What’s New in Version 2.1.16.40 #

This version is mainly for Malaysia user to setup and prepare some of the required fields in facing the upcoming implementation of e-Invoice. Kindly note that this version is not able to send e- Invoice yet.

e-Invoice Module #

AutoCount had added e-Invoice module under Tools → Options → General → Country & Tax. Under the section, you can find a new tab e-Invoice (Refer Figure 1). This tab is only available for account books under country Malaysia.

In this tab, you can tick to enable the module and set your Start Date. Any other e-Invoice columns will be visible once this module is ticked.

Get TIN Function #

A new function had been added at Debtor Maintenance – Get TIN from AIP Server. You will need to enable the e-Invoice module to access this function. This function facilitates the process of getting buyer information through our AIP server and reduce additional manual work. To access this function, go to A/R → Debtor Maintenance. Assuming that we are trying to get a customer information, we can edit one of the Debtor in the list. You will then see a new button “Get TIN from AIP Server” just beside the Tax Entity field (Refer Figure 2).

Click on this button and a dialog will appear (Refer Figure 3). In this dialog, you can search for available company information or generate request link.

For this case, we will be generating a link to request for their information. Click on the “Request Company Tax Information” button. A new dialog box will appear (Refer Figure 4). Type in your email address at “Your Email” field. This email will be sent a notification once the receiver had submitted their tax information.

After that click on the “Get Link” button. An URL will be generated (Refer Figure 5). You can then copy the generated URL by clicking on the “Copy Requested Link” button and share this link to your customer. You can either share it through email or WhatsApp.

After that, your customer will click on this link. It will open their browser and direct them to a page which allows them to key in their company information (Refer Figure 6).

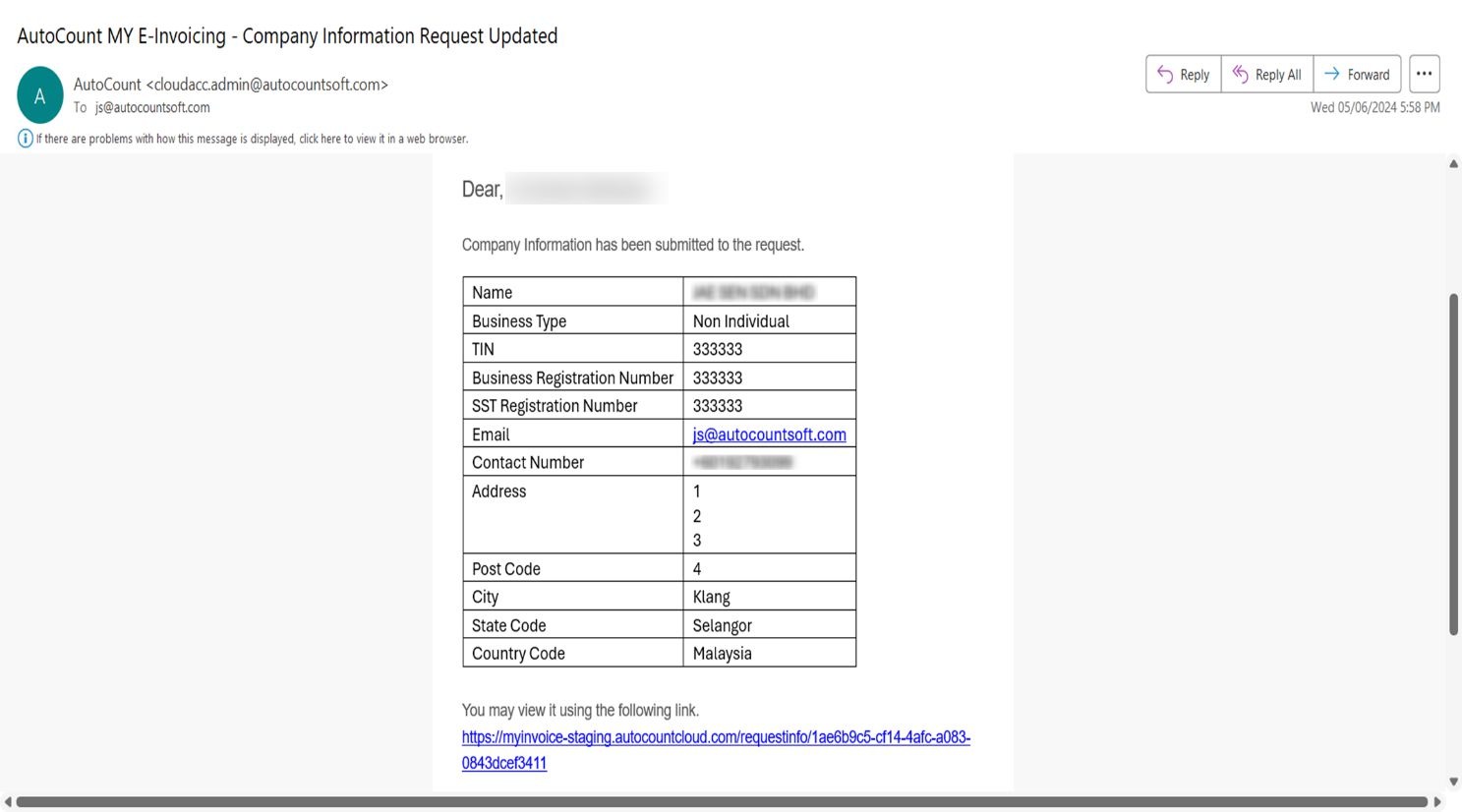

Assuming that your customer filled up the form and submitted. A notification email will be sent to both you and the customer (Refer Figure 7).

Once you had received this email, you can now go back to your Debtor Maintenance and edit this debtor, click on the “Get TIN from AIP Server” again. The customer information will be prompted in our Tax Entity form and you can then click save (Refer Figure 8). This debtor will then be auto linked to the Tax Entity that is auto generated.

Import Tax Entity #

A new Import Tax Entity by Excel had been added in this version. This function allows you to import your customer information into our Tax Entity Maintenance. You can find this function under File → Import From Excel → Import Tax Entity (Refer Figure 9). The import works the same as other import by excel function.

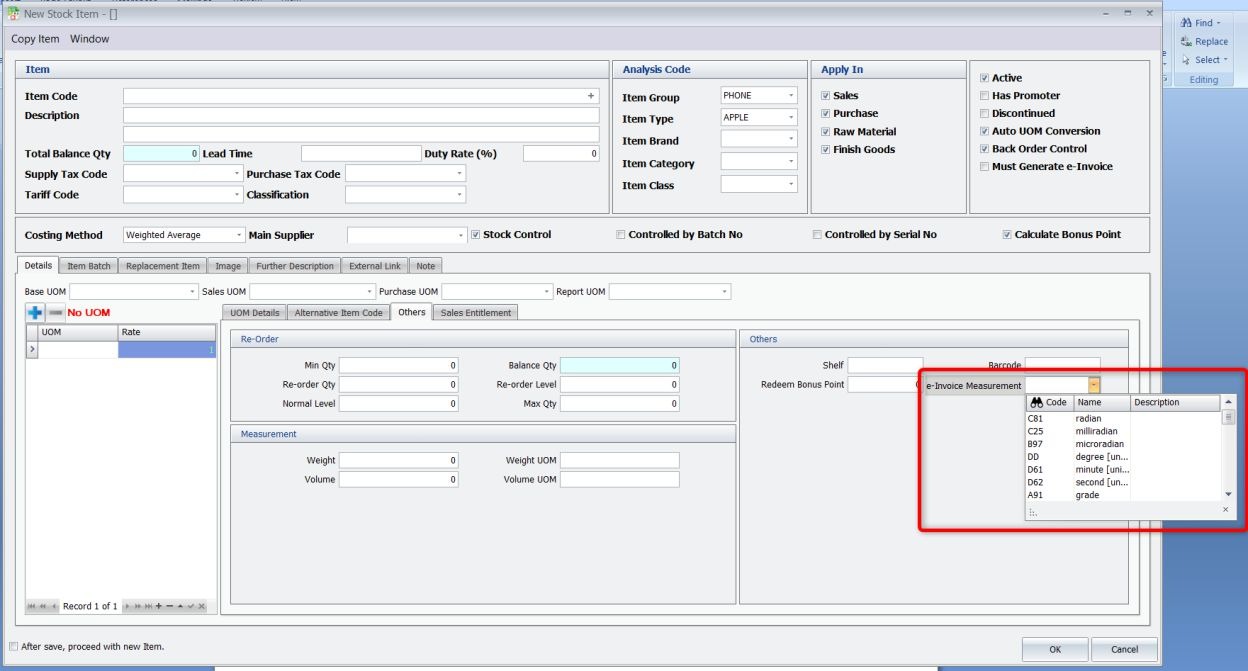

e-Invoice related columns at Item Maintenance #

We had added 3 new fields which are related to Malaysia e-Invoice in Item Maintenance. These fields are only visible if you enable e-Invoice module. These 3 fields are:

- Classification (Refer Figure 10)

- E-Invoice measurement (Refer Figure 11)

- Must Generate e-Invoice (Refer Figure 12)

For Classification and e-Invoice Measurement, user will need to input the types accordingly for e-Invoice submission purpose. For “Must Generate e-Invoice” checkbox, tick this if you wish to ensure that any transactions that has this item will need to have TIN information and submit as e-Invoice.

Credit By : Webstation