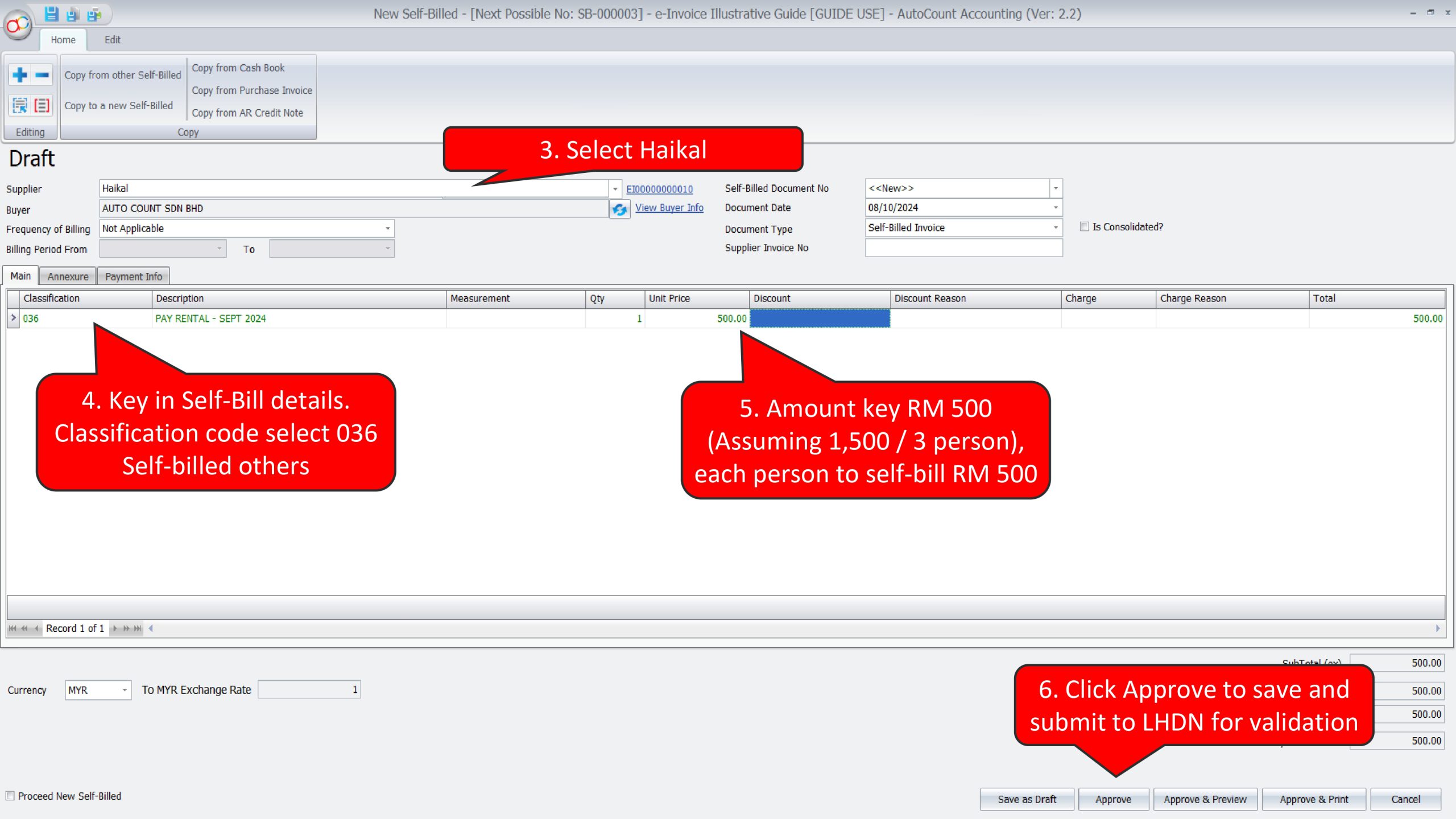

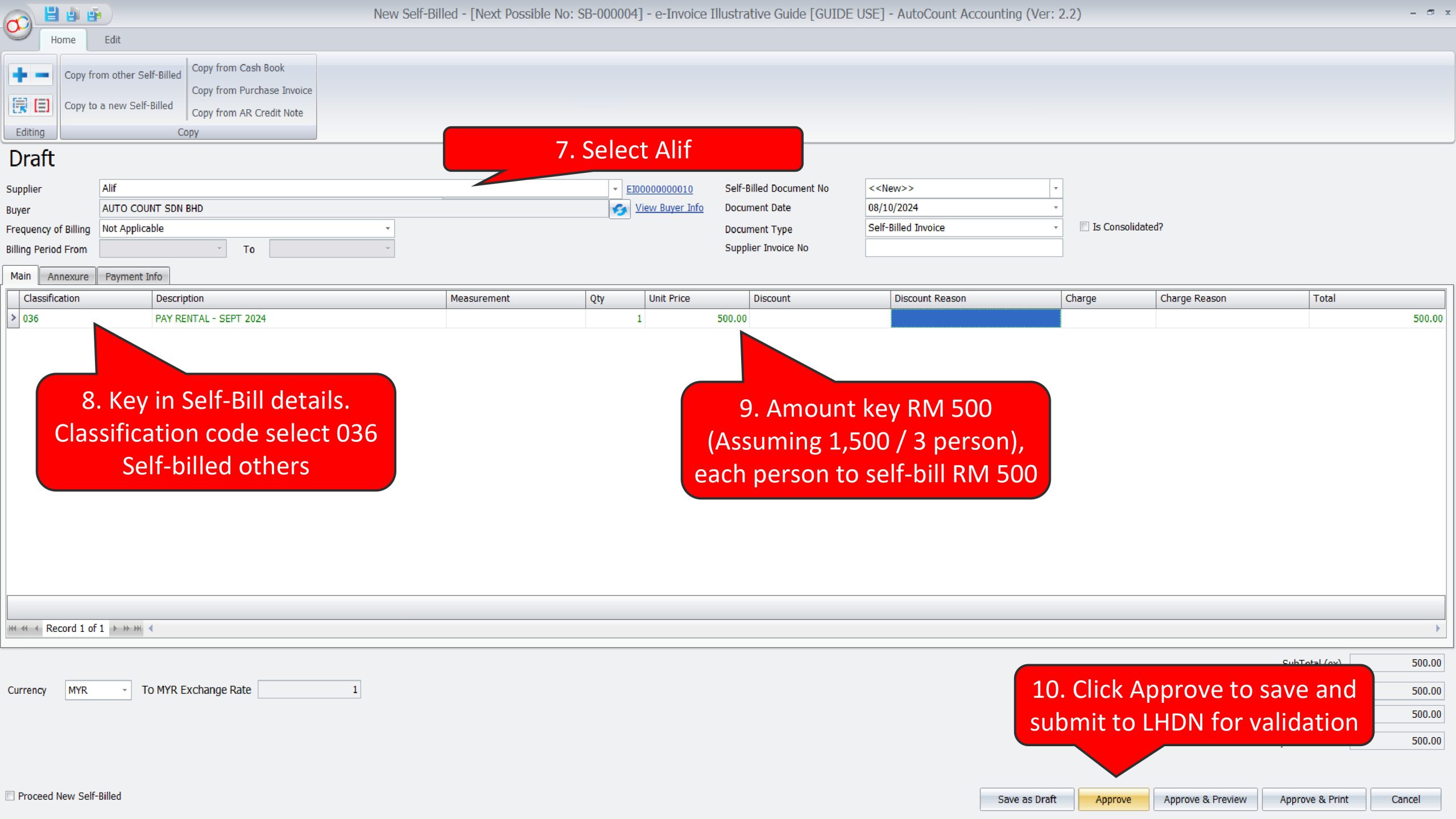

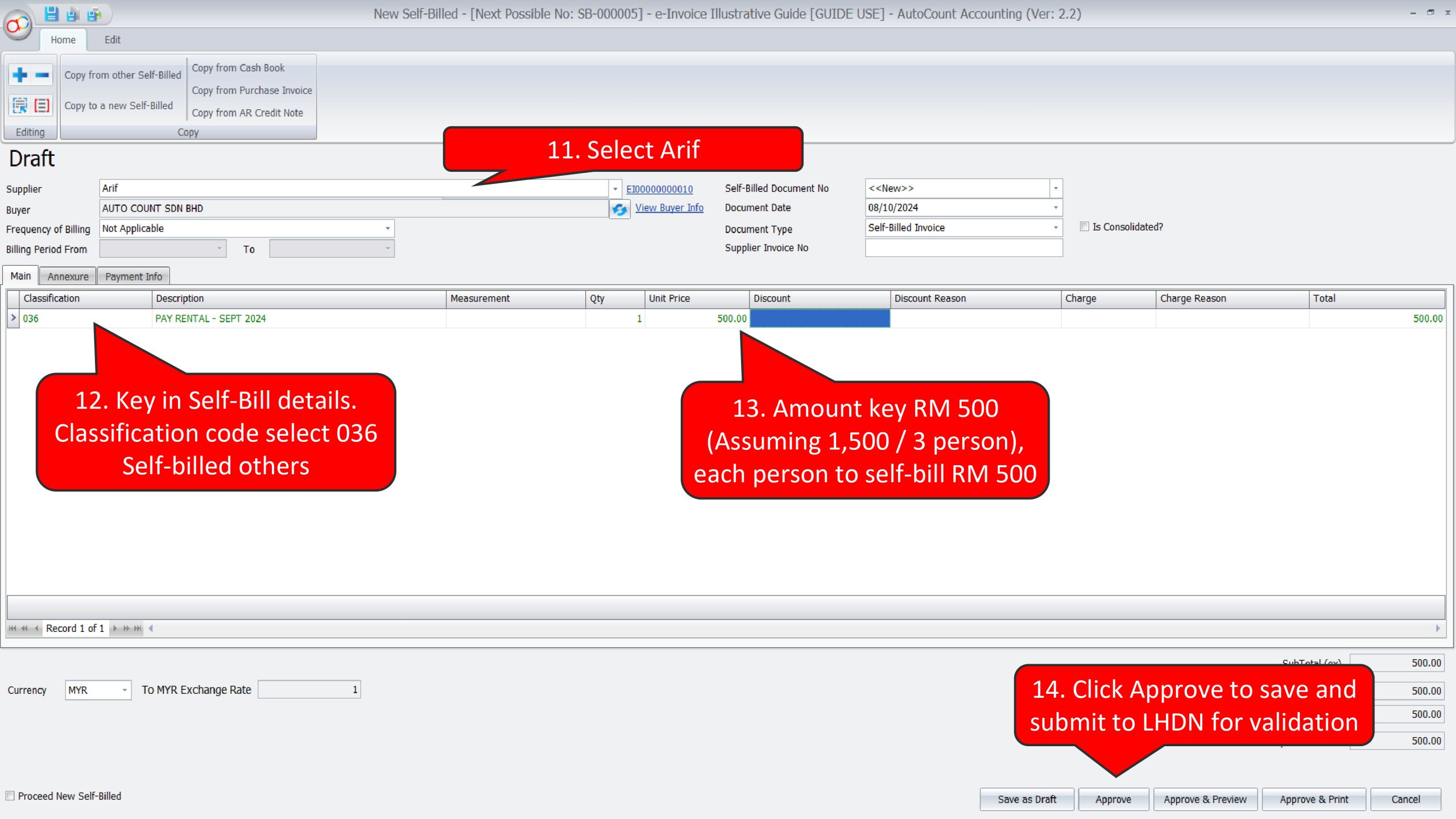

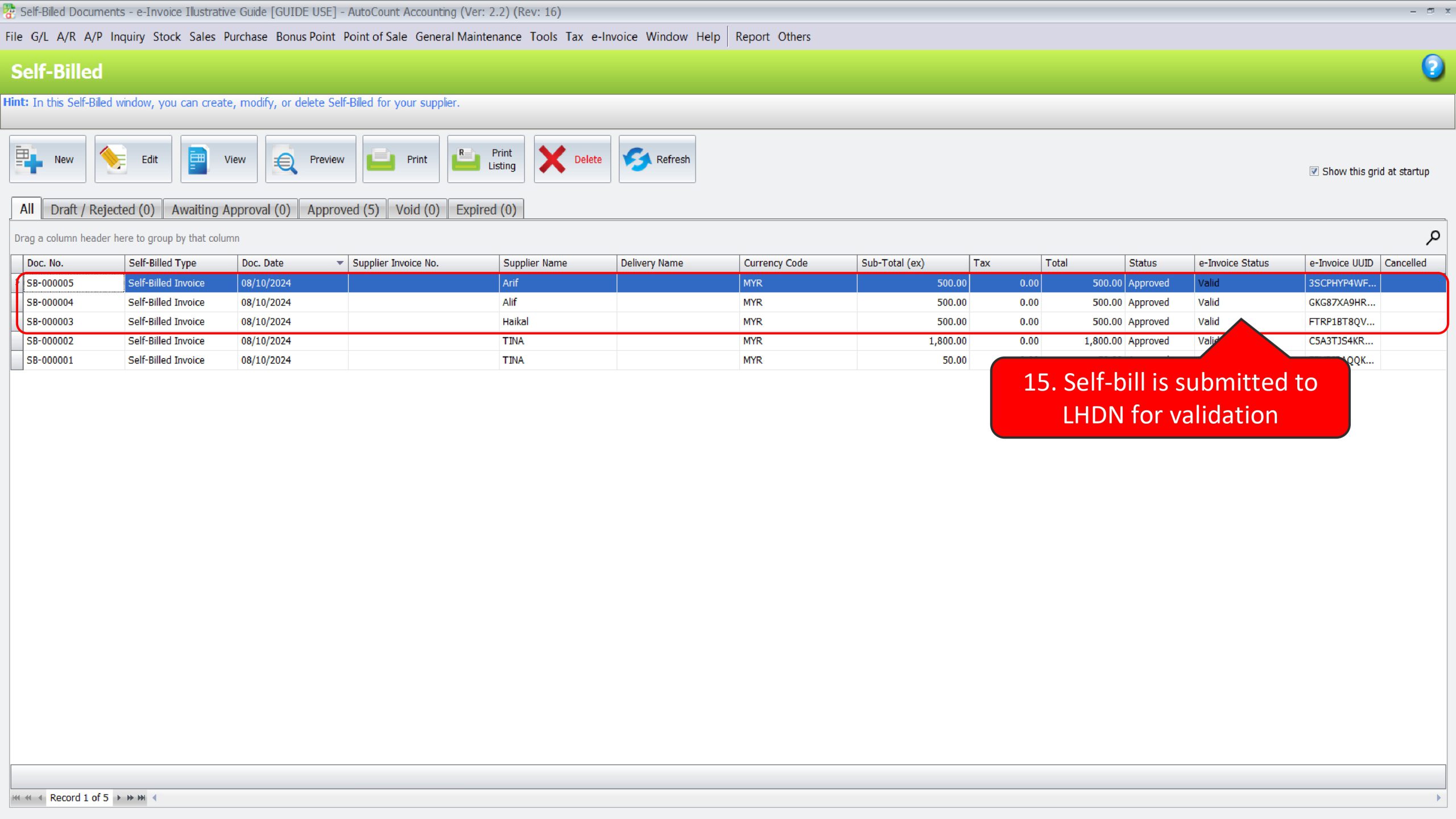

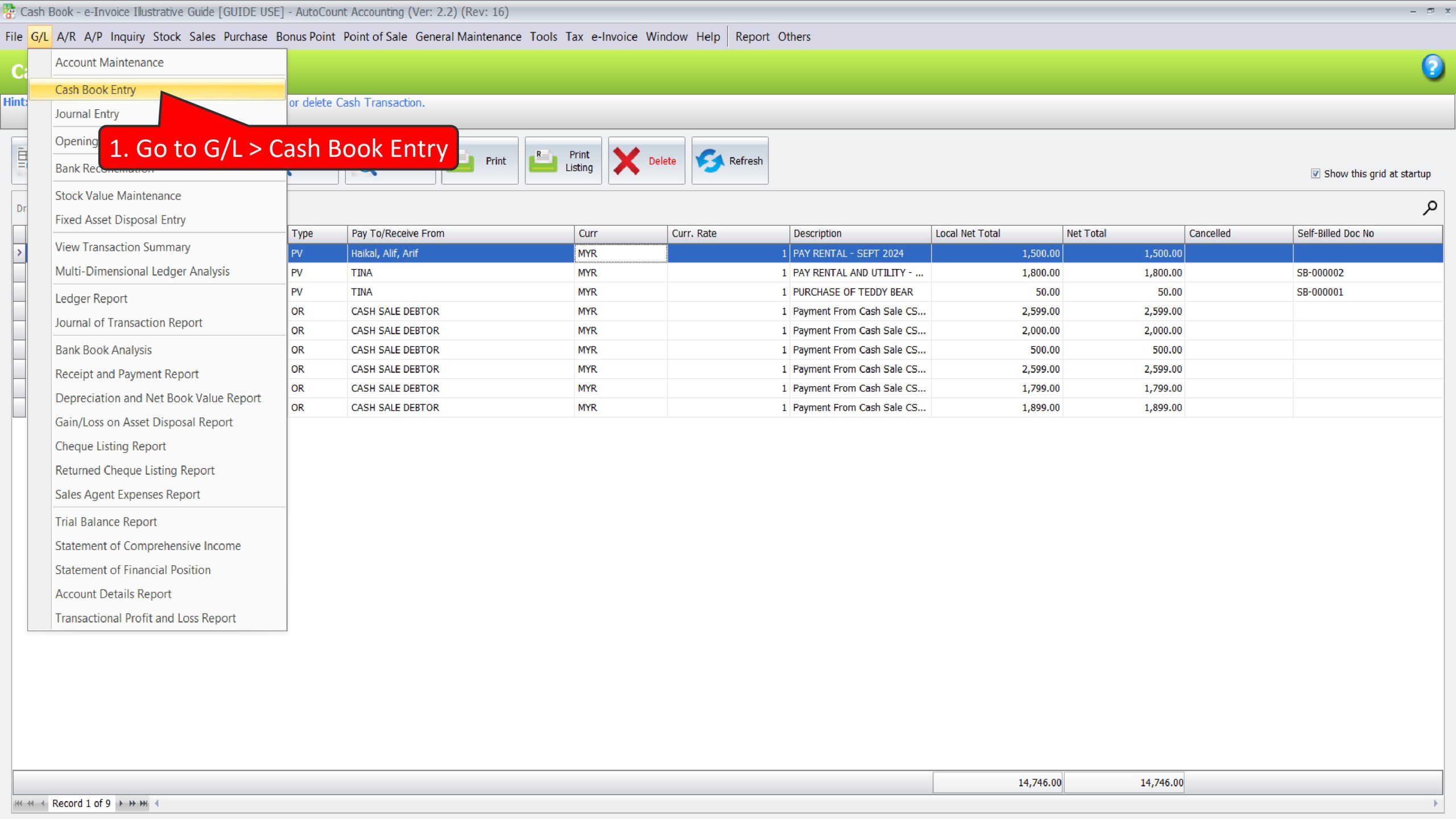

Illustration 18: Tenants need to issue self-billed e-Invoices for rental with multiple landlords who are not conducting a business #

In this scenario, Best Mesra Sdn Bhd needs to perform 2 actions in AutoCount Accounting:

- Create a Payment Voucher to record rental payment to Haikal, Alif and Arif

- Create 3 Self-Bill e-Invoice to submit and report this rental expenses to LHDN, respectively to Haikal, Alif, and Arif based on agreed proportion

Create a Payment Voucher to record rental payment to Haikal, Alif and Arif

Create 3 Self-Bill e-Invoice to submit and report this rental expenses to LHDN, respectively to Haikal, Alif, and Arif based on agreed proportion

*Assuming pro-rated, rental to be divided by 3

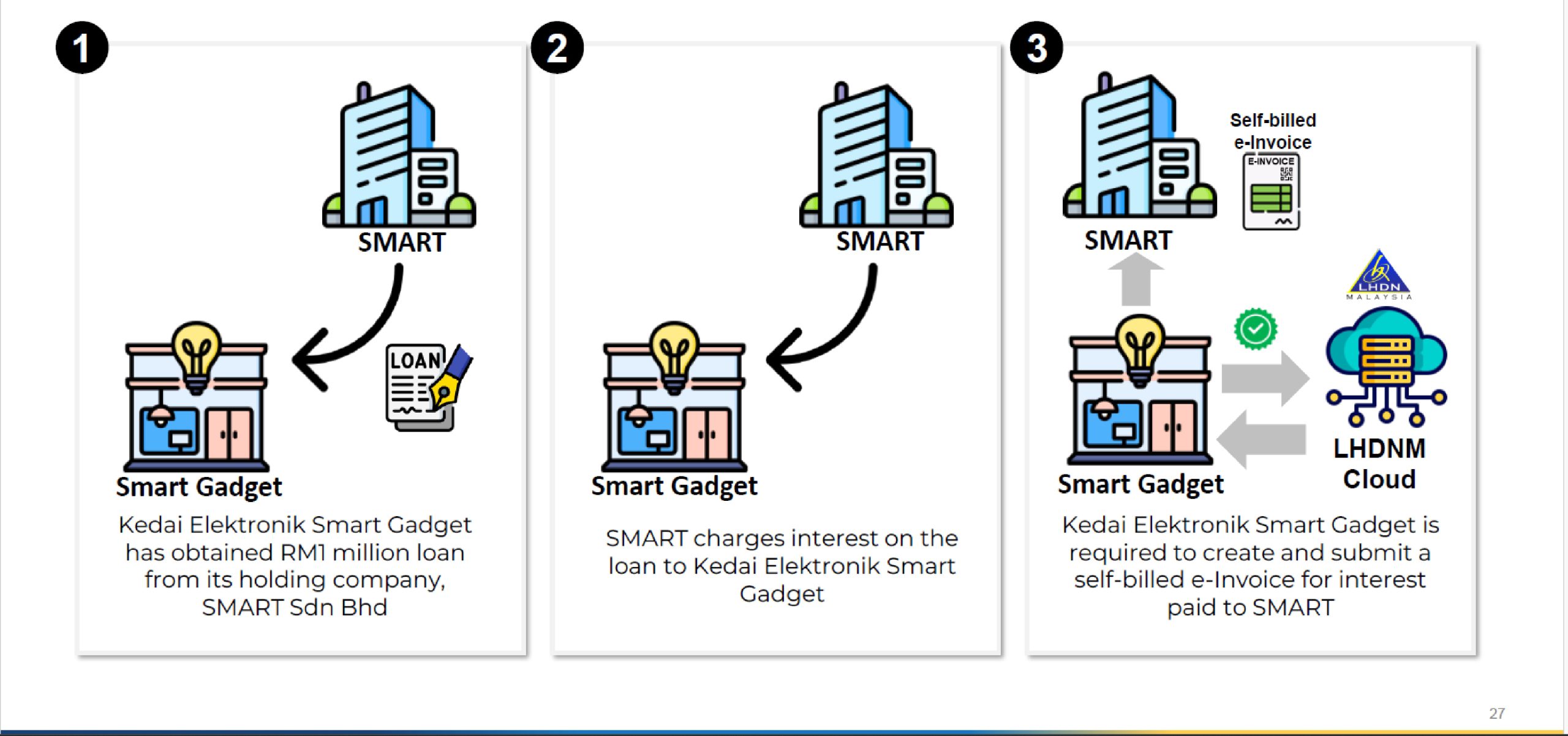

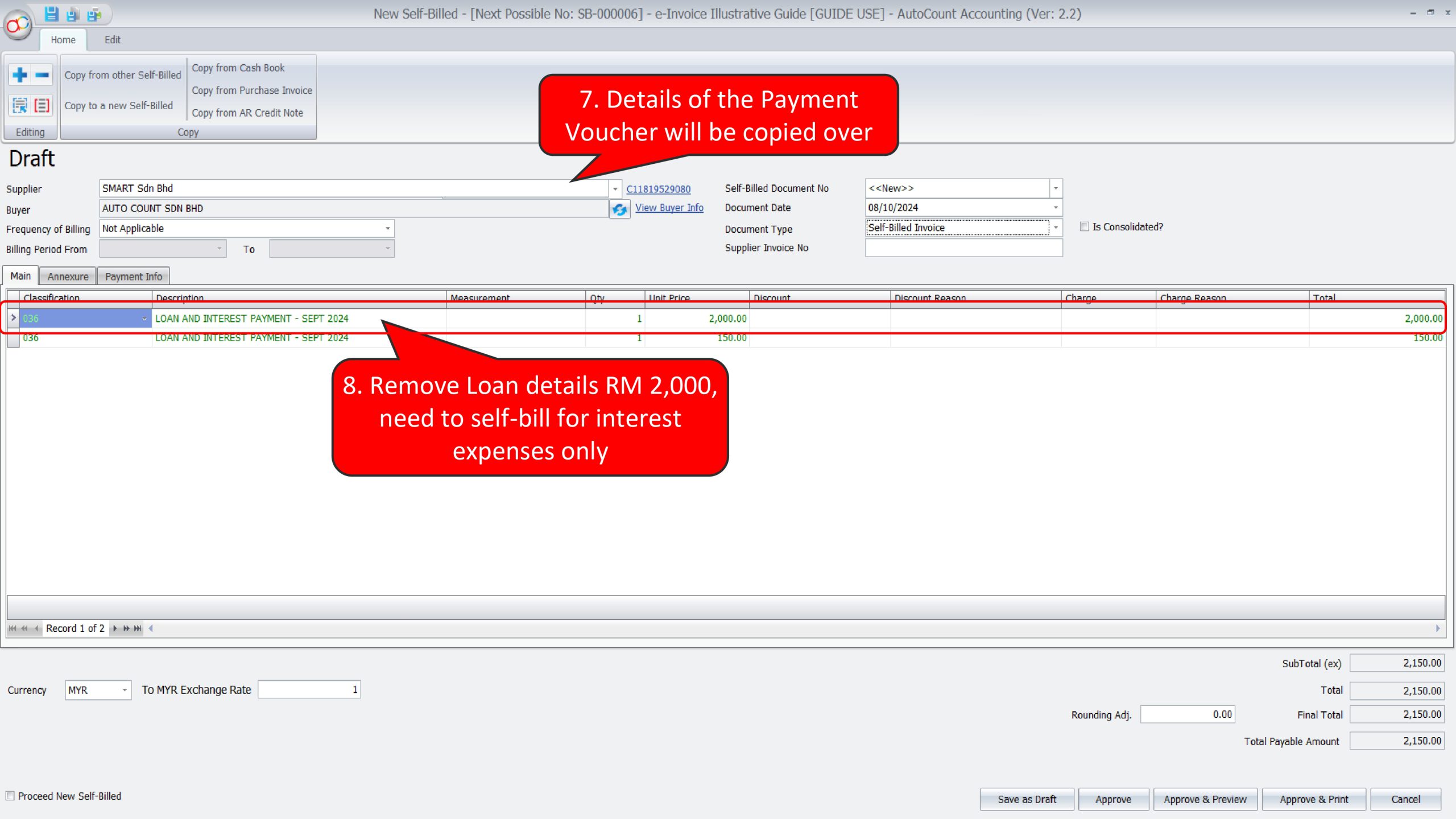

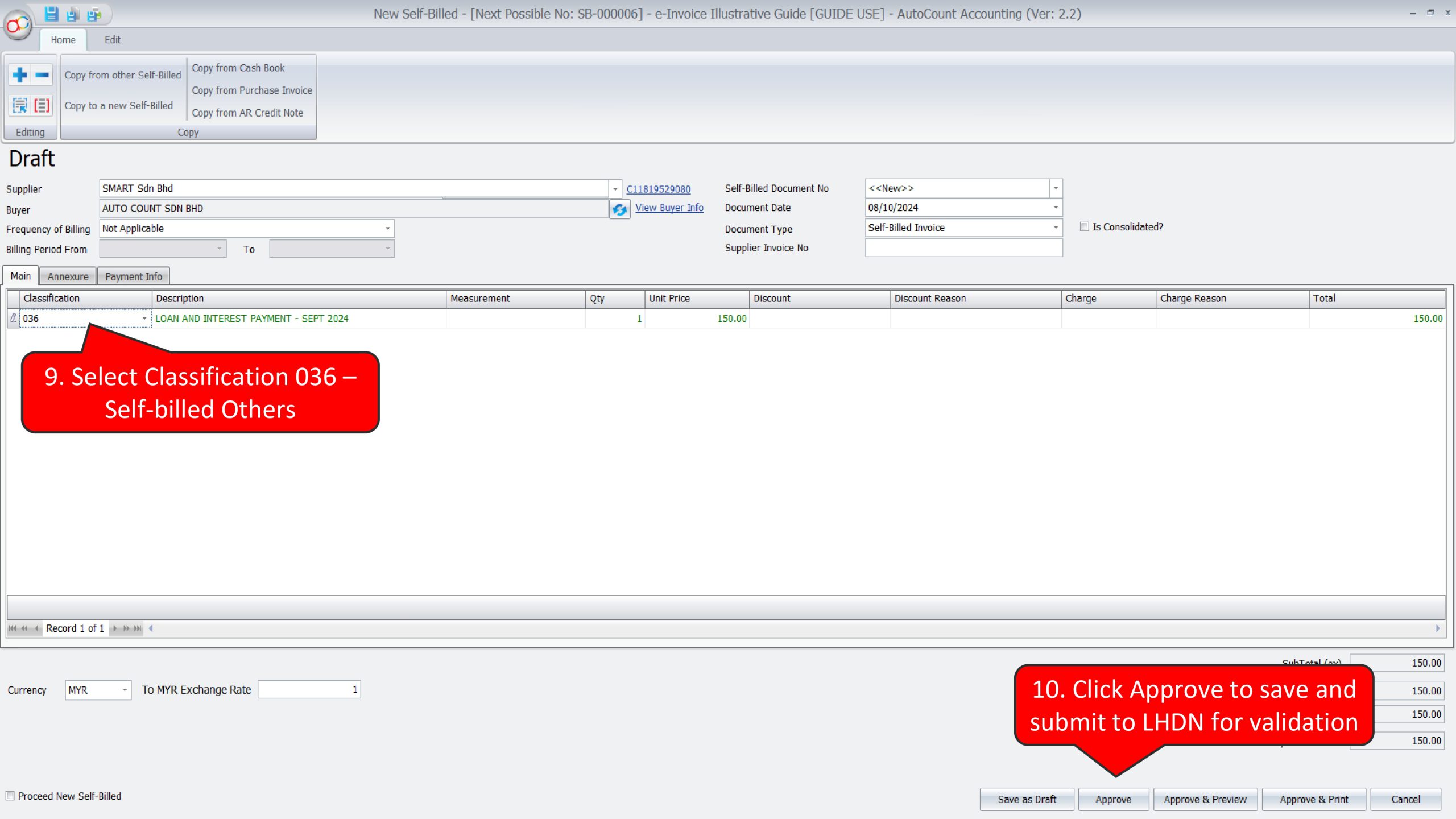

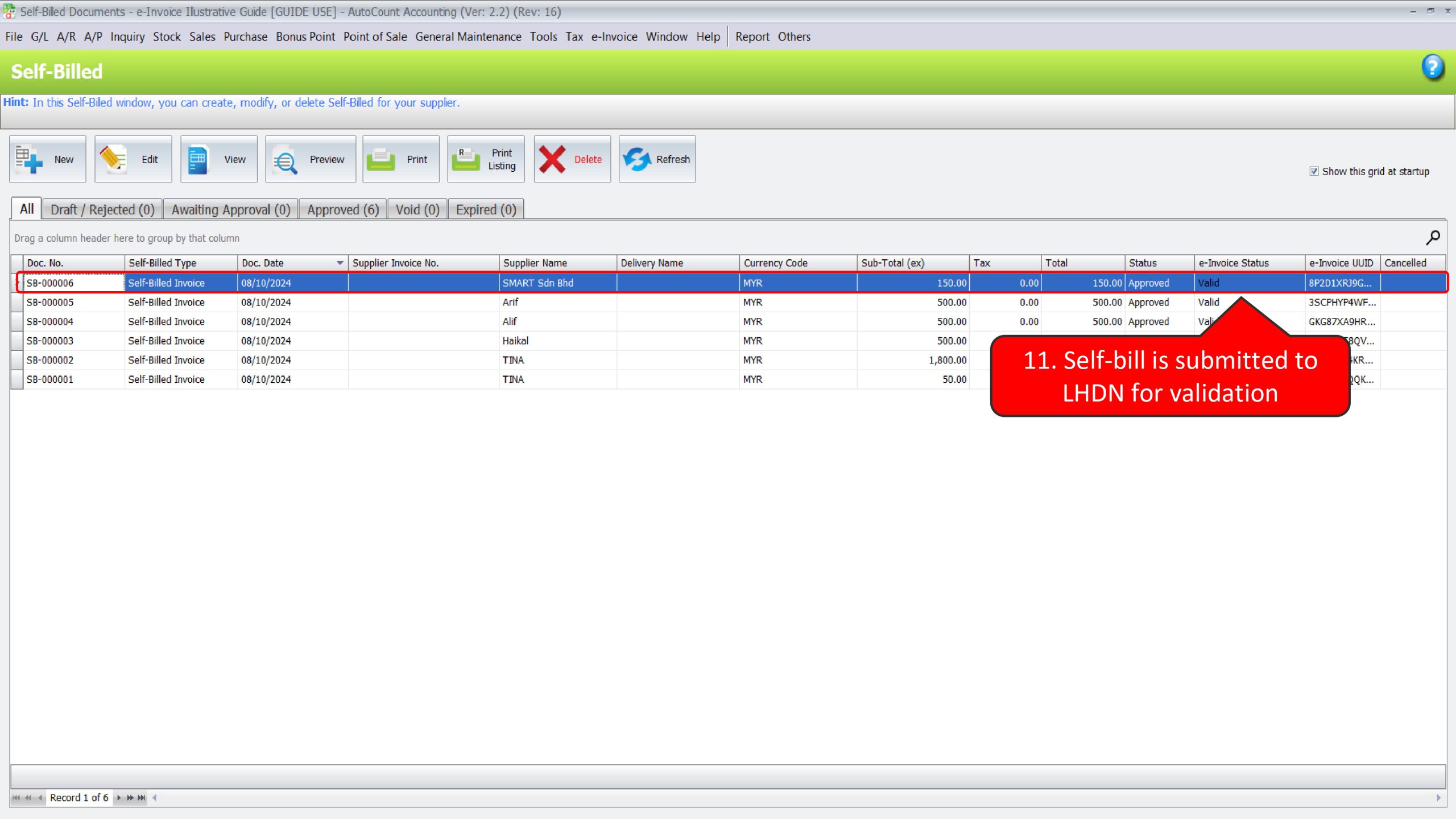

Illustration 20: Buyers are required to issue a self-billed e-Invoice on interest payments made to related companies (non-financial institution) #

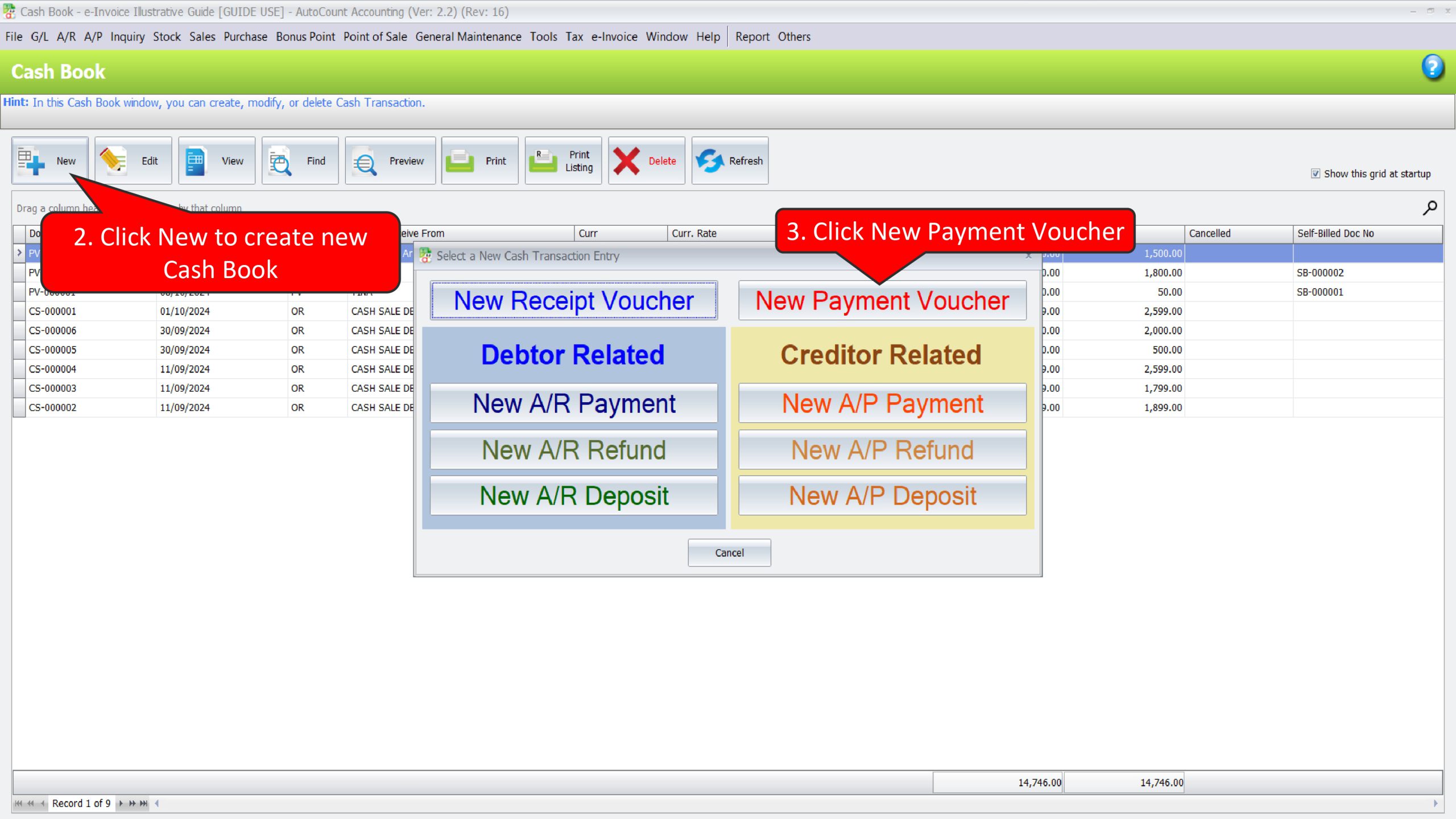

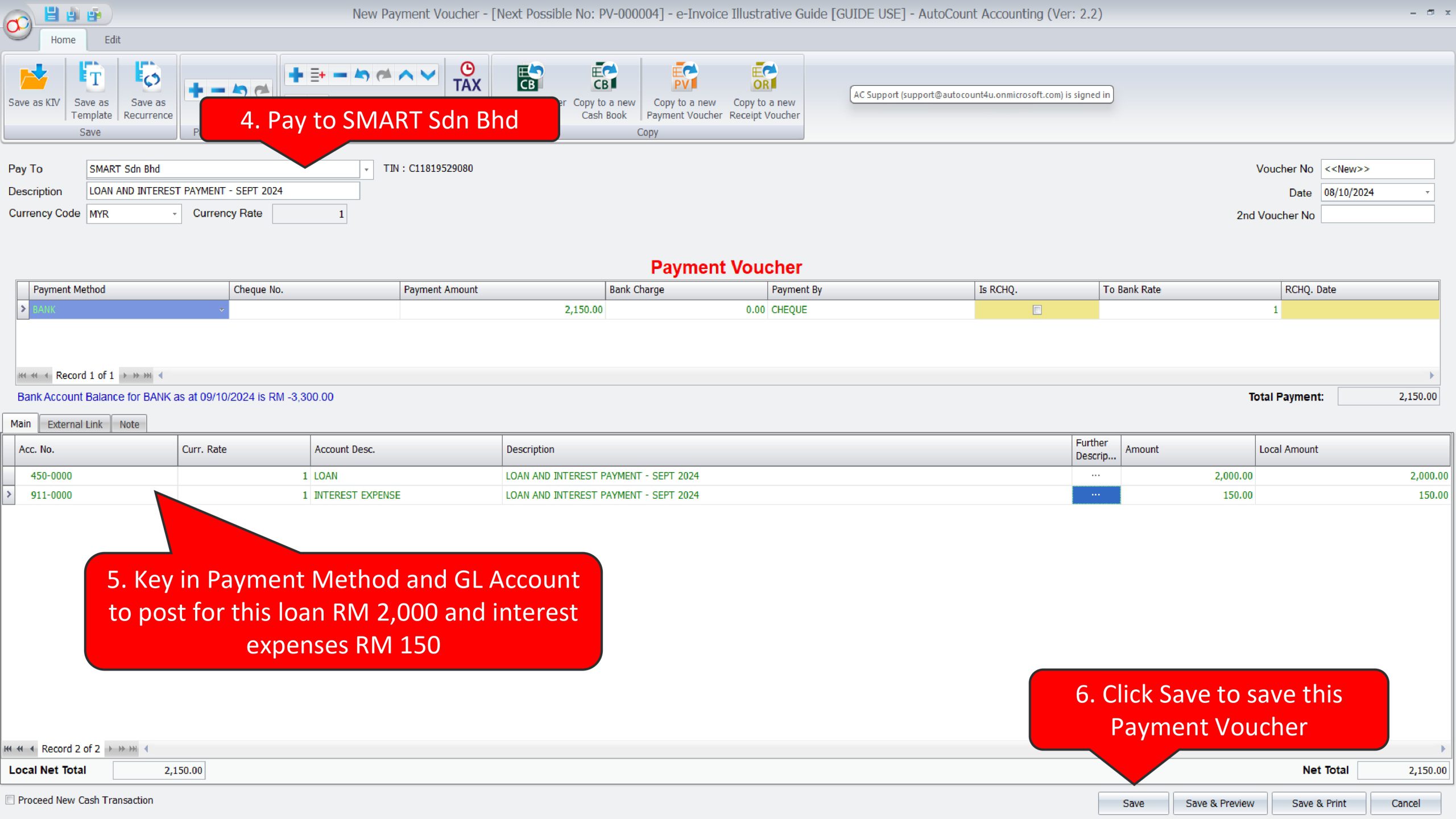

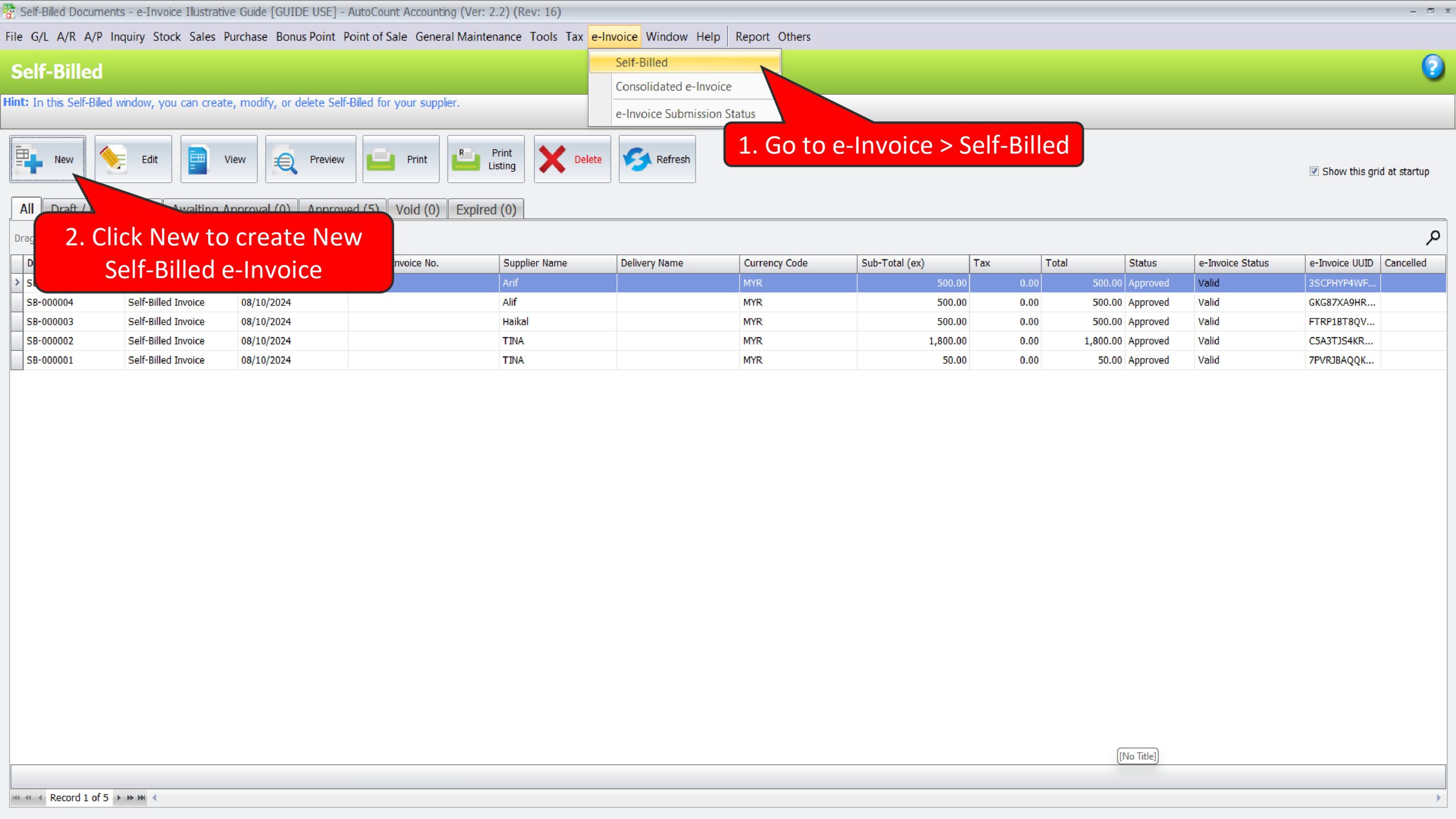

In this scenario, Kedai Elektronik Smart Gadget needs to perform 2 actions in AutoCount Accounting:

- Create a Payment Voucher to record interest payment to SMART Sdn Bhd

- Create a Self-Bill e-Invoice to submit and report this interest expenses to LHDN

Create a Payment Voucher to record interest payment to SMART Sdn Bhd

Create a Self-Bill e-Invoice to submit and report this interest expenses to LHDN

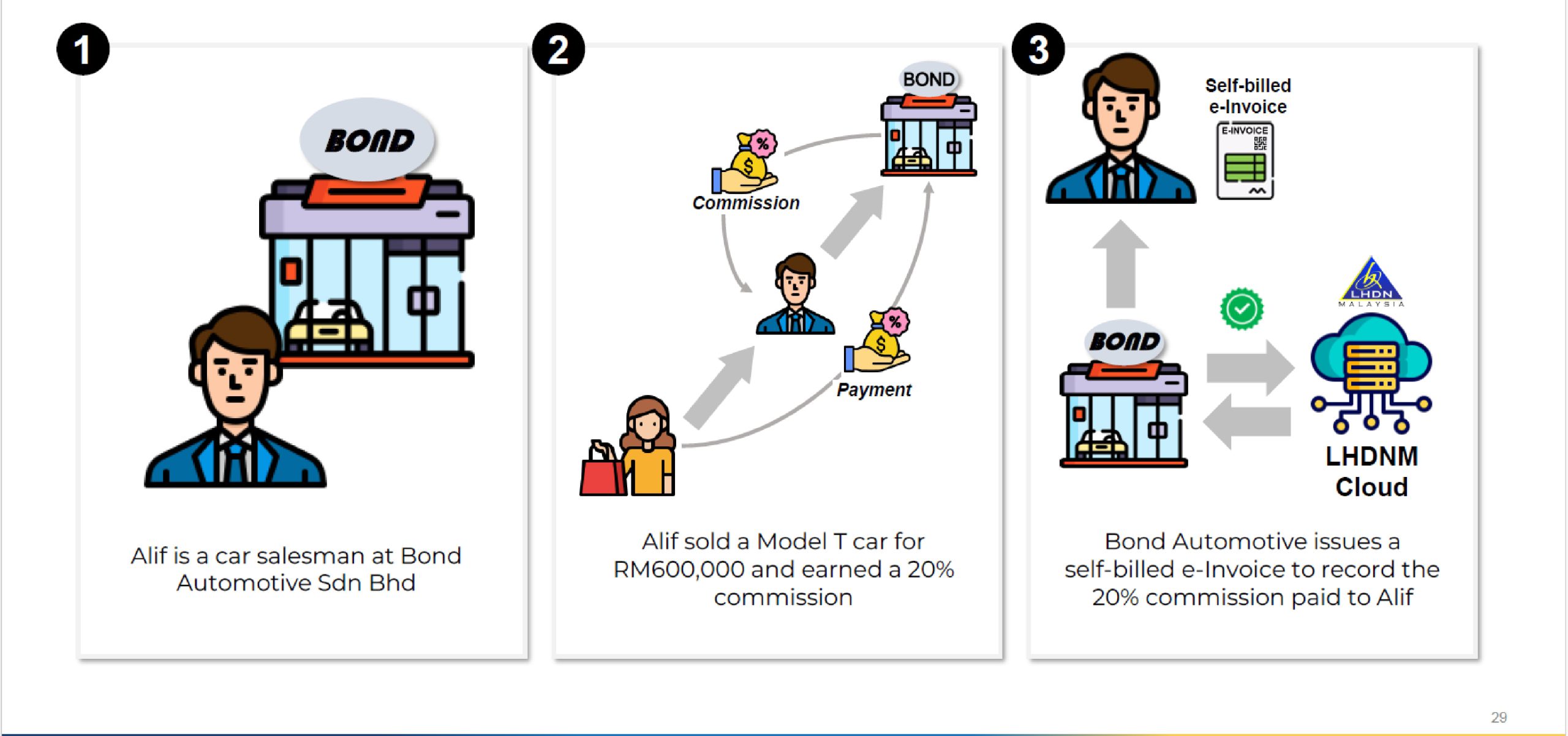

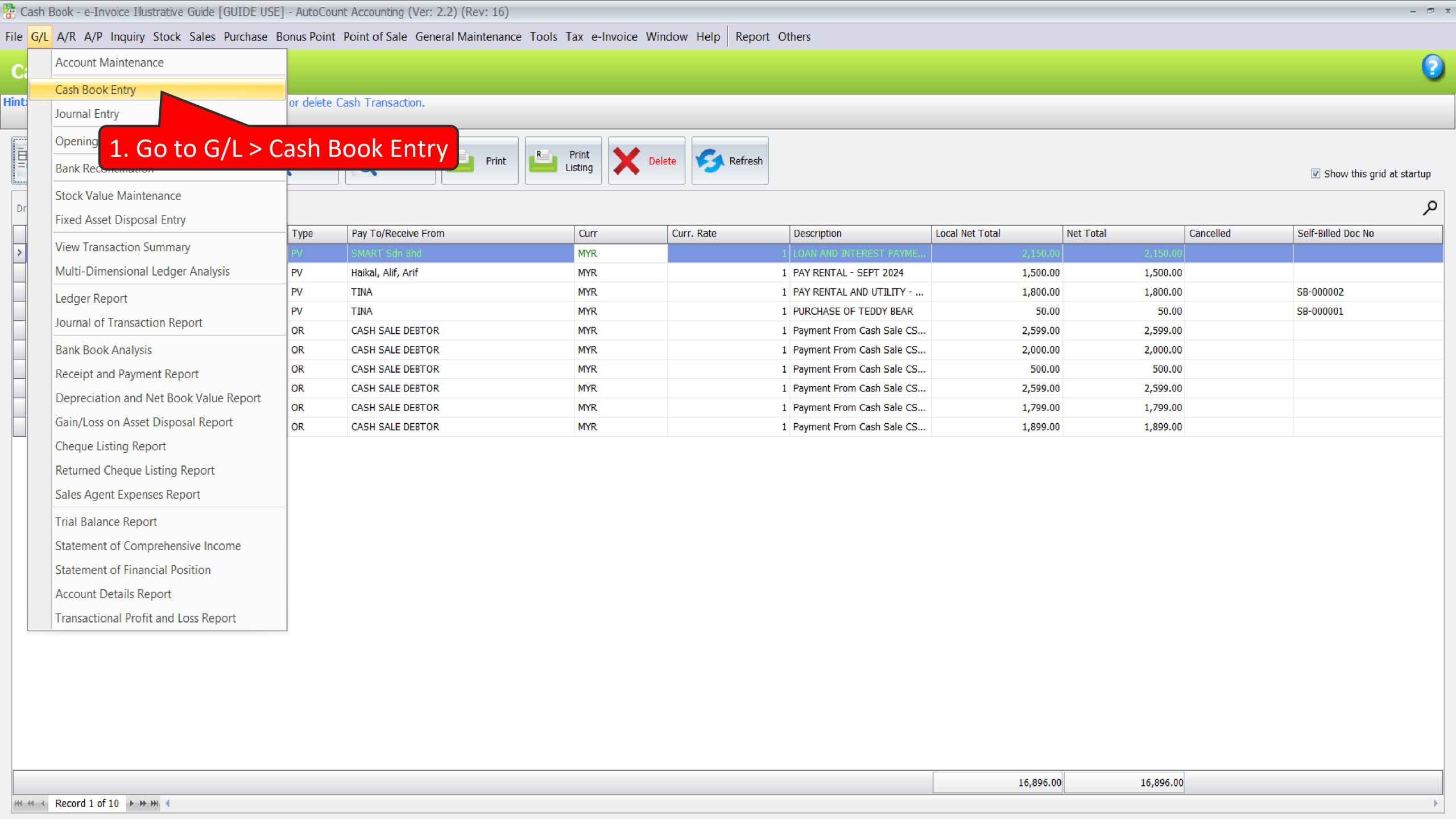

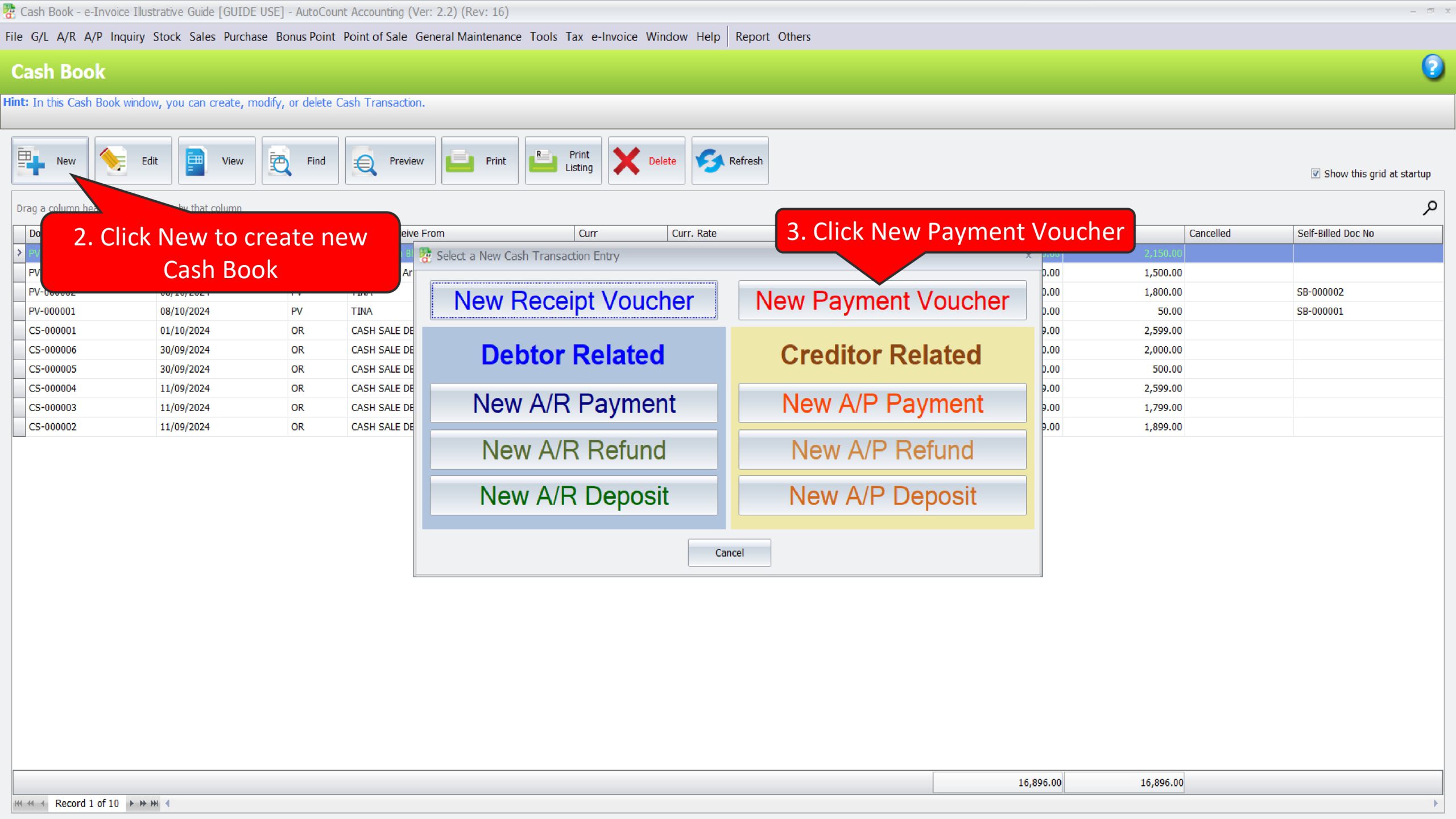

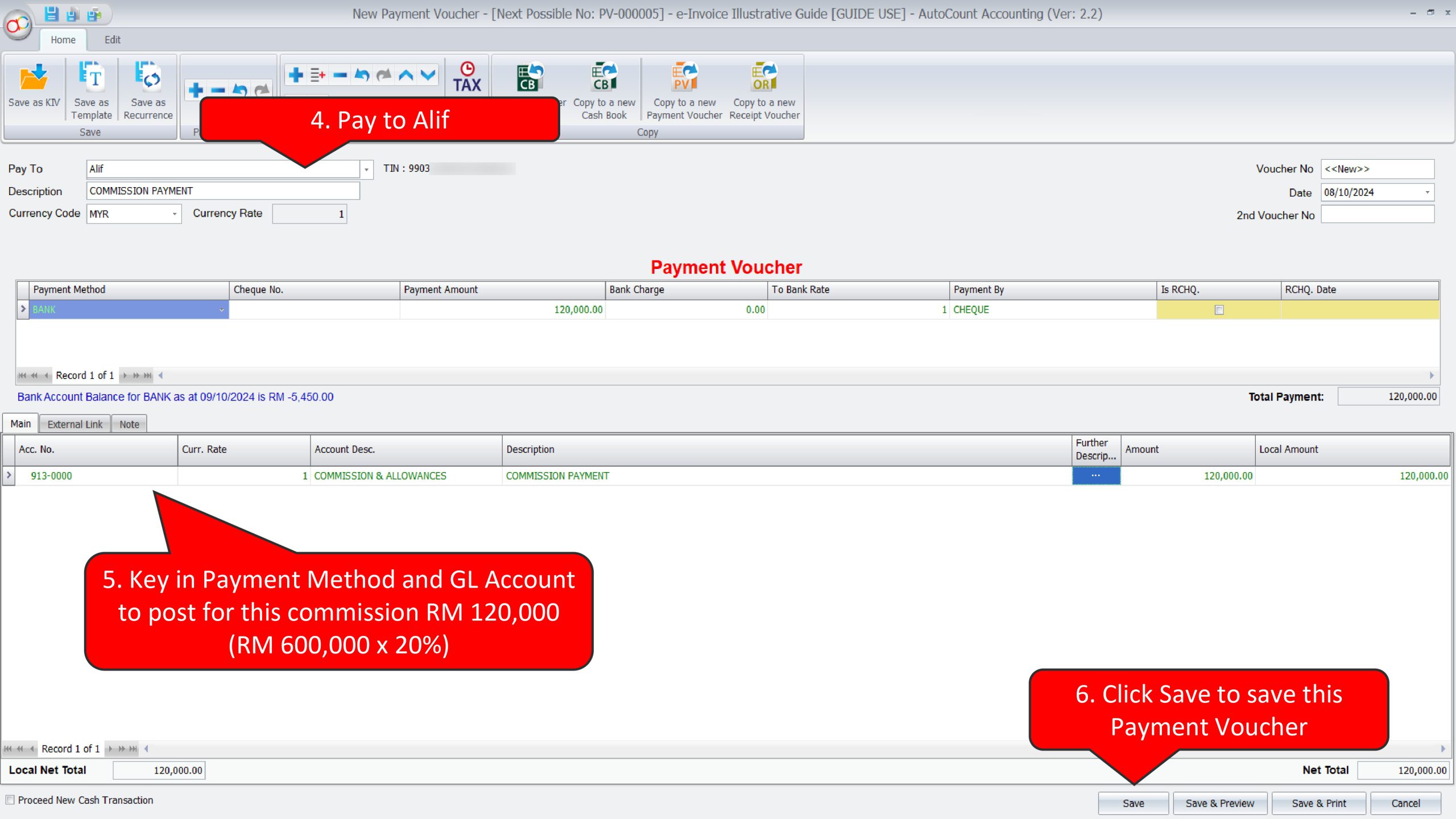

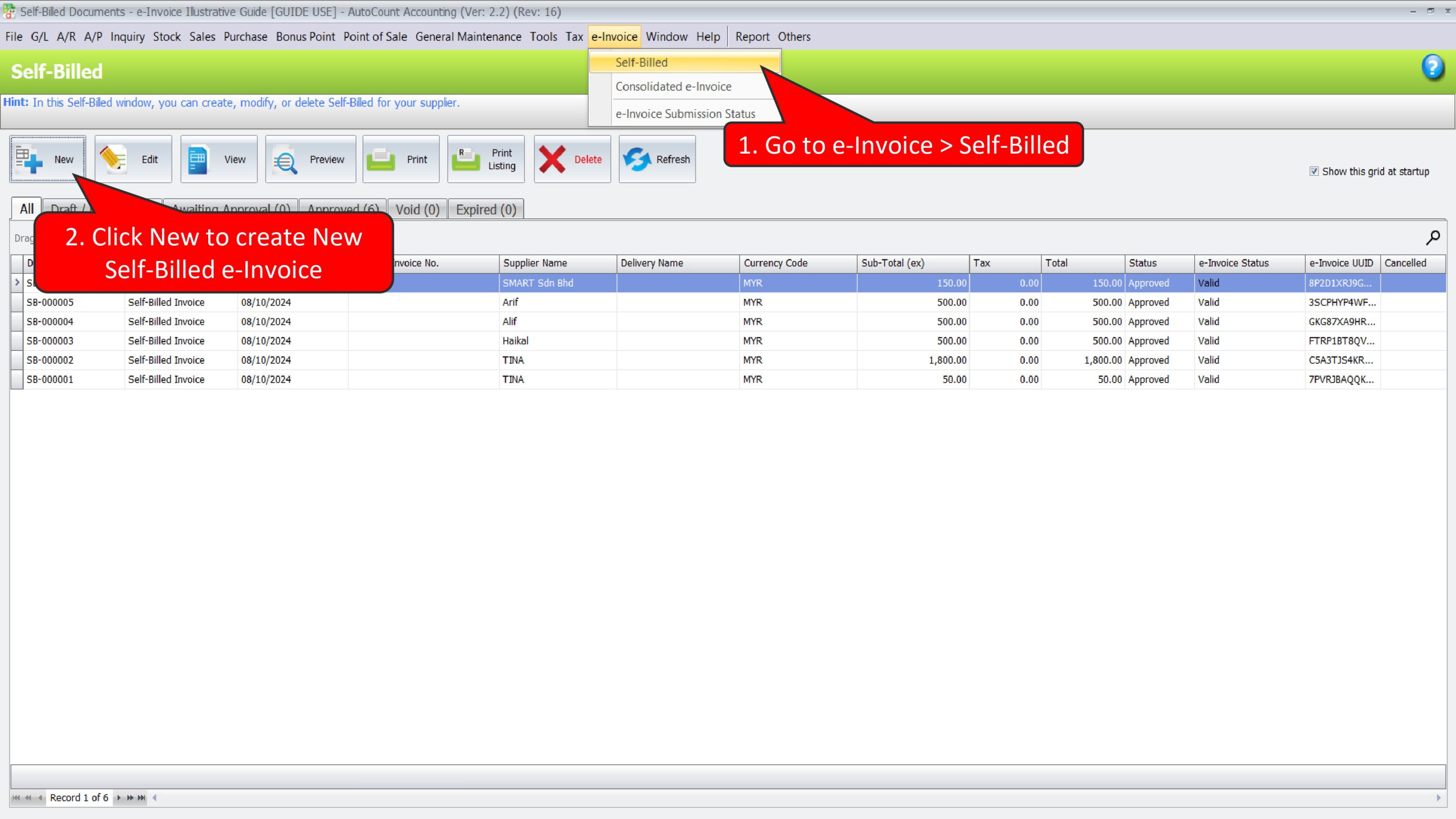

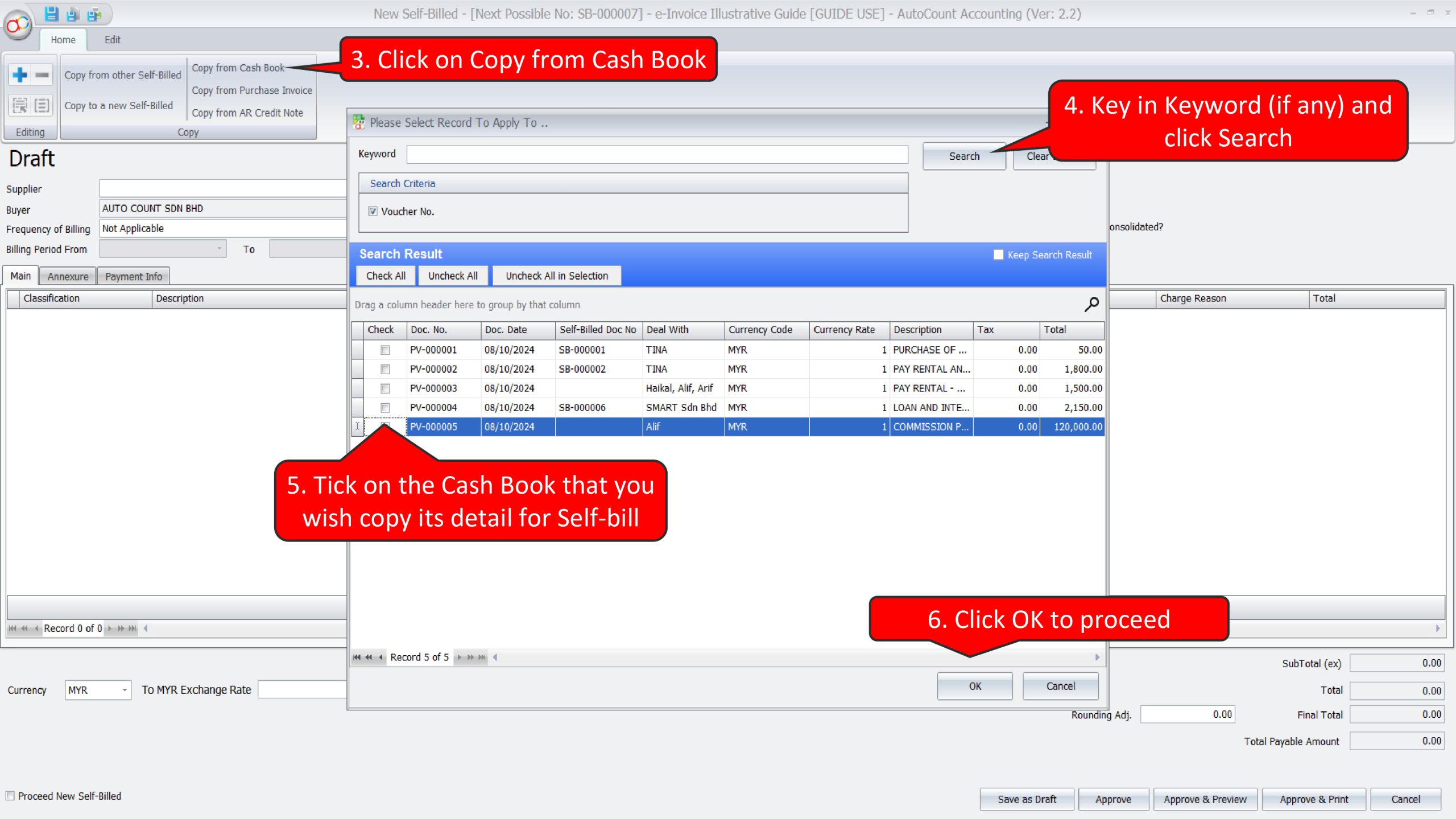

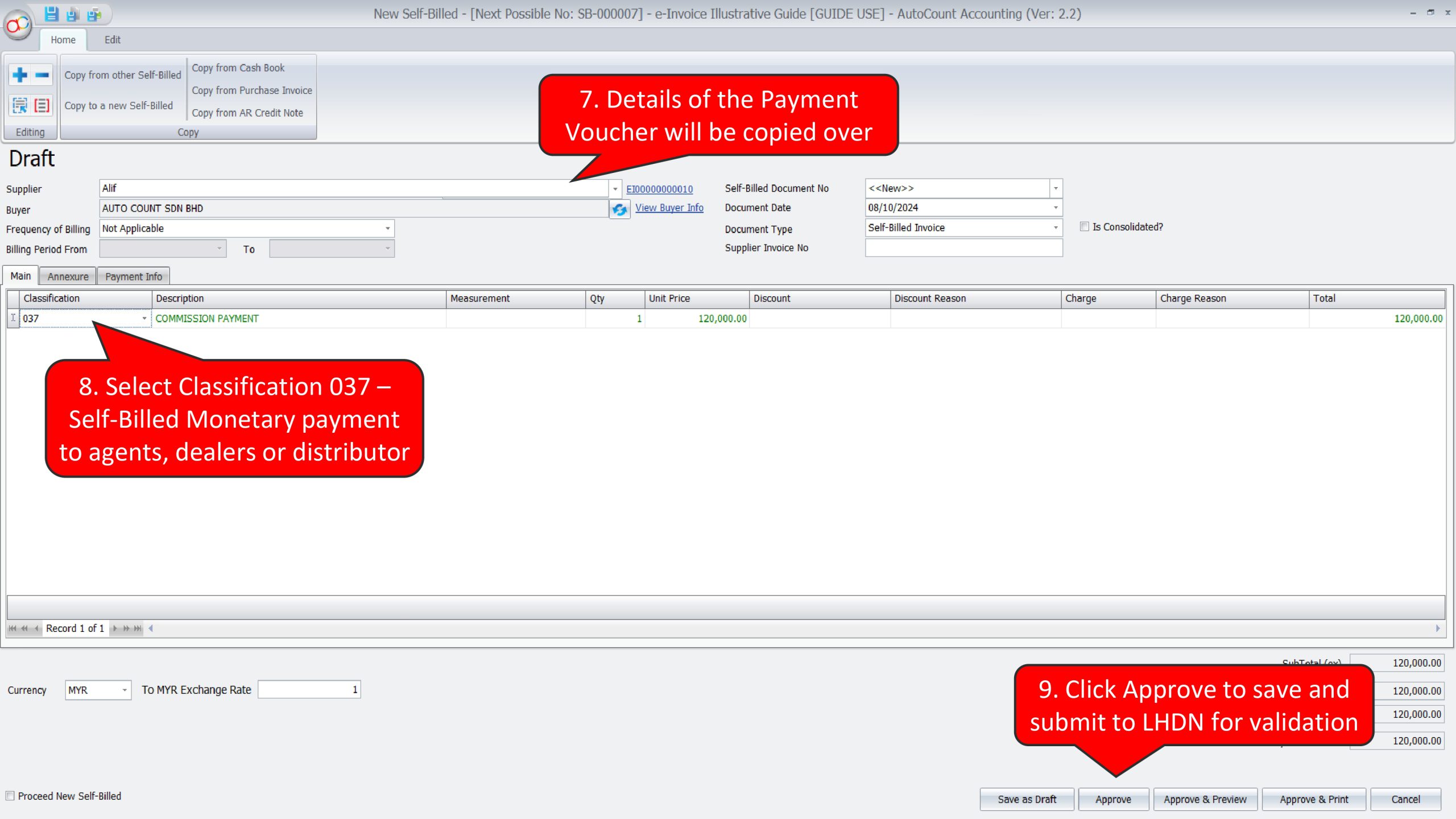

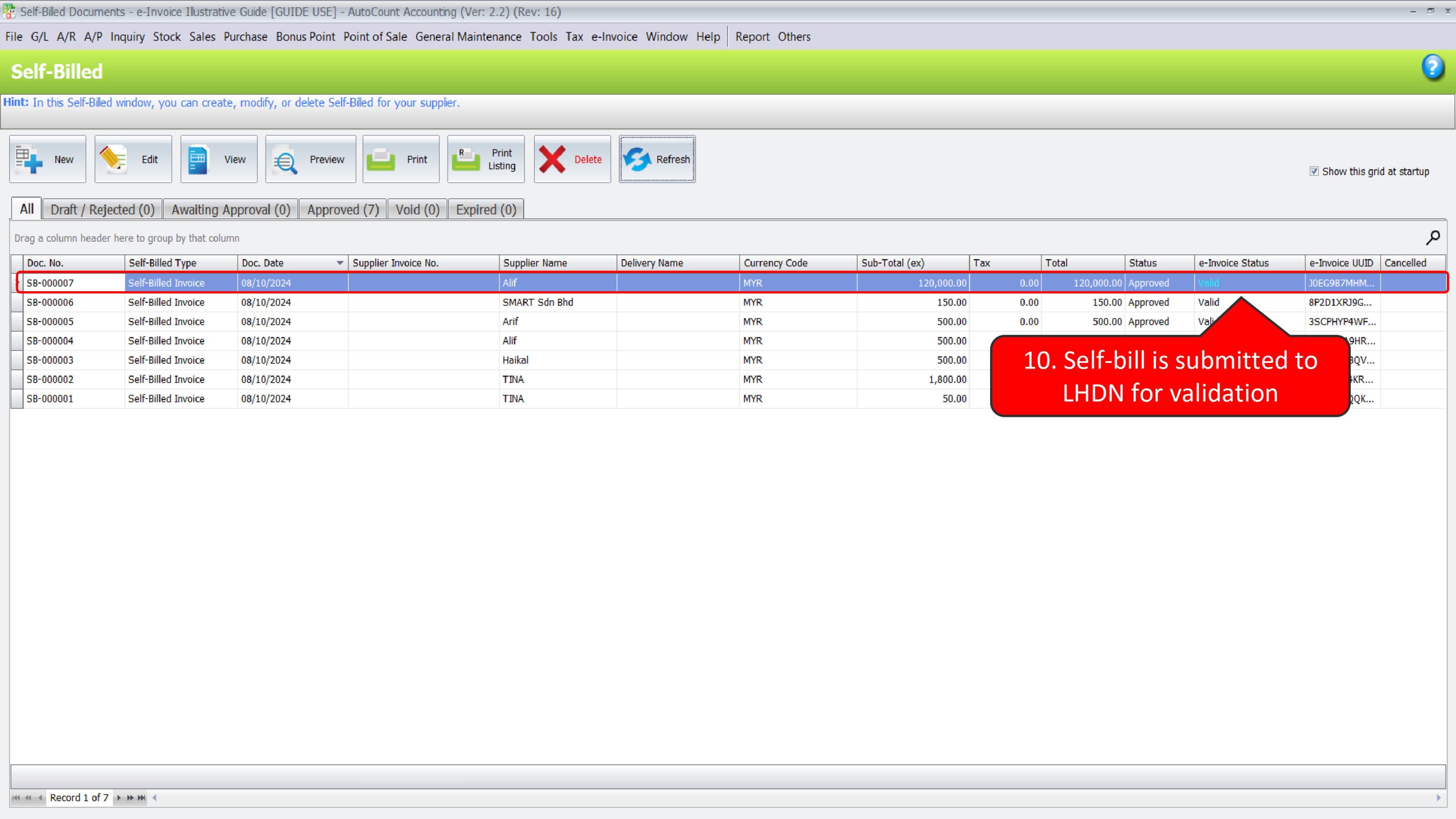

Illustration 21: Buyer (Payor) shall issue self-billed e-Invoice to applicable transactions for payments to agents, dealers and distributors (i.e., Commission) #

In this scenario, Bond Automotive needs to perform 2 actions in AutoCount Accounting:

- Create a Payment Voucher to record commission payment to Alif

- Create a Self-Bill e-Invoice to submit and report this commission expenses to LHDN

Create a Payment Voucher to record commission payment to Alif

Create a Self-Bill e-Invoice to submit report this commission expenses to LHDN

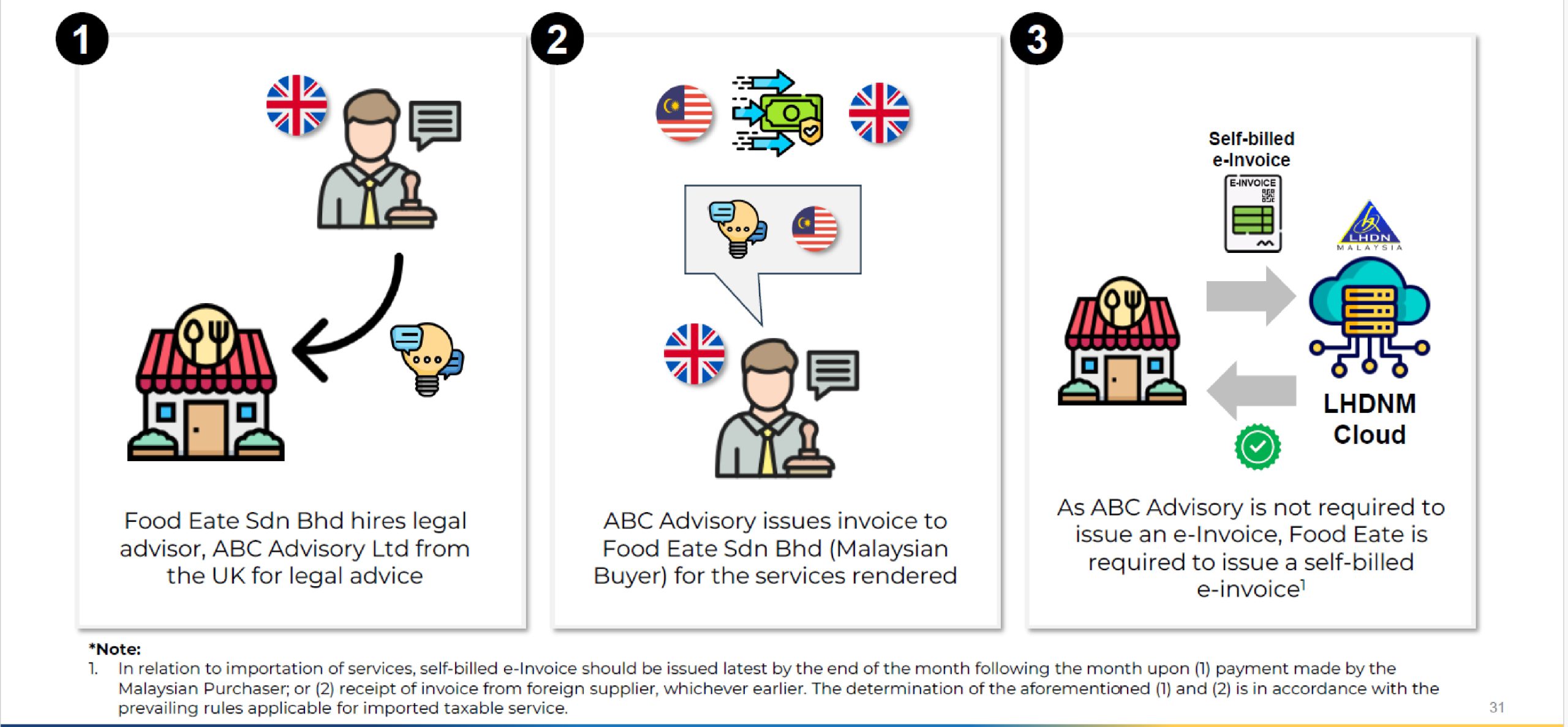

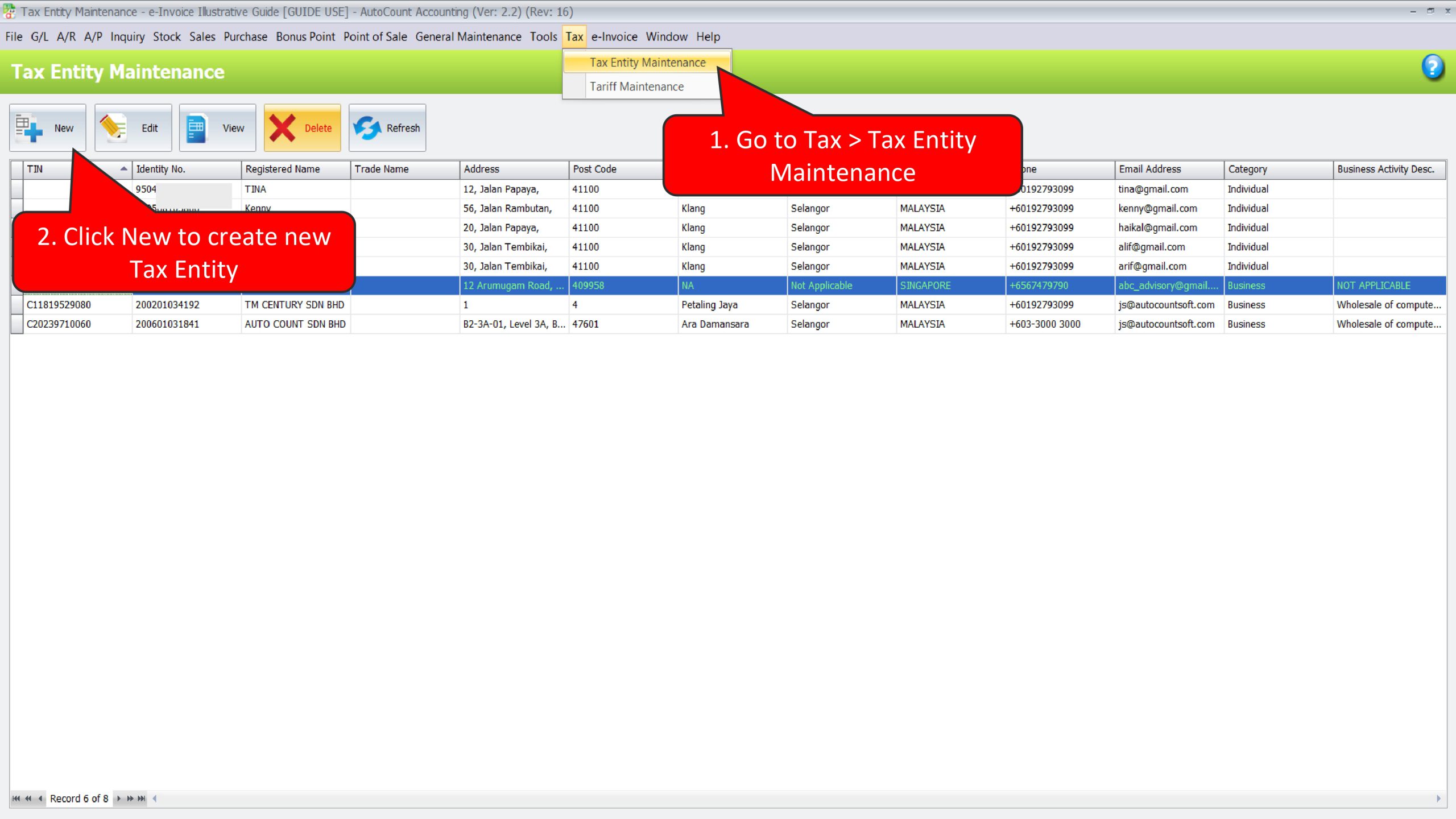

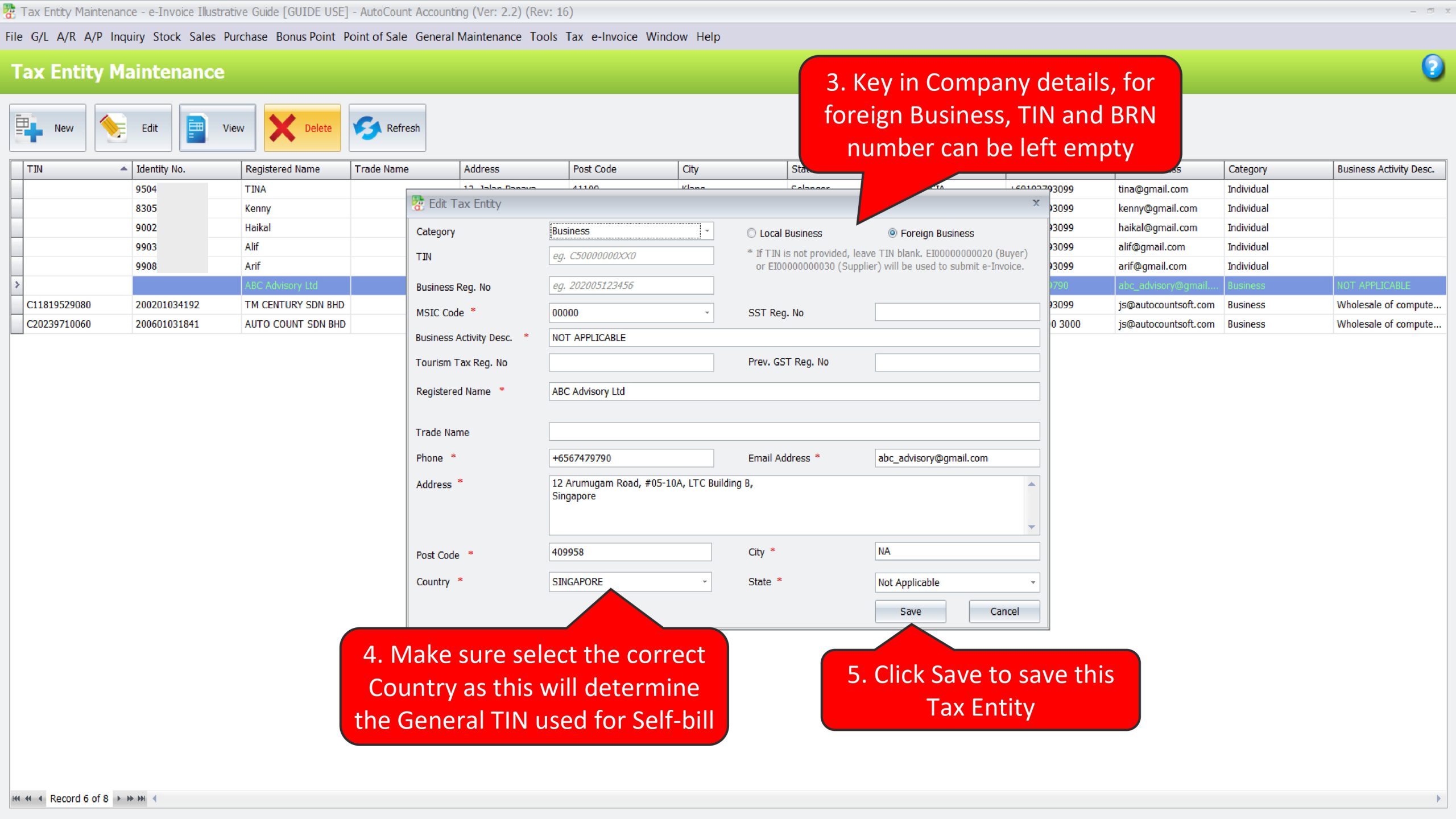

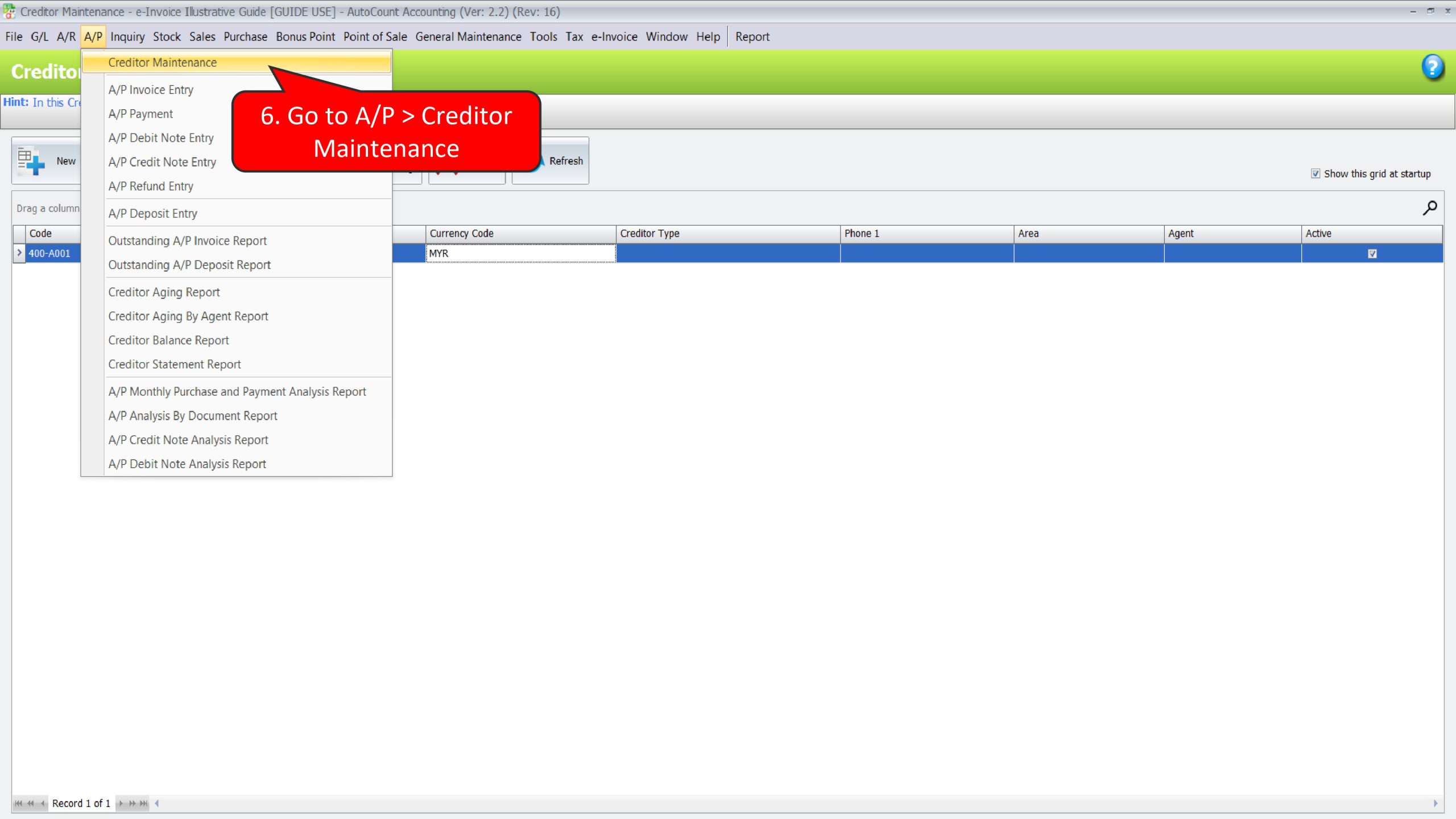

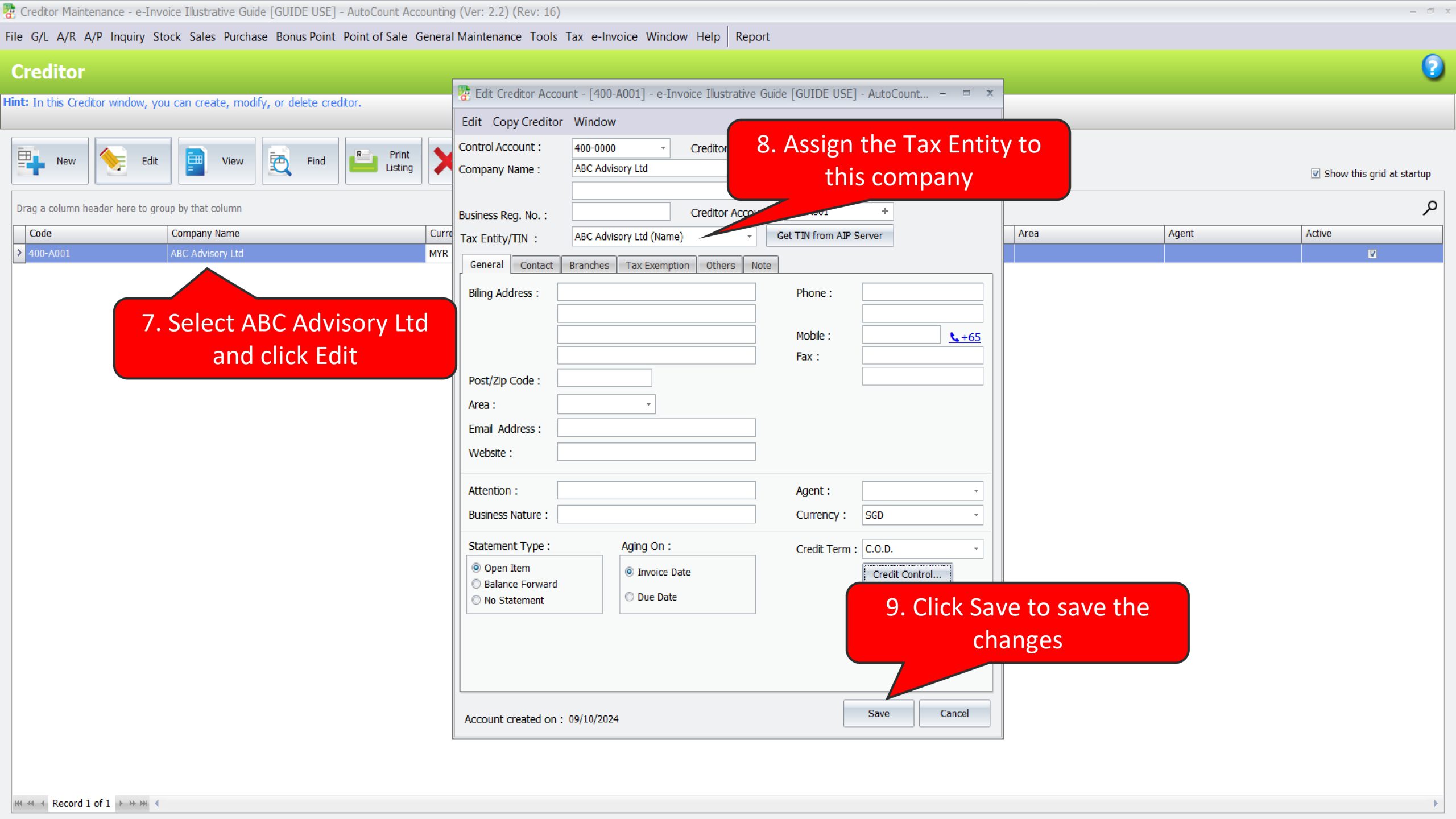

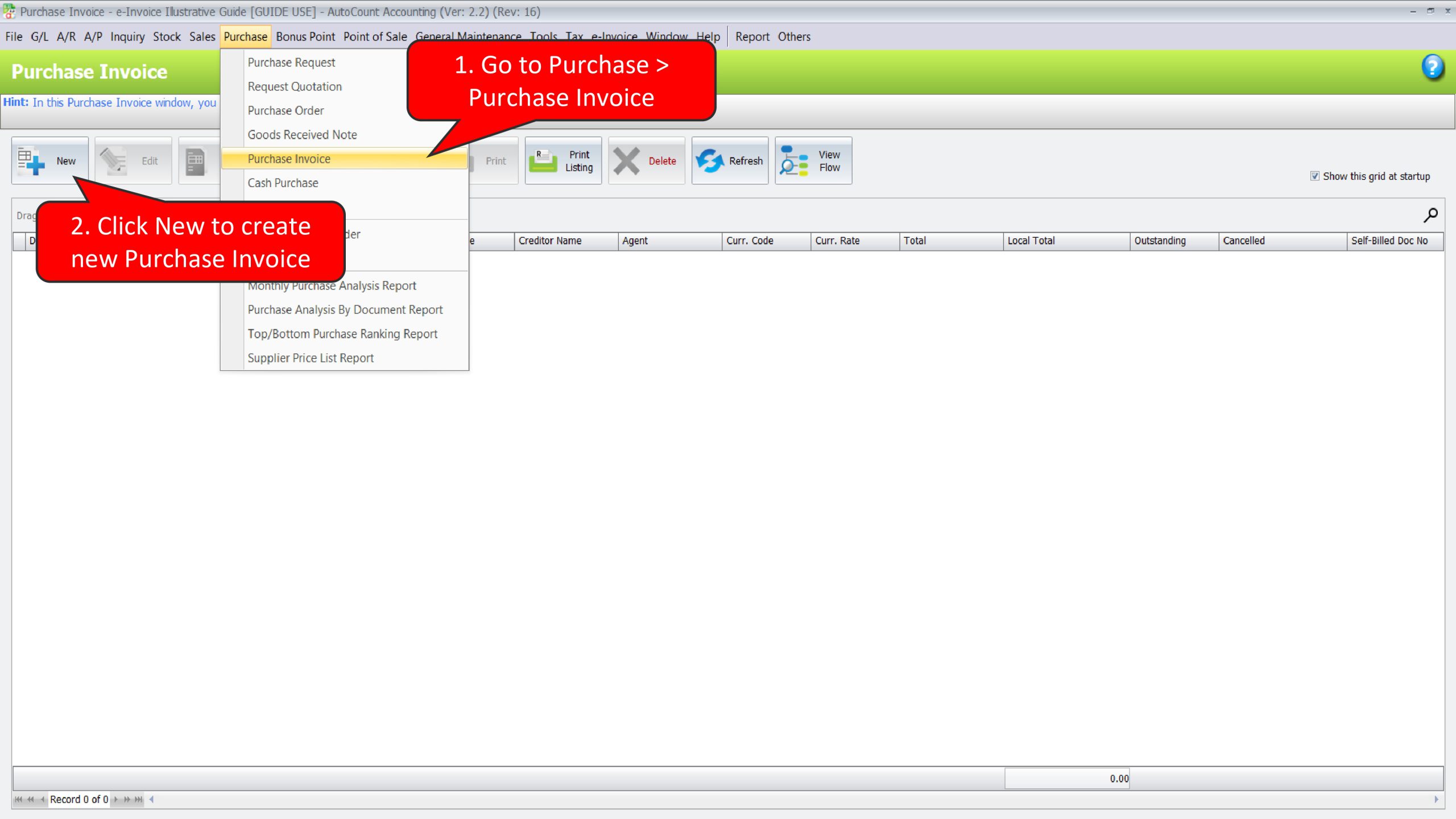

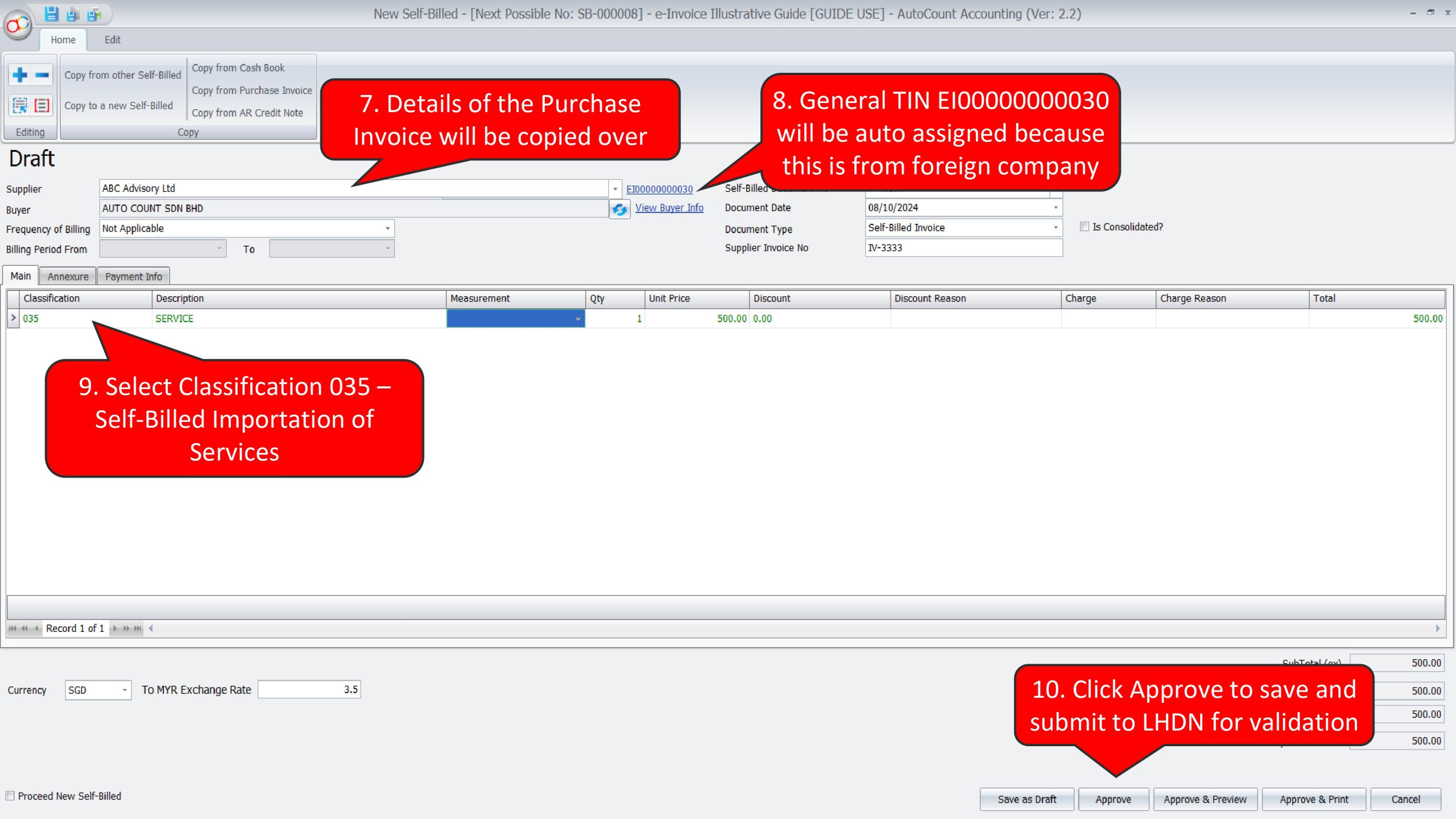

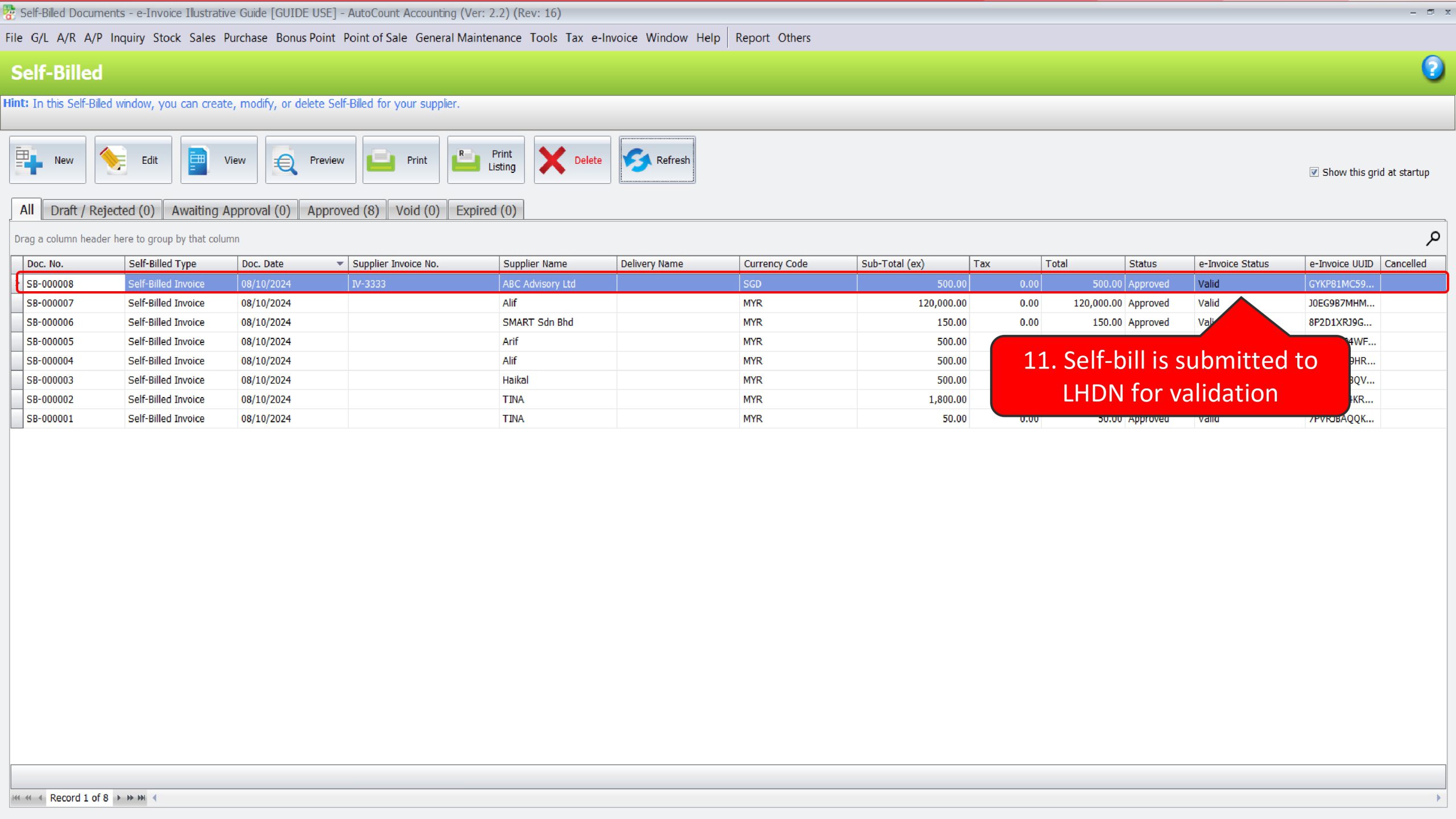

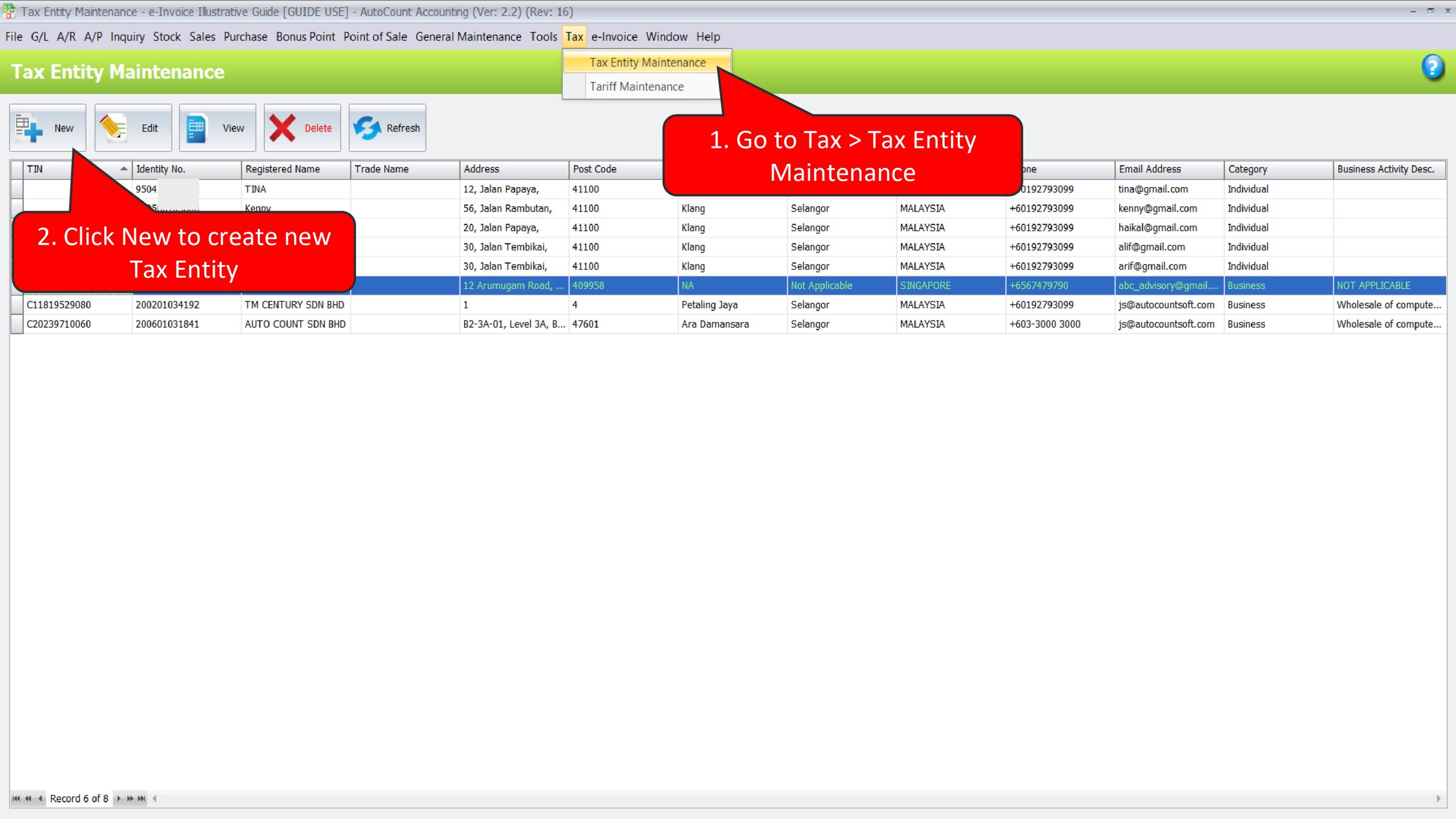

Illustration 22: Malaysian Buyers are required to issue self-billed e-Invoices for services acquired from Foreign Sellers #

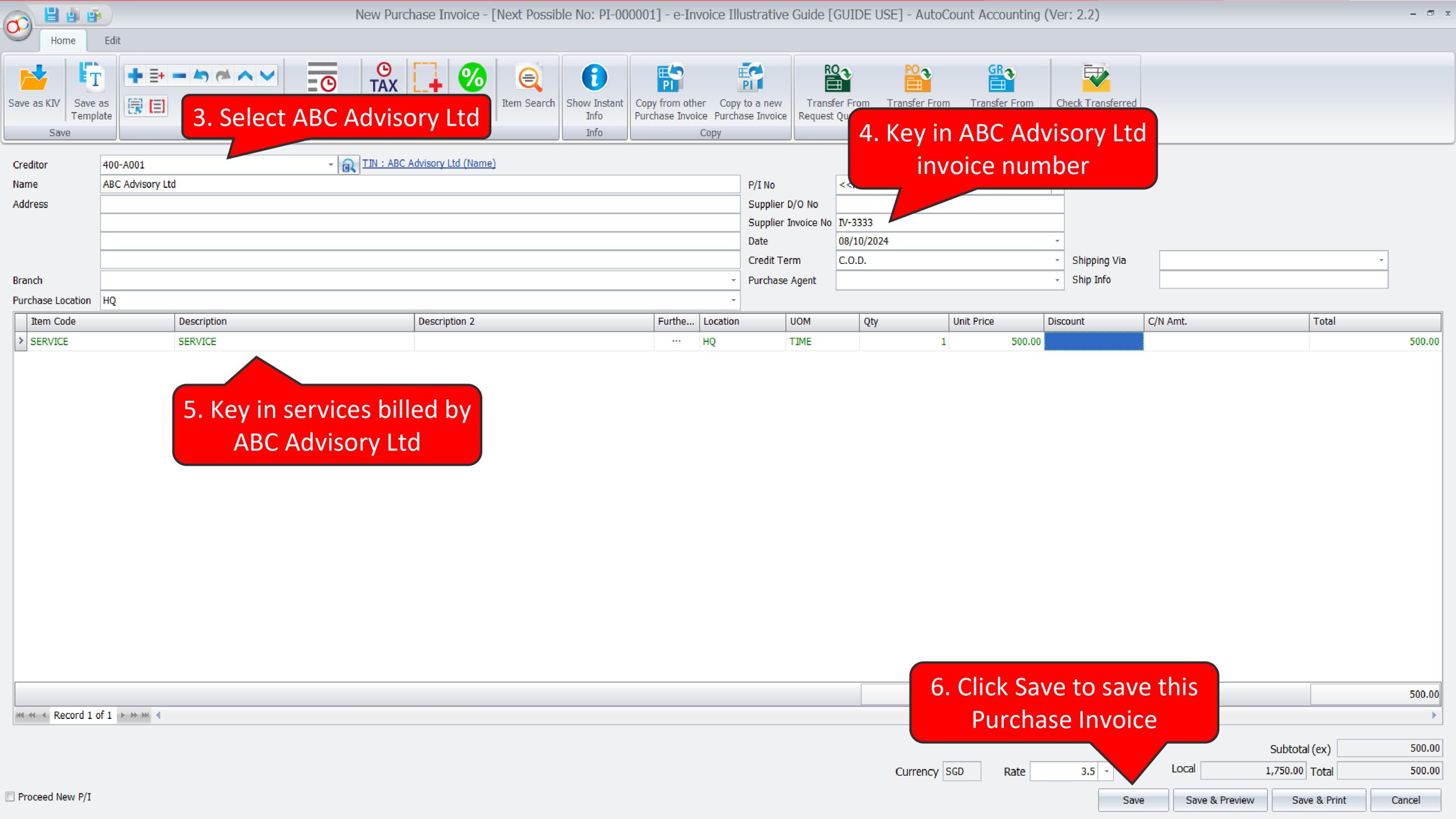

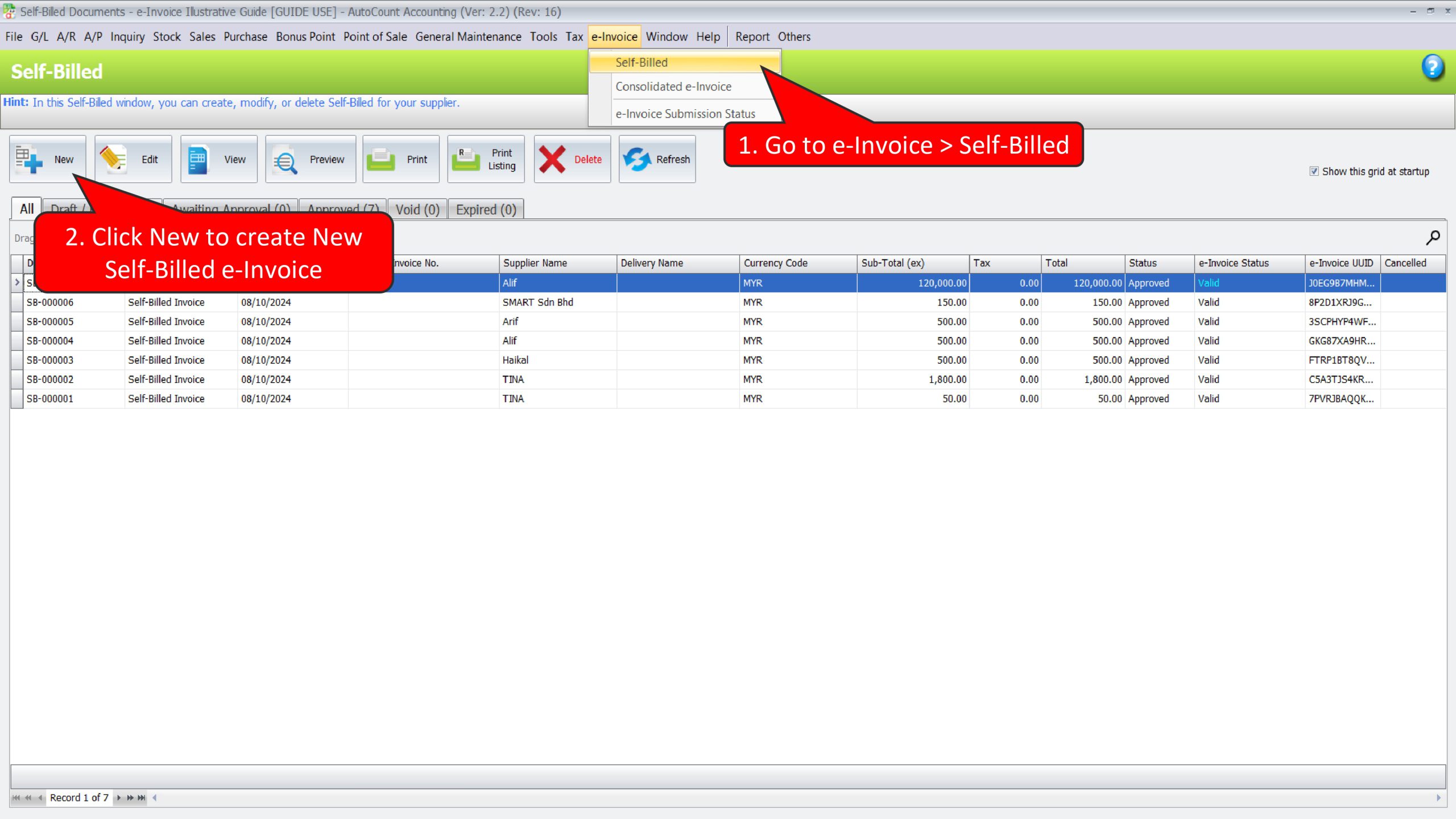

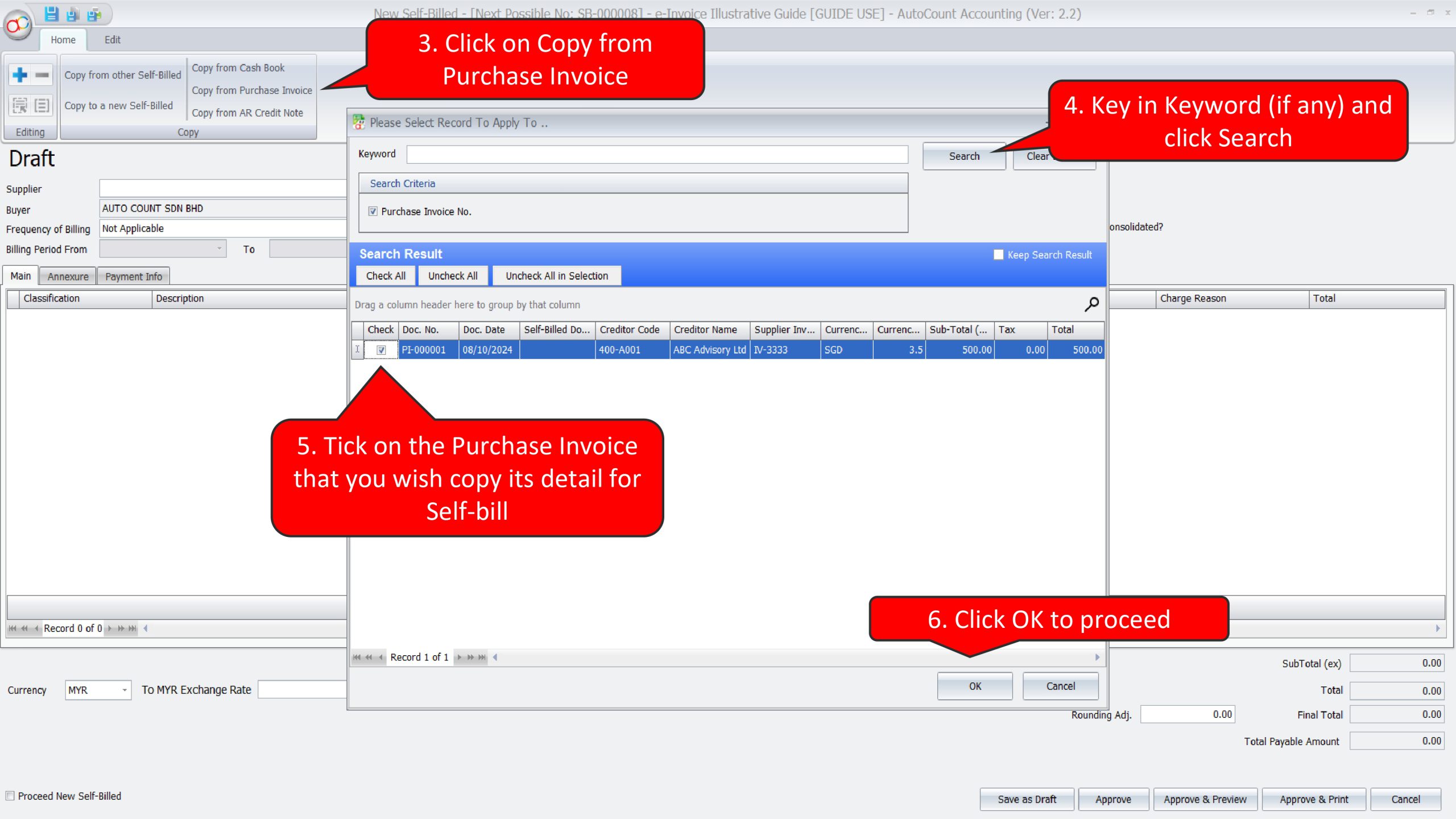

In this scenario, Food Eate Sdn Bhd needs to perform 2 actions in AutoCount Accounting:

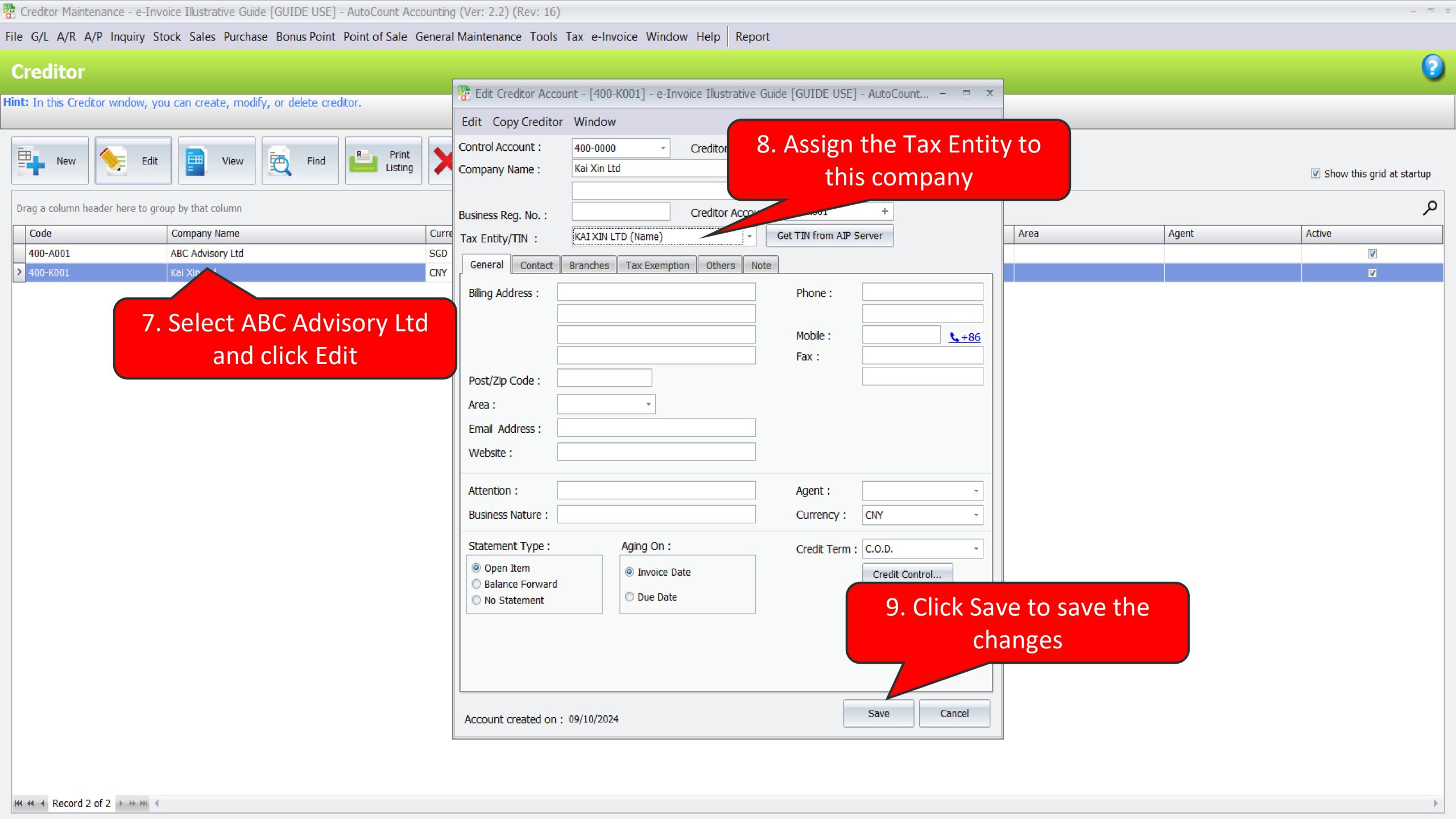

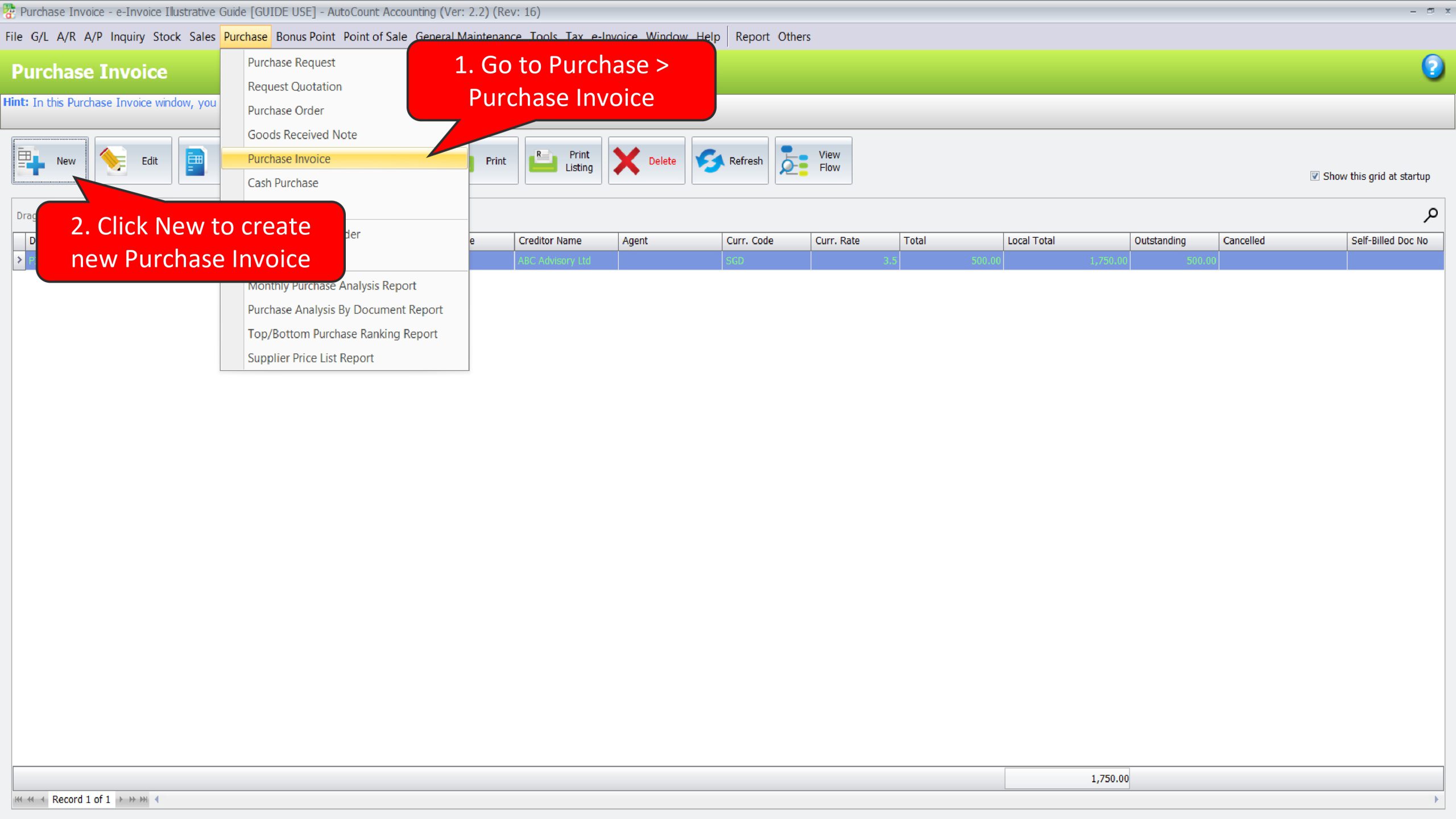

- Create a Purchase Invoice for service provided by ABC Advisory Ltd

- Create a Self-Bill e-Invoice to submit and report this imported service expenses to LHDN

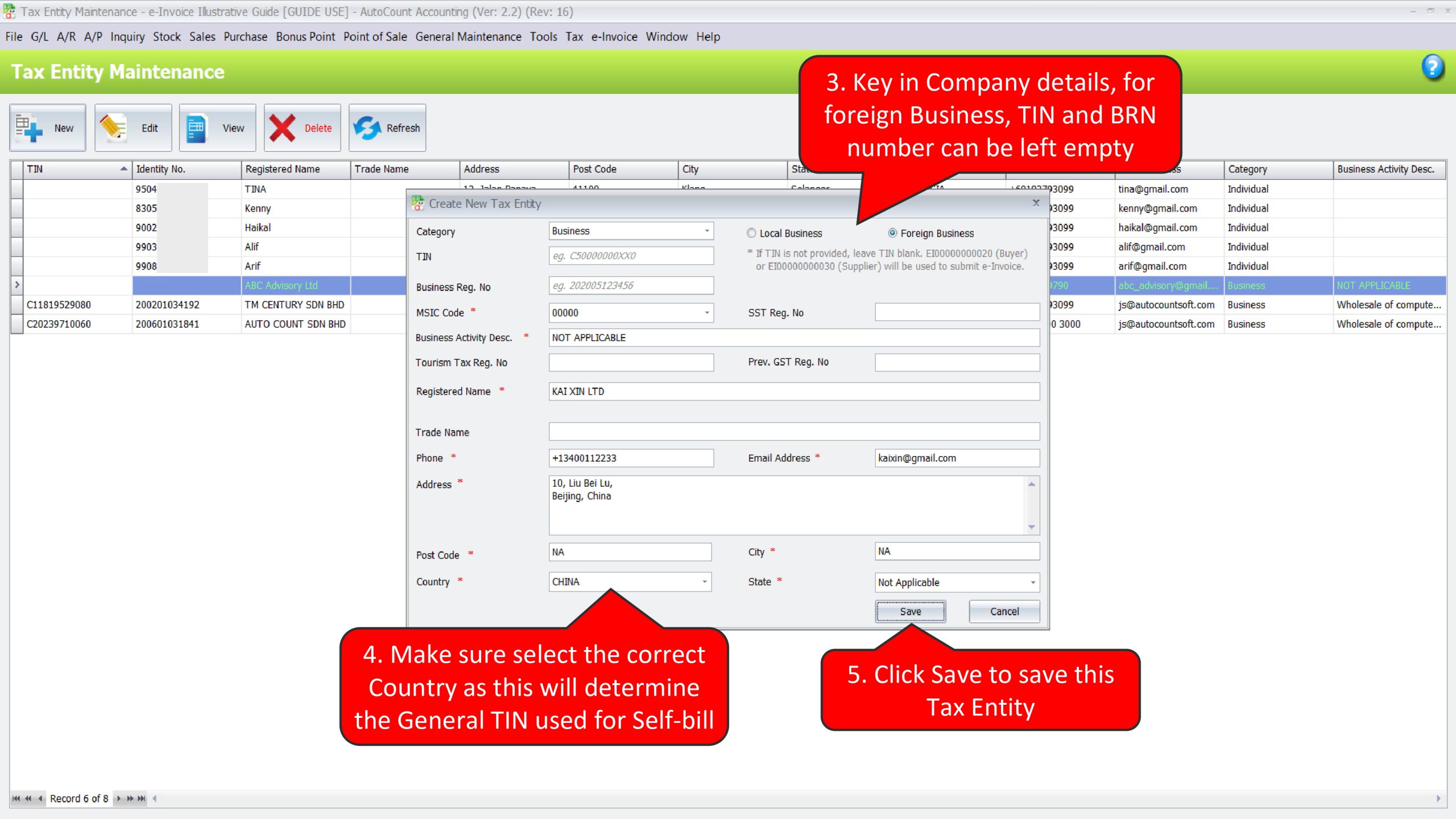

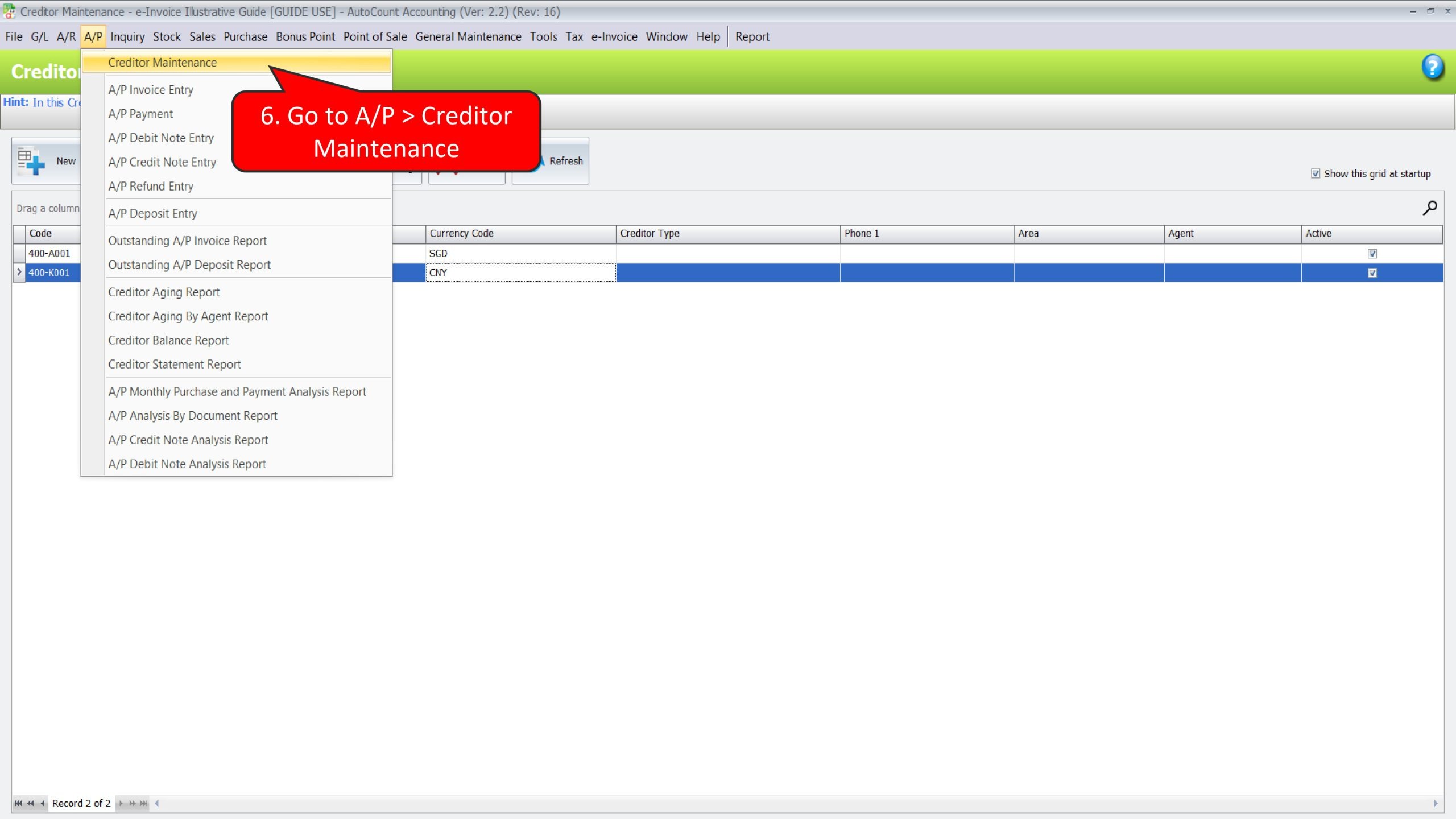

Before proceed to transaction, make sure you already had a Tax Entity for ABC Advisory Ltd, else you can refer to the following steps on how to do it

Create a Purchase Invoice for service provided by ABC Advisory Ltd

Create a Self-Bill e-Invoice to submit and report this imported service expenses to LHDN

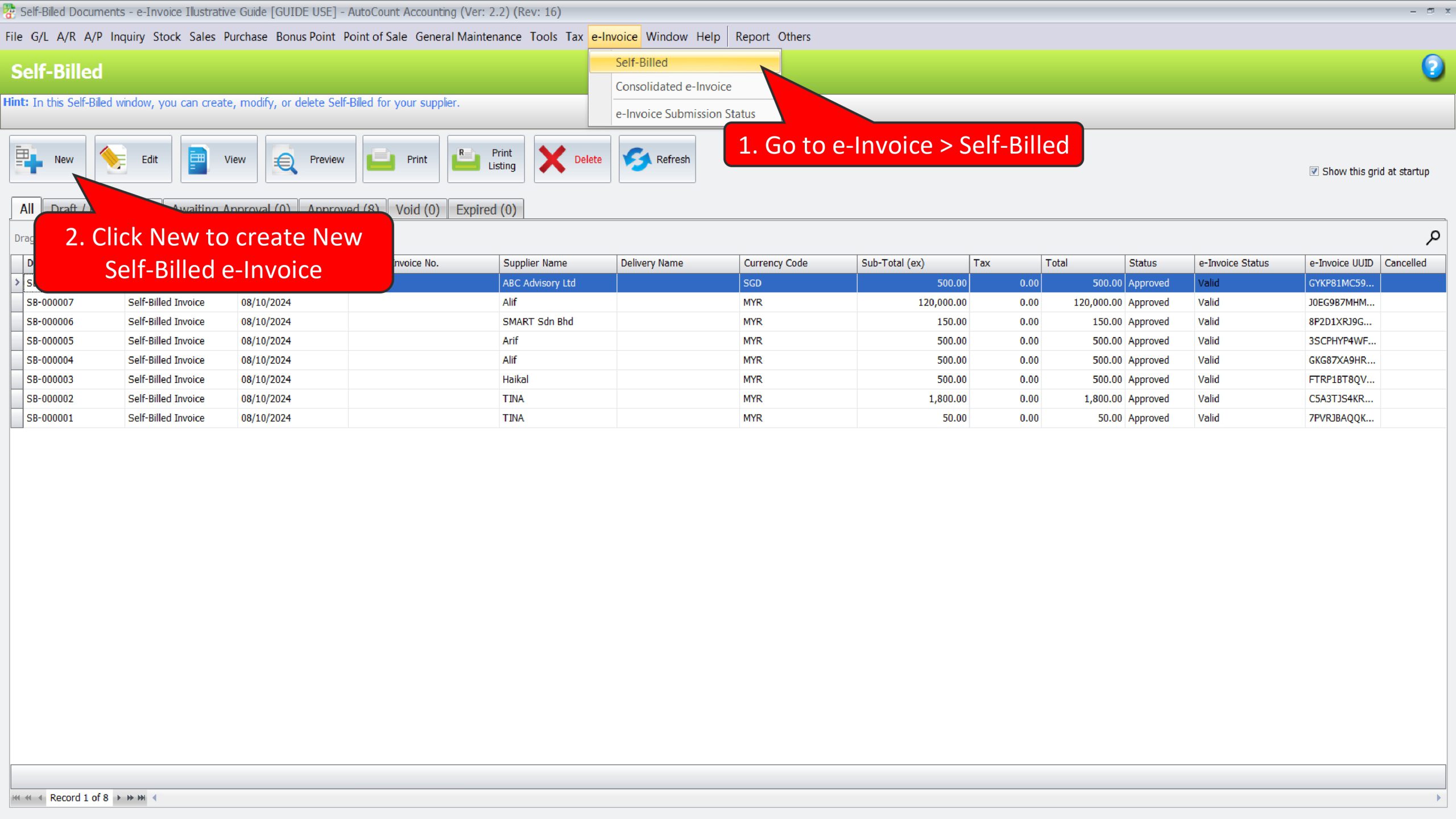

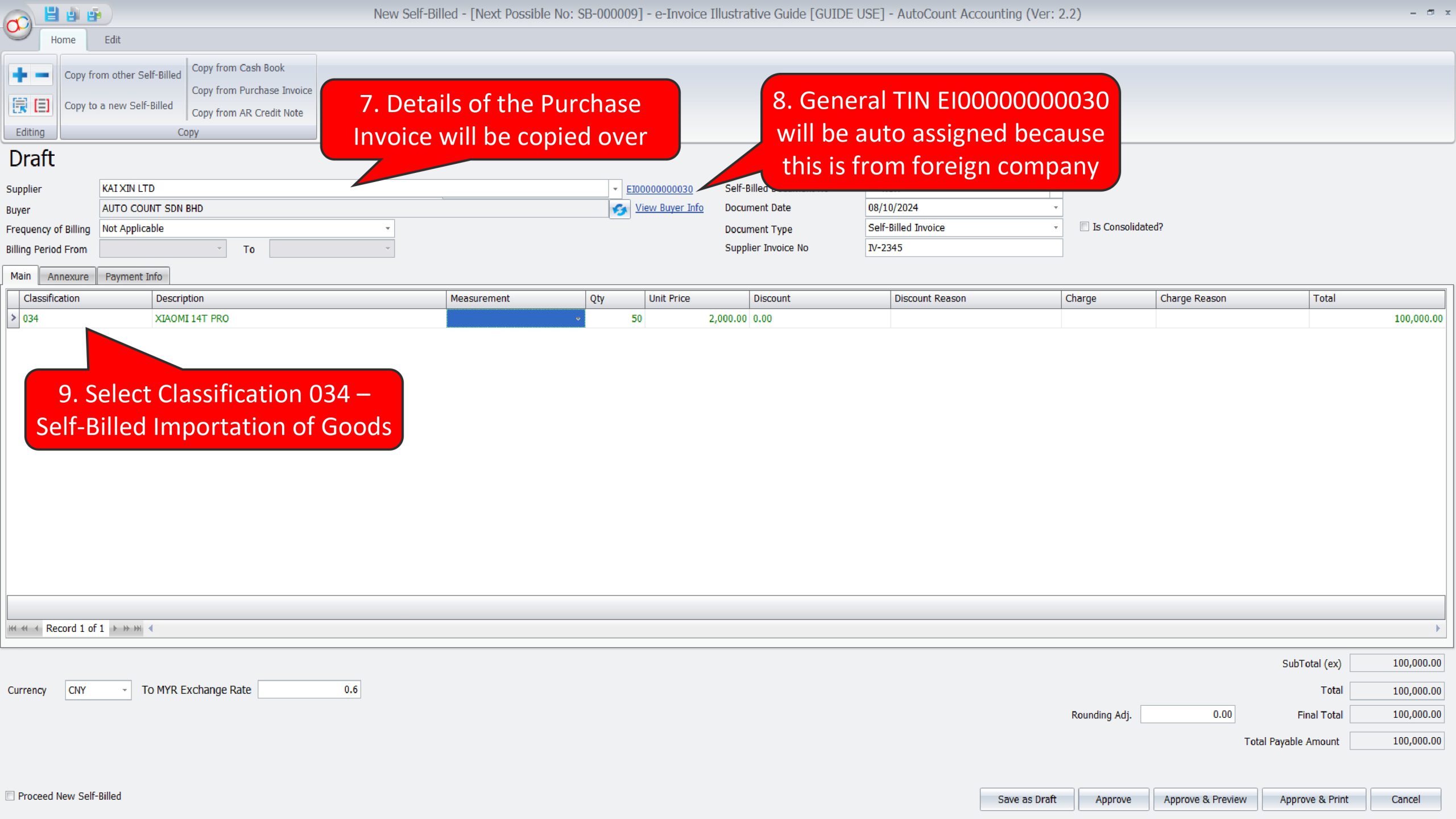

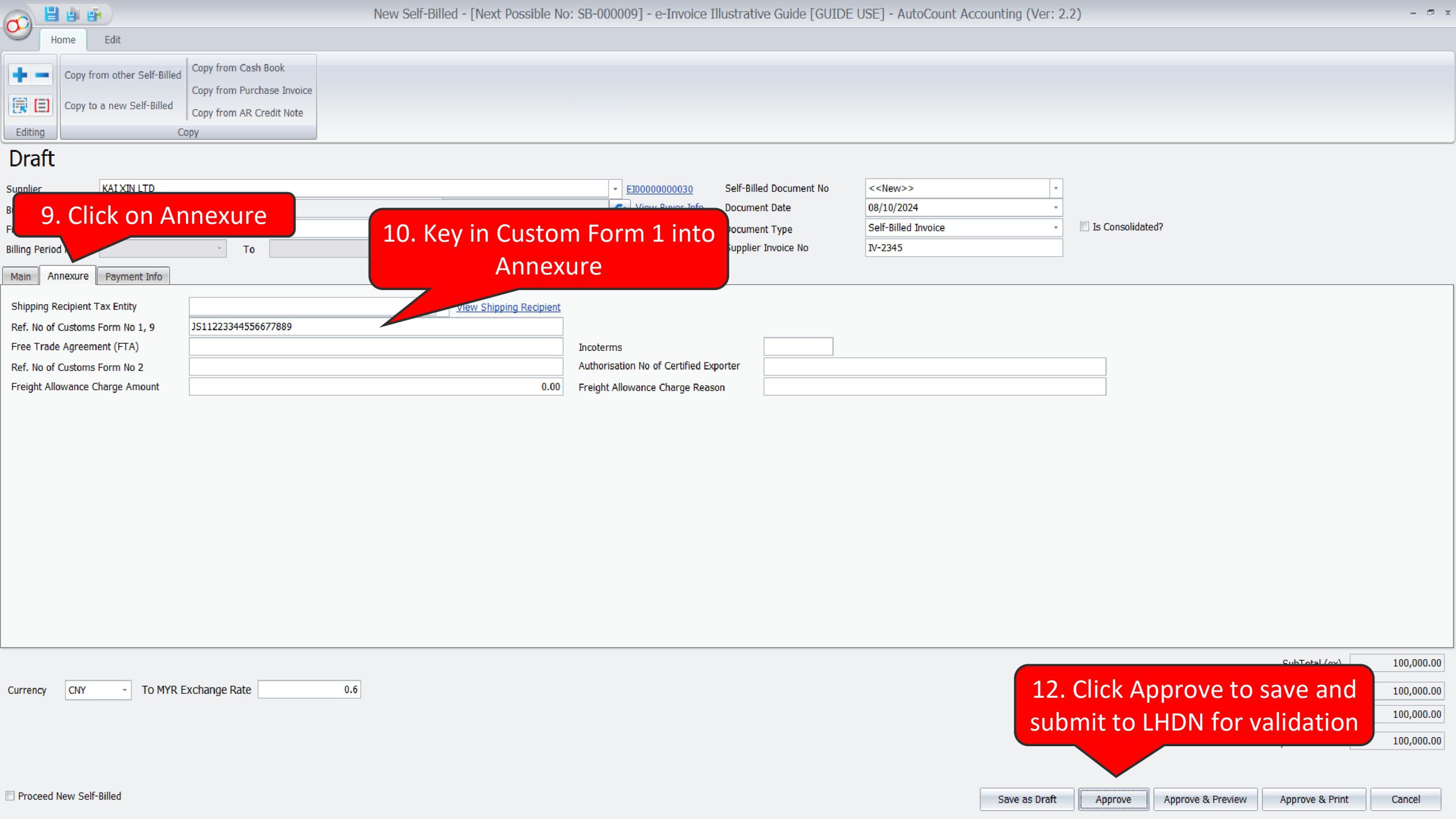

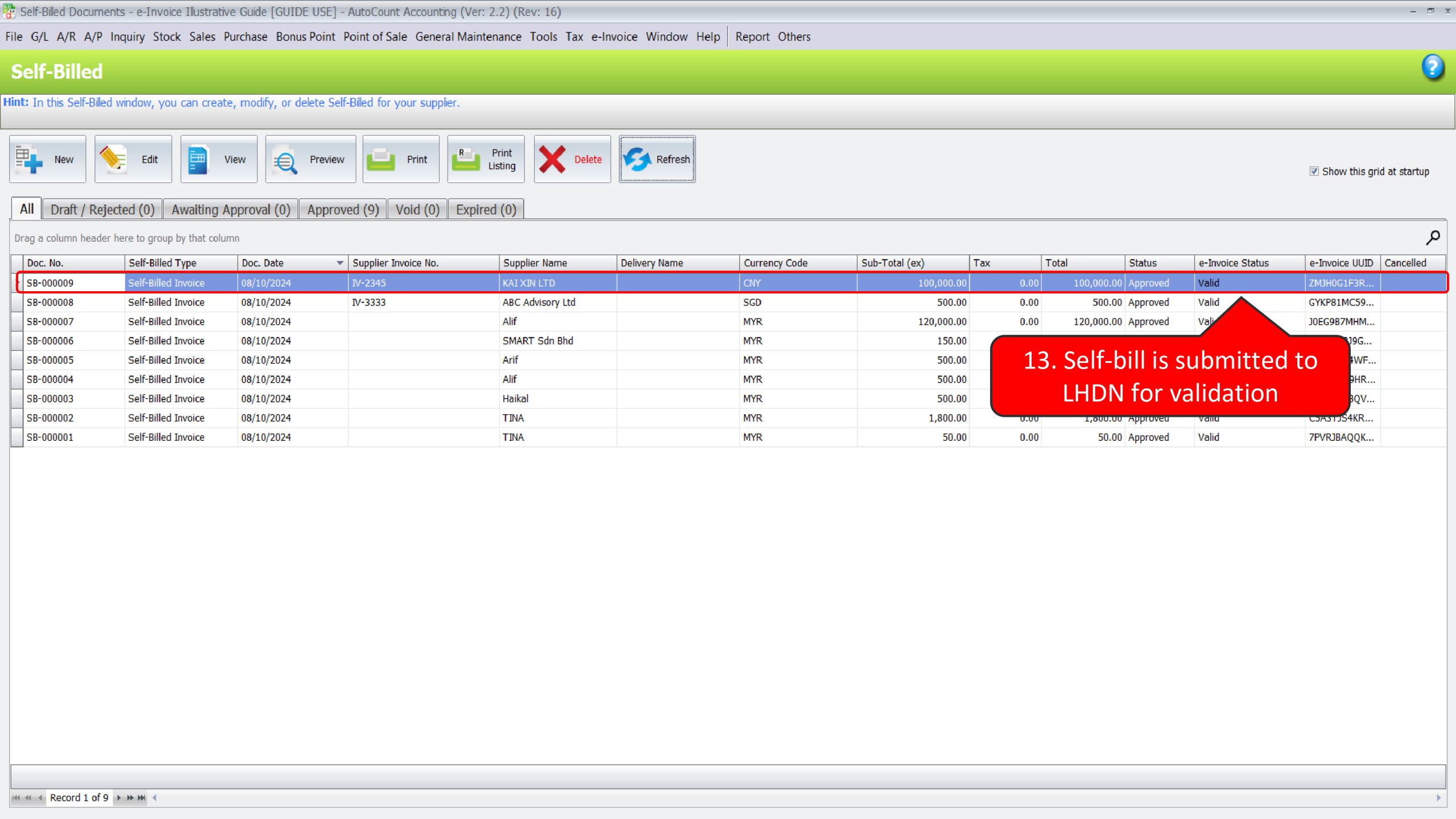

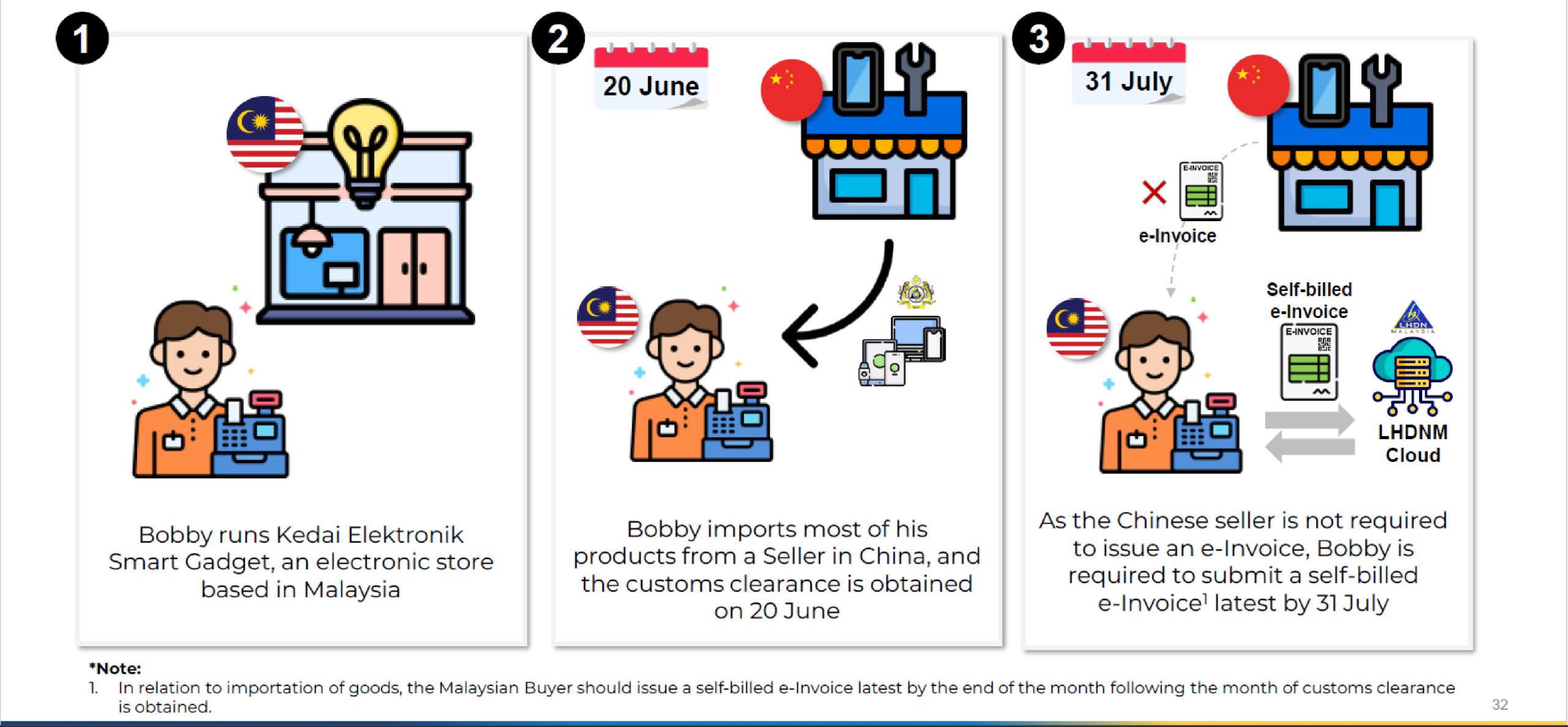

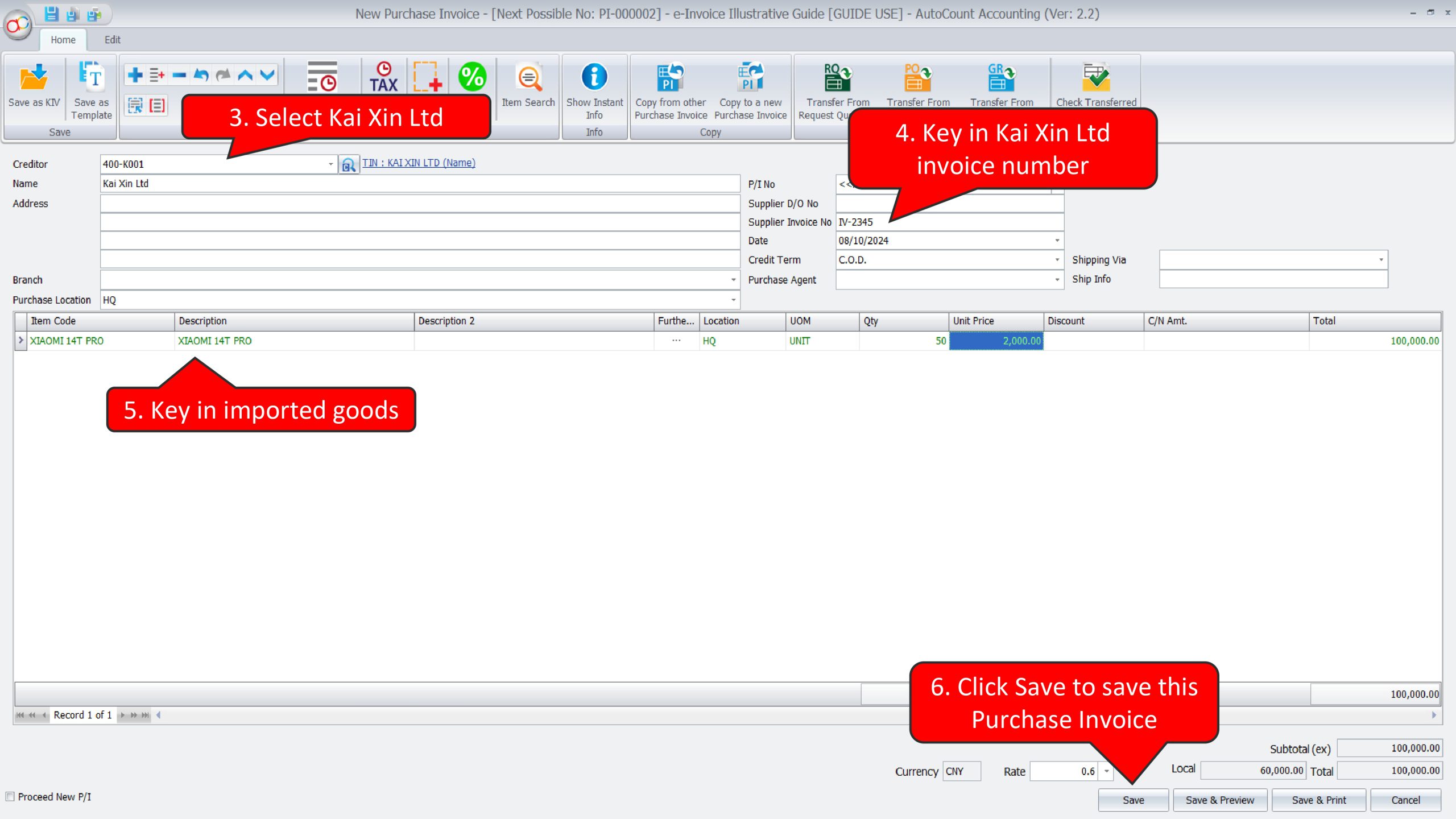

Illustration 23: Businesses are required to issue a self-billed e-Invoice when purchasing imported goods from a Foreign Sellers #

In this scenario, Kedai Elektronik Smart Gadget needs to perform 2 actions in AutoCount Accounting:

- Create a Purchase Invoice for goods imported from China

- Create a Self-Bill e-Invoice to submit and report this imported goods expenses to LHDN

Before proceed to transaction, make sure you already had a Tax Entity for Kai Xin Ltd (Assuming this is the China exporter), else you can refer to the following steps on how to do it

Create a Purchase Invoice for goods imported from China

Create a Self-Bill e-Invoice to submit and report this imported goods expenses to LHDN